Answered step by step

Verified Expert Solution

Question

1 Approved Answer

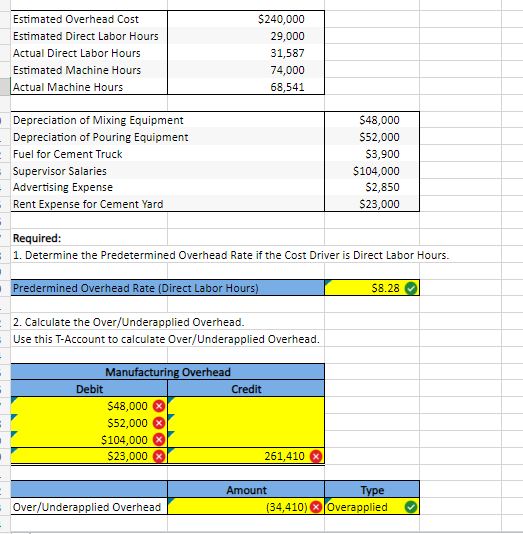

begin{tabular}{|l|r|r|} hline Estimated Overhead Cost & $240,000 & Estimated Direct Labor Hours & 29,000 & Actual Direct Labor Hours & 31,587 &

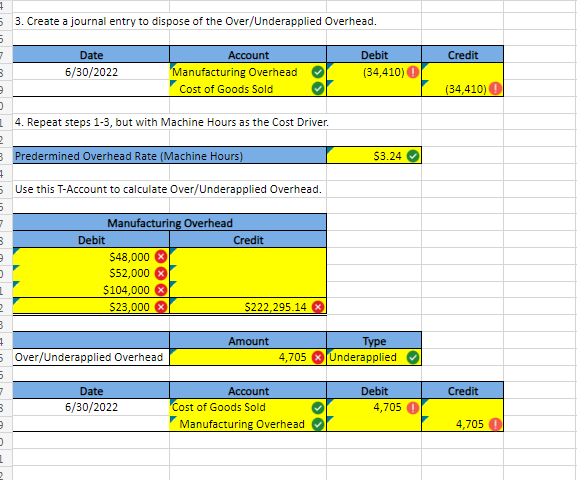

\begin{tabular}{|l|r|r|} \hline Estimated Overhead Cost & $240,000 & \\ Estimated Direct Labor Hours & 29,000 & \\ Actual Direct Labor Hours & 31,587 & \\ Estimated Machine Hours & 74,000 & \\ \hline Actual Machine Hours & 68,541 & \\ \hline & & \\ \hline \multicolumn{2}{|l|}{ Depreciation of Mixing Equipment } & $48,000 \\ Depreciation of Pouring Equipment & $52,000 \\ Fuel for Cement Truck & $3,900 \\ Supervisor Salaries & $104,000 \\ Advertising Expense & $2,850 \\ Rent Expense for Cement Yard & $23,000 \\ \hline \end{tabular} 1. Determine the Predetermined Overhead Rate if the Cost Driver is Direct Labor Hours. \begin{tabular}{|l|r|} \hline Predermined Overhead Rate (Direct Labor Hours) & $8.28Q \\ \hline \end{tabular} 2. Calculate the Over/Underapplied Overhead. Use this T-Account to calculate Over/Underapplied Overhead. \begin{tabular}{|r|r|} \hline \multicolumn{2}{|c|}{ Manufacturing Overhead } \\ \hline Debit & \multicolumn{1}{|c|}{ Credit } \\ \hline$48,000 & \\ \hline 52,000 & \\ \hline$104,000 & \\ \hline$23,000 & 261,410 \\ \hline \hline \end{tabular} \begin{tabular}{|l|c|c|} \hline & Amount & Type \\ \hline Over/Underapplied Overhead & (34,410) & Overapplied \\ \hline \end{tabular} 3. Create a journal entry to dispose of the Over/Underapplied Overhead. \begin{tabular}{|c|c|c|c|} \hline Date & Account & Debit & Credit \\ \hline 6/30/2022 & Manufacturing Overhead & (34,410)(1) & \\ \hline & Cost of Goods Sold & & (34,410)0 \\ \hline \multicolumn{4}{|c|}{ 4. Repeat steps 1-3, but with Machine Hours as the Cost Driver. } \\ \hline \multicolumn{2}{|c|}{ Predermined Overhead Rate (Machine Hours) } & $3.24 & \\ \hline \multicolumn{4}{|c|}{ Use this T-Account to calculate Over/Underapplied Overhead. } \\ \hline \multicolumn{4}{|c|}{ Manufacturing Overhead } \\ \hline Debit & Credit & & \\ \hline \multicolumn{4}{|l|}{$48,000} \\ \hline \multicolumn{4}{|l|}{$52,000} \\ \hline$104,000 & & & \\ \hline \multirow[t]{2}{*}{$23,000} & $222,295.14 & & \\ \hline & Amount & Type & \\ \hline Over/Underapplied Overhead & 4,705 & Underapplied O & \\ \hline Date & Account & Debit & Credit \\ \hline 6/30/2022 & Cost of Goods Sold & 4,705 & \\ \hline & Manufacturing Overhead & & 4,705(1) \\ \hline \end{tabular}

