Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|l|r|r|} hline multicolumn{3}{|c|}{ Consolidated Statements of Income } multicolumn{1}{|c|}{ For Years ended December 31 ($ millions) } & multicolumn{1}{c|}{2018} & multicolumn{1}{c|}{2017} hline Net

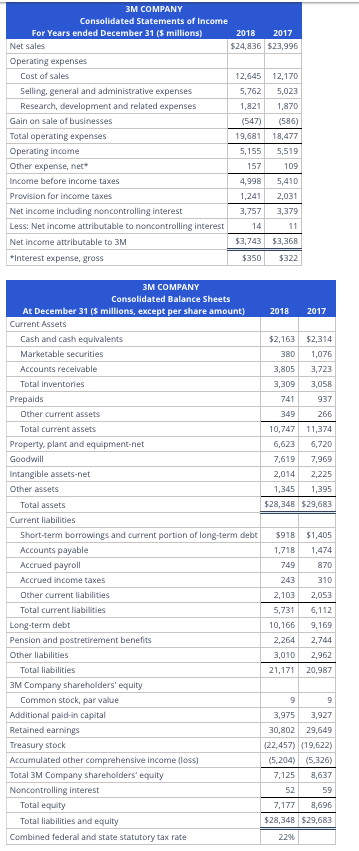

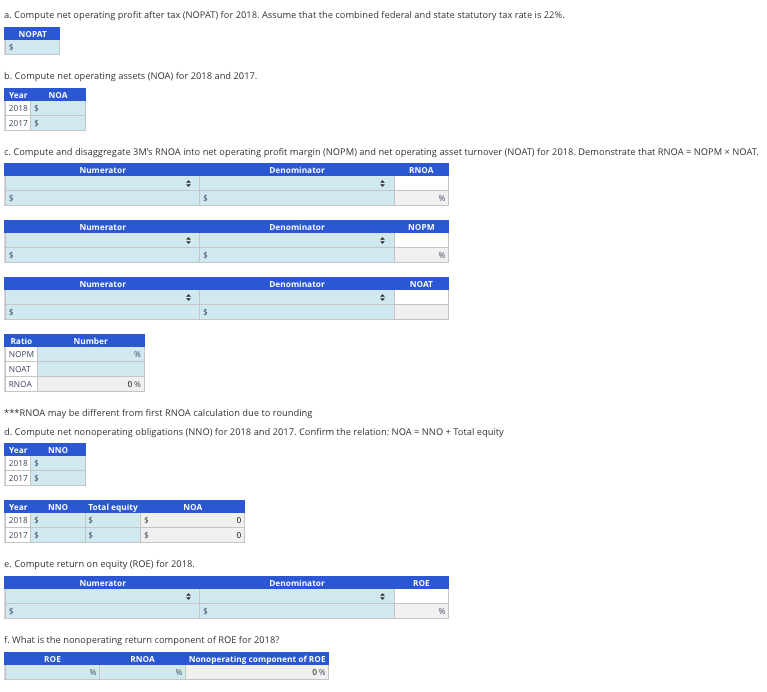

\begin{tabular}{|l|r|r|} \hline \multicolumn{3}{|c|}{ Consolidated Statements of Income } \\ \multicolumn{1}{|c|}{ For Years ended December 31 (\$ millions) } & \multicolumn{1}{c|}{2018} & \multicolumn{1}{c|}{2017} \\ \hline Net sales & $24,836 & $23,996 \\ \hline Operating expenses & & \\ \hline Cost of sales & 12,645 & 12,170 \\ \hline Selling, general and administrative expenses & 5,762 & 5,023 \\ \hline \multicolumn{1}{|c|}{ Research, development and related expenses } & 1,821 & 1,870 \\ \hline Gain on sale of businesses & (547) & (586) \\ \hline Total operating expenses & 19,681 & 18,477 \\ \hline Operating income & 5,155 & 5,519 \\ \hline Other expense, net* & 157 & 109 \\ \hline Income before income taxes & 4,998 & 5,410 \\ \hline Provision for income taxes & 1,241 & 2,031 \\ \hline Net income including noncontrolling interest & 3,757 & 3,379 \\ \hline Less: Net income attributable to noncontrolling interest & 14 & 11 \\ \hline Net income attributable to 3M & $3,743 & $3,368 \\ \hline *Interest expense, gross & $3350 & $322 \\ \hline \end{tabular} b. Compute net operating assets (NOA) for 2018 and 2017 . c. Compute and disaggregate 3M's RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018. Demonstrate that RNOA = NOPM NOAT. *** RNOA may be different from first RNOA calculation due to rounding d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity e. Compute return on equity (ROE) for 2018 . f. What is the nonoperating return component of ROE for 2018 ? \begin{tabular}{|l|r|r|} \hline \multicolumn{3}{|c|}{ Consolidated Statements of Income } \\ \multicolumn{1}{|c|}{ For Years ended December 31 (\$ millions) } & \multicolumn{1}{c|}{2018} & \multicolumn{1}{c|}{2017} \\ \hline Net sales & $24,836 & $23,996 \\ \hline Operating expenses & & \\ \hline Cost of sales & 12,645 & 12,170 \\ \hline Selling, general and administrative expenses & 5,762 & 5,023 \\ \hline \multicolumn{1}{|c|}{ Research, development and related expenses } & 1,821 & 1,870 \\ \hline Gain on sale of businesses & (547) & (586) \\ \hline Total operating expenses & 19,681 & 18,477 \\ \hline Operating income & 5,155 & 5,519 \\ \hline Other expense, net* & 157 & 109 \\ \hline Income before income taxes & 4,998 & 5,410 \\ \hline Provision for income taxes & 1,241 & 2,031 \\ \hline Net income including noncontrolling interest & 3,757 & 3,379 \\ \hline Less: Net income attributable to noncontrolling interest & 14 & 11 \\ \hline Net income attributable to 3M & $3,743 & $3,368 \\ \hline *Interest expense, gross & $3350 & $322 \\ \hline \end{tabular} b. Compute net operating assets (NOA) for 2018 and 2017 . c. Compute and disaggregate 3M's RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018. Demonstrate that RNOA = NOPM NOAT. *** RNOA may be different from first RNOA calculation due to rounding d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity e. Compute return on equity (ROE) for 2018 . f. What is the nonoperating return component of ROE for 2018

