Answered step by step

Verified Expert Solution

Question

1 Approved Answer

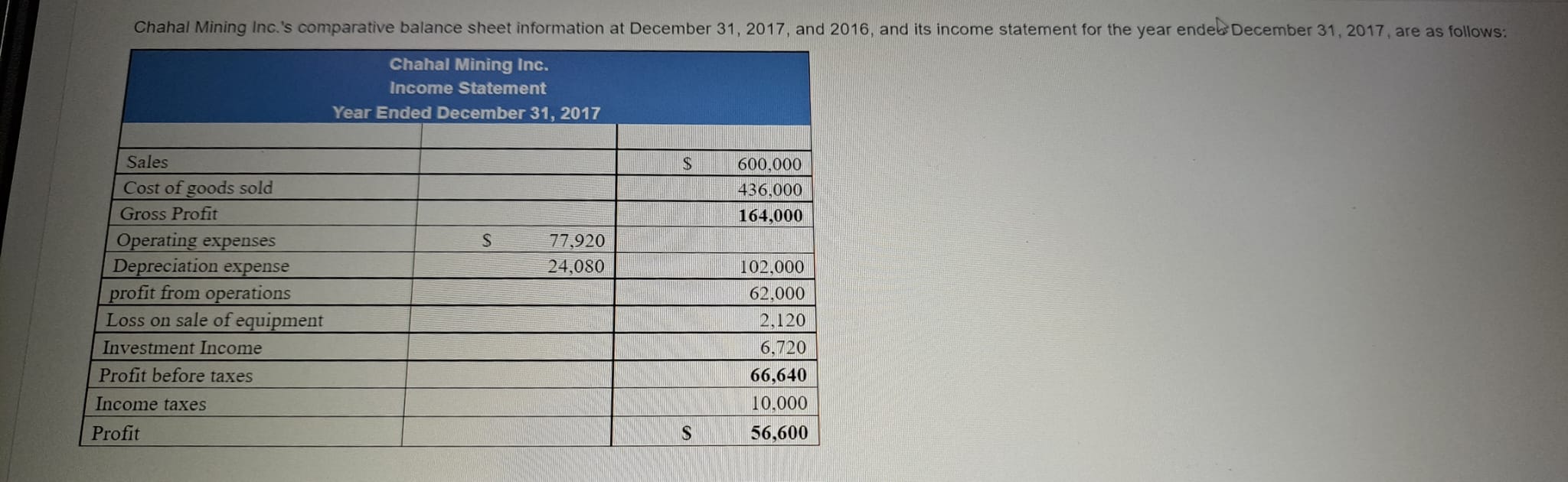

begin{tabular}{|l|r|r|} hline multicolumn{2}{|c|}{ChahalMiningInc.IncomeStatementYearEndedDecember31,2017} hline Sales & & hline Cost of goods sold & & 600,000 hline Gross Profit & & 436,000