\begin{tabular}{|l|r|r|} \hline Estimated Overhead Cost & $240,000 & \\ Estimated Direct Labor Hours & 29,000 & \\ Actual Direct Labor Hours & 31,587 & \\ Estimated Machine Hours & 74,000 & \\ \hline Actual Machine Hours & 68,541 & \\ \hline & & \\ \hline \multicolumn{2}{|l|}{ Depreciation of Mixing Equipment } & $48,000 \\ Depreciation of Pouring Equipment & $52,000 \\ Fuel for Cement Truck & $3,900 \\ Supervisor Salaries & $104,000 \\ Advertising Expense & $2,850 \\ Rent Expense for Cement Yard & $23,000 \\ \hline \end{tabular} 1. Determine the Predetermined Overhead Rate if the Cost Driver is Direct Labor Hours. \begin{tabular}{|l|r|} \hline Predermined Overhead Rate (Direct Labor Hours) & $8.28Q \\ \hline \end{tabular} 2. Calculate the Over/Underapplied Overhead. Use this T-Account to calculate Over/Underapplied Overhead. \begin{tabular}{|r|r|} \hline \multicolumn{2}{|c|}{ Manufacturing Overhead } \\ \hline Debit & \multicolumn{1}{|c|}{ Credit } \\ \hline$48,000 & \\ \hline 52,000 & \\ \hline$104,000 & \\ \hline$23,000 & 261,410 \\ \hline \hline \end{tabular} \begin{tabular}{|l|c|c|} \hline & Amount & Type \\ \hline Over/Underapplied Overhead & (34,410) & Overapplied \\ \hline \end{tabular} 3. Create a journal entry to dispose of the Over/Underapplied Overhead. \begin{tabular}{|c|c|c|c|} \hline Date & Account & Debit & Credit \\ \hline 6/30/2022 & Manufacturing Overhead & (34,410)(1) & \\ \hline & Cost of Goods Sold & & (34,410)0 \\ \hline \multicolumn{4}{|c|}{ 4. Repeat steps 1-3, but with Machine Hours as the Cost Driver. } \\ \hline \multicolumn{2}{|c|}{ Predermined Overhead Rate (Machine Hours) } & $3.24 & \\ \hline \multicolumn{4}{|c|}{ Use this T-Account to calculate Over/Underapplied Overhead. } \\ \hline \multicolumn{4}{|c|}{ Manufacturing Overhead } \\ \hline Debit & Credit & & \\ \hline \multicolumn{4}{|l|}{$48,000} \\ \hline \multicolumn{4}{|l|}{$52,000} \\ \hline$104,000 & & & \\ \hline \multirow[t]{2}{*}{$23,000} & $222,295.14 & & \\ \hline & Amount & Type & \\ \hline Over/Underapplied Overhead & 4,705 & Underapplied O & \\ \hline Date & Account & Debit & Credit \\ \hline 6/30/2022 & Cost of Goods Sold & 4,705 & \\ \hline & Manufacturing Overhead & & 4,705(1) \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started