Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{lr} multicolumn{2}{c}{ Customer loans } hline Assets & hline Ovemight & 17,500.00 Marketable securities & 340,245.00 Investment book & 252,679.00

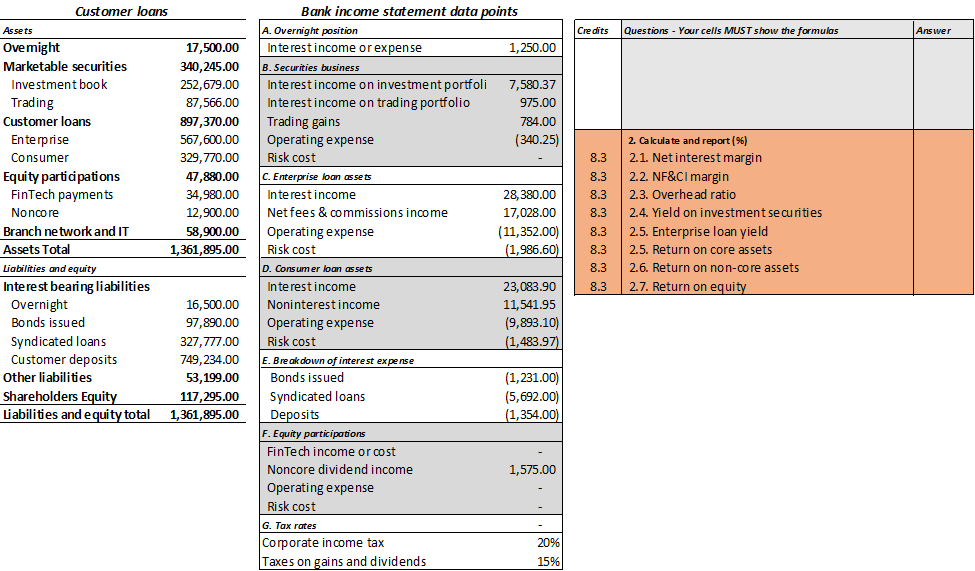

\begin{tabular}{lr} \multicolumn{2}{c}{ Customer loans } \\ \hline Assets & \\ \hline Ovemight & 17,500.00 \\ Marketable securities & 340,245.00 \\ Investment book & 252,679.00 \\ Trading & 87,566.00 \\ Customer loans & 897,370.00 \\ Enterprise & 567,600.00 \\ Consumer & 329,770.00 \\ Equity participations & 47,880.00 \\ FinTech payments & 34,980.00 \\ Noncore & 12,900.00 \\ Branch network and IT & 58,900.00 \\ \hline Assets Total & 1,361,895.00 \\ \hline Liabilities and equity & \\ \hline Interest bearing liabilities & 16,500.00 \\ Overnight & 97,890.00 \\ Bonds issued & 327,777.00 \\ Syndicated loans & 749,234.00 \\ Customer deposits & 53,199.00 \\ Other liabilities & 117,295.00 \\ \hline Shareholders Equity & 1,361,895.00 \\ \hline Liabilities and equity total \\ \hline \end{tabular} Bank income statement data points \begin{tabular}{|lr|} \hline A. Overnight position \\ \hline Interest income or expense & 1,250.00 \\ \hline B. Securities business & \\ \hline Interest income on investment portfoli & 7,580.37 \\ Interest income on trading portfolio & 975.00 \\ Trading gains & 784.00 \\ Operating expense & (340.25) \\ Risk cost & - \\ \hline C. Enterprise loan assets & \\ \hline Interest income & 28,380.00 \\ Net fees \& commissions income & 17,028.00 \\ Operating expense & (11,352.00) \\ Risk cost & (1,986.60) \\ \hline D. Consumer loan asset & \\ \hline Interest income & 23,083.90 \\ Noninterest income & 11,541.95 \\ Operating expense & (9,893.10) \\ Risk cost & (1,483.97) \\ \hline E. Breakdown of interest expense & \\ \hline Bonds issued & (1,231.00) \\ Syndicated loans & (5,692.00) \\ Deposits & (1,354.00) \\ \hline F. Equity participations & - \\ \hline FinTech income or cost & - \\ Noncore dividend income & - \\ Operating expense & 0% \\ Risk cost & - \\ \hline G. Tax rates & \\ \hline Corporate income tax & \\ Taxes on gains and dividends & \\ \hline \end{tabular} \begin{tabular}{lr} \multicolumn{2}{c}{ Customer loans } \\ \hline Assets & \\ \hline Ovemight & 17,500.00 \\ Marketable securities & 340,245.00 \\ Investment book & 252,679.00 \\ Trading & 87,566.00 \\ Customer loans & 897,370.00 \\ Enterprise & 567,600.00 \\ Consumer & 329,770.00 \\ Equity participations & 47,880.00 \\ FinTech payments & 34,980.00 \\ Noncore & 12,900.00 \\ Branch network and IT & 58,900.00 \\ \hline Assets Total & 1,361,895.00 \\ \hline Liabilities and equity & \\ \hline Interest bearing liabilities & 16,500.00 \\ Overnight & 97,890.00 \\ Bonds issued & 327,777.00 \\ Syndicated loans & 749,234.00 \\ Customer deposits & 53,199.00 \\ Other liabilities & 117,295.00 \\ \hline Shareholders Equity & 1,361,895.00 \\ \hline Liabilities and equity total \\ \hline \end{tabular} Bank income statement data points \begin{tabular}{|lr|} \hline A. Overnight position \\ \hline Interest income or expense & 1,250.00 \\ \hline B. Securities business & \\ \hline Interest income on investment portfoli & 7,580.37 \\ Interest income on trading portfolio & 975.00 \\ Trading gains & 784.00 \\ Operating expense & (340.25) \\ Risk cost & - \\ \hline C. Enterprise loan assets & \\ \hline Interest income & 28,380.00 \\ Net fees \& commissions income & 17,028.00 \\ Operating expense & (11,352.00) \\ Risk cost & (1,986.60) \\ \hline D. Consumer loan asset & \\ \hline Interest income & 23,083.90 \\ Noninterest income & 11,541.95 \\ Operating expense & (9,893.10) \\ Risk cost & (1,483.97) \\ \hline E. Breakdown of interest expense & \\ \hline Bonds issued & (1,231.00) \\ Syndicated loans & (5,692.00) \\ Deposits & (1,354.00) \\ \hline F. Equity participations & - \\ \hline FinTech income or cost & - \\ Noncore dividend income & - \\ Operating expense & 0% \\ Risk cost & - \\ \hline G. Tax rates & \\ \hline Corporate income tax & \\ Taxes on gains and dividends & \\ \hline \end{tabular}