\begin{tabular}{|l|r|r|} \hline \multicolumn{3}{|c|}{ Consolidated Statements of Income } \\ \multicolumn{1}{|c|}{ For Years ended December 31 (\$ millions) } & \multicolumn{1}{c|}{2018} & \multicolumn{1}{c|}{2017} \\ \hline Net sales & $24,836 & $23,996 \\ \hline Operating expenses & & \\ \hline Cost of sales & 12,645 & 12,170 \\ \hline Selling, general and administrative expenses & 5,762 & 5,023 \\ \hline \multicolumn{1}{|c|}{ Research, development and related expenses } & 1,821 & 1,870 \\ \hline Gain on sale of businesses & (547) & (586) \\ \hline Total operating expenses & 19,681 & 18,477 \\ \hline Operating income & 5,155 & 5,519 \\ \hline Other expense, net* & 157 & 109 \\ \hline Income before income taxes & 4,998 & 5,410 \\ \hline Provision for income taxes & 1,241 & 2,031 \\ \hline Net income including noncontrolling interest & 3,757 & 3,379 \\ \hline Less: Net income attributable to noncontrolling interest & 14 & 11 \\ \hline Net income attributable to 3M & $3,743 & $3,368 \\ \hline *Interest expense, gross & $3350 & $322 \\ \hline \end{tabular} b. Compute net operating assets (NOA) for 2018 and 2017 . c. Compute and disaggregate 3M's RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018. Demonstrate that RNOA = NOPM NOAT. *** RNOA may be different from first RNOA calculation due to rounding d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity e. Compute return on equity (ROE) for 2018 . f. What is the nonoperating return component of ROE for 2018 ? \begin{tabular}{|l|r|r|} \hline \multicolumn{3}{|c|}{ Consolidated Statements of Income } \\ \multicolumn{1}{|c|}{ For Years ended December 31 (\$ millions) } & \multicolumn{1}{c|}{2018} & \multicolumn{1}{c|}{2017} \\ \hline Net sales & $24,836 & $23,996 \\ \hline Operating expenses & & \\ \hline Cost of sales & 12,645 & 12,170 \\ \hline Selling, general and administrative expenses & 5,762 & 5,023 \\ \hline \multicolumn{1}{|c|}{ Research, development and related expenses } & 1,821 & 1,870 \\ \hline Gain on sale of businesses & (547) & (586) \\ \hline Total operating expenses & 19,681 & 18,477 \\ \hline Operating income & 5,155 & 5,519 \\ \hline Other expense, net* & 157 & 109 \\ \hline Income before income taxes & 4,998 & 5,410 \\ \hline Provision for income taxes & 1,241 & 2,031 \\ \hline Net income including noncontrolling interest & 3,757 & 3,379 \\ \hline Less: Net income attributable to noncontrolling interest & 14 & 11 \\ \hline Net income attributable to 3M & $3,743 & $3,368 \\ \hline *Interest expense, gross & $3350 & $322 \\ \hline \end{tabular} b. Compute net operating assets (NOA) for 2018 and 2017 . c. Compute and disaggregate 3M's RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018. Demonstrate that RNOA = NOPM NOAT. *** RNOA may be different from first RNOA calculation due to rounding d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity e. Compute return on equity (ROE) for 2018 . f. What is the nonoperating return component of ROE for 2018 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started