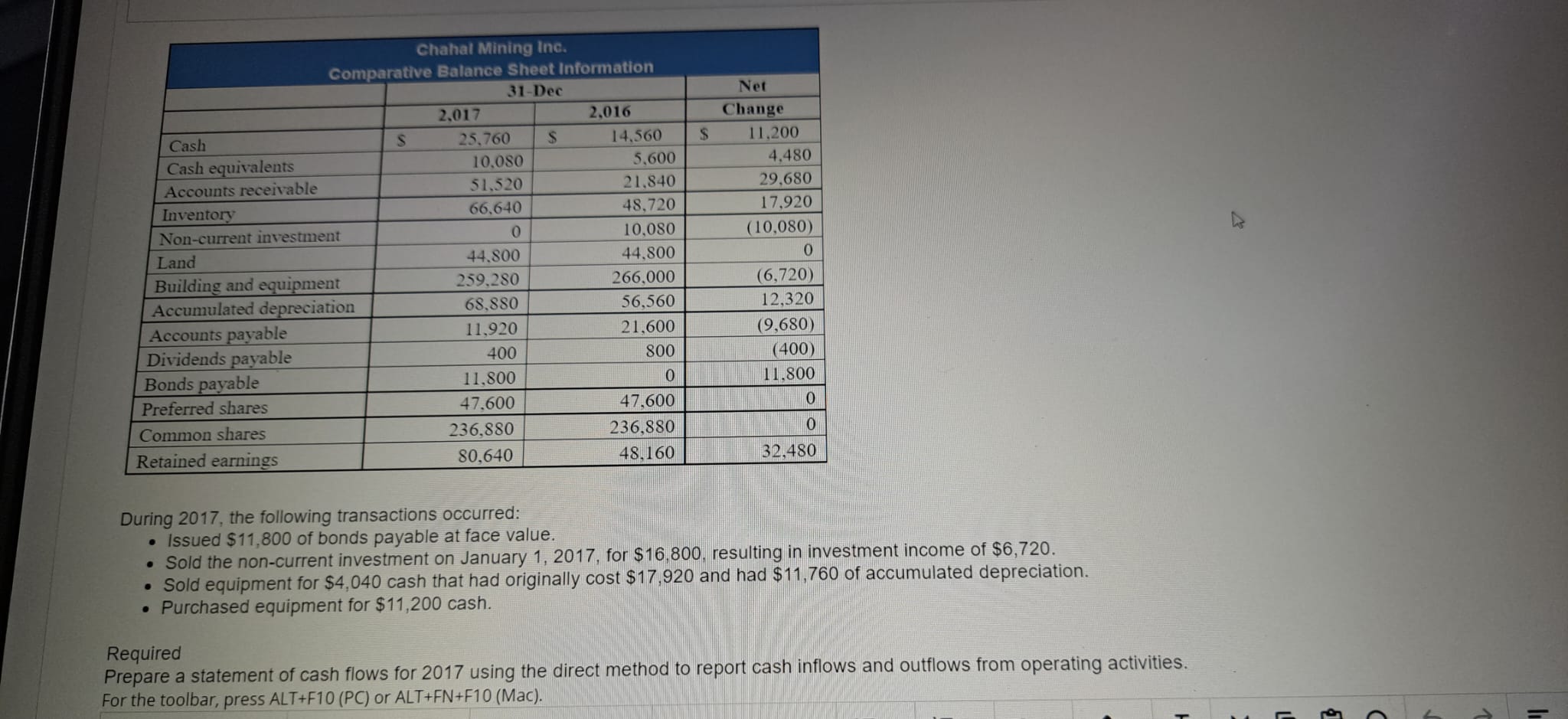

\begin{tabular}{|l|r|r|} \hline \multicolumn{2}{|c|}{ChahalMiningInc.IncomeStatementYearEndedDecember31,2017} \\ \hline Sales & & \\ \hline Cost of goods sold & & 600,000 \\ \hline Gross Profit & & 436,000 \\ \hline Operating expenses & & 164,000 \\ \hline Depreciation expense & & \\ \hline profit from operations & & 102,000 \\ \hline Loss on sale of equipment & & 62,000 \\ \hline Investment Income & & 2,080 \\ \hline Profit before taxes & & 6,720 \\ \hline Income taxes & & 66,640 \\ \hline Profit & & 10,000 \\ \hline \end{tabular} During 2017 , the following transactions occurred: - Issued $11,800 of bonds payable at face value. - Sold the non-current investment on January 1,2017 , for $16,800, resulting in investment income of $6,720. - Sold equipment for $4,040 cash that had originally cost $17,920 and had $11,760 of accumulated depreciation. - Purchased equipment for $11,200 cash. Required Prepare a statement of cash flows for 2017 using the direct method to report cash inflows and outflows from operating activities. For the toolbar, press ALT+F10(PC) or ALT+FN+F10 (Mac). \begin{tabular}{|l|r|r|} \hline \multicolumn{2}{|c|}{ChahalMiningInc.IncomeStatementYearEndedDecember31,2017} \\ \hline Sales & & \\ \hline Cost of goods sold & & 600,000 \\ \hline Gross Profit & & 436,000 \\ \hline Operating expenses & & 164,000 \\ \hline Depreciation expense & & \\ \hline profit from operations & & 102,000 \\ \hline Loss on sale of equipment & & 62,000 \\ \hline Investment Income & & 2,080 \\ \hline Profit before taxes & & 6,720 \\ \hline Income taxes & & 66,640 \\ \hline Profit & & 10,000 \\ \hline \end{tabular} During 2017 , the following transactions occurred: - Issued $11,800 of bonds payable at face value. - Sold the non-current investment on January 1,2017 , for $16,800, resulting in investment income of $6,720. - Sold equipment for $4,040 cash that had originally cost $17,920 and had $11,760 of accumulated depreciation. - Purchased equipment for $11,200 cash. Required Prepare a statement of cash flows for 2017 using the direct method to report cash inflows and outflows from operating activities. For the toolbar, press ALT+F10(PC) or ALT+FN+F10 (Mac)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started