\begin{tabular}{lr} \multicolumn{2}{c}{ Customer loans } \\ \hline Assets & \\ \hline Ovemight & 17,500.00 \\ Marketable securities & 340,245.00 \\ Investment book & 252,679.00 \\ Trading & 87,566.00 \\ Customer loans & 897,370.00 \\ Enterprise & 567,600.00 \\ Consumer & 329,770.00 \\ Equity participations & 47,880.00 \\ FinTech payments & 34,980.00 \\ Noncore & 12,900.00 \\ Branch network and IT & 58,900.00 \\ \hline Assets Total & 1,361,895.00 \\ \hline Liabilities and equity & \\ \hline Interest bearing liabilities & 16,500.00 \\ Overnight & 97,890.00 \\ Bonds issued & 327,777.00 \\ Syndicated loans & 749,234.00 \\ Customer deposits & 53,199.00 \\ Other liabilities & 117,295.00 \\ \hline Shareholders Equity & 1,361,895.00 \\ \hline Liabilities and equity total \\ \hline \end{tabular} Bank income statement data points \begin{tabular}{|lr|} \hline A. Overnight position \\ \hline Interest income or expense & 1,250.00 \\ \hline B. Securities business & \\ \hline Interest income on investment portfoli & 7,580.37 \\ Interest income on trading portfolio & 975.00 \\ Trading gains & 784.00 \\ Operating expense & (340.25) \\ Risk cost & - \\ \hline C. Enterprise loan assets & \\ \hline Interest income & 28,380.00 \\ Net fees \& commissions income & 17,028.00 \\ Operating expense & (11,352.00) \\ Risk cost & (1,986.60) \\ \hline D. Consumer loan asset & \\ \hline Interest income & 23,083.90 \\ Noninterest income & 11,541.95 \\ Operating expense & (9,893.10) \\ Risk cost & (1,483.97) \\ \hline E. Breakdown of interest expense & \\ \hline Bonds issued & (1,231.00) \\ Syndicated loans & (5,692.00) \\ Deposits & (1,354.00) \\ \hline F. Equity participations & - \\ \hline FinTech income or cost & - \\ Noncore dividend income & - \\ Operating expense & 0% \\ Risk cost & - \\ \hline G. Tax rates & \\ \hline Corporate income tax & \\ Taxes on gains and dividends & \\ \hline \end{tabular} \begin{tabular}{lr} \multicolumn{2}{c}{ Customer loans } \\ \hline Assets & \\ \hline Ovemight & 17,500.00 \\ Marketable securities & 340,245.00 \\ Investment book & 252,679.00 \\ Trading & 87,566.00 \\ Customer loans & 897,370.00 \\ Enterprise & 567,600.00 \\ Consumer & 329,770.00 \\ Equity participations & 47,880.00 \\ FinTech payments & 34,980.00 \\ Noncore & 12,900.00 \\ Branch network and IT & 58,900.00 \\ \hline Assets Total & 1,361,895.00 \\ \hline Liabilities and equity & \\ \hline Interest bearing liabilities & 16,500.00 \\ Overnight & 97,890.00 \\ Bonds issued & 327,777.00 \\ Syndicated loans & 749,234.00 \\ Customer deposits & 53,199.00 \\ Other liabilities & 117,295.00 \\ \hline Shareholders Equity & 1,361,895.00 \\ \hline Liabilities and equity total \\ \hline \end{tabular} Bank income statement data points \begin{tabular}{|lr|} \hline A. Overnight position \\ \hline Interest income or expense & 1,250.00 \\ \hline B. Securities business & \\ \hline Interest income on investment portfoli & 7,580.37 \\ Interest income on trading portfolio & 975.00 \\ Trading gains & 784.00 \\ Operating expense & (340.25) \\ Risk cost & - \\ \hline C. Enterprise loan assets & \\ \hline Interest income & 28,380.00 \\ Net fees \& commissions income & 17,028.00 \\ Operating expense & (11,352.00) \\ Risk cost & (1,986.60) \\ \hline D. Consumer loan asset & \\ \hline Interest income & 23,083.90 \\ Noninterest income & 11,541.95 \\ Operating expense & (9,893.10) \\ Risk cost & (1,483.97) \\ \hline E. Breakdown of interest expense & \\ \hline Bonds issued & (1,231.00) \\ Syndicated loans & (5,692.00) \\ Deposits & (1,354.00) \\ \hline F. Equity participations & - \\ \hline FinTech income or cost & - \\ Noncore dividend income & - \\ Operating expense & 0% \\ Risk cost & - \\ \hline G. Tax rates & \\ \hline Corporate income tax & \\ Taxes on gains and dividends & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started