Answered step by step

Verified Expert Solution

Question

1 Approved Answer

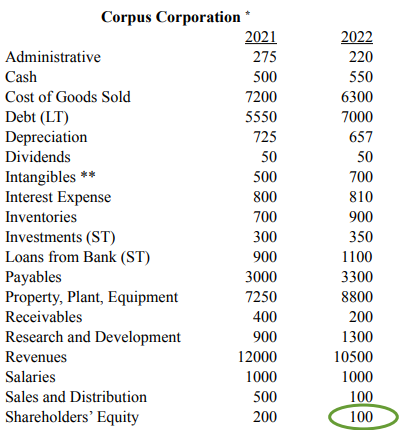

begin{tabular}{lrr} multicolumn{3}{c}{ Corpus Corporation * } cline { 2 - 3 } Administrative & 2021 & 2022 Cash & 500 & 220

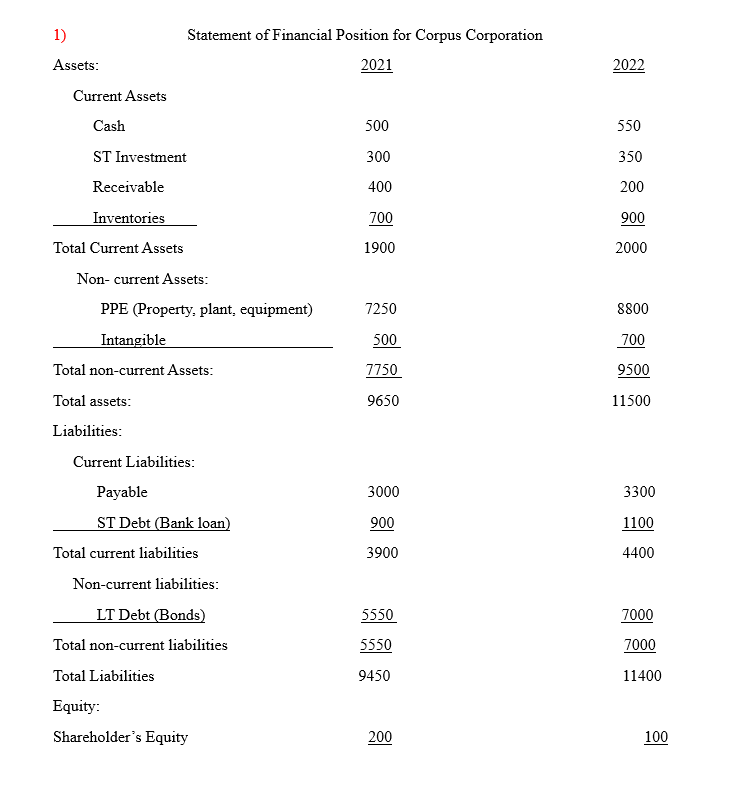

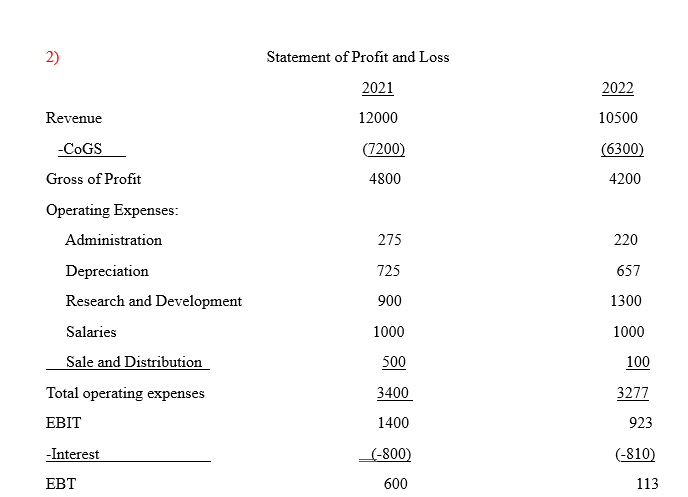

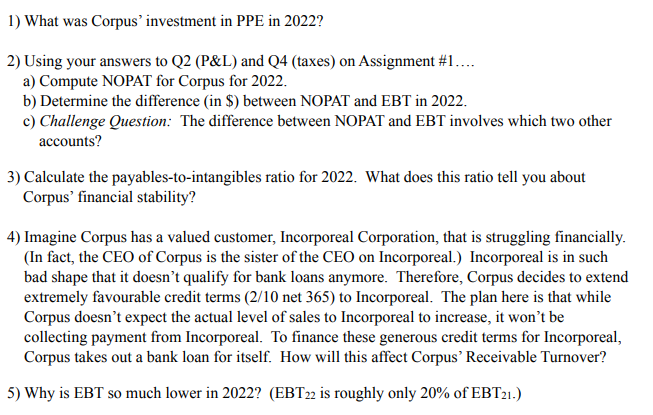

\begin{tabular}{lrr} \multicolumn{3}{c}{ Corpus Corporation * } \\ \cline { 2 - 3 } Administrative & 2021 & 2022 \\ Cash & 500 & 220 \\ Cost of Goods Sold & 7200 & 550 \\ Debt (LT) & 5550 & 7000 \\ Depreciation & 725 & 657 \\ Dividends & 50 & 50 \\ Intangibles ** & 500 & 700 \\ Interest Expense & 800 & 810 \\ Inventories & 700 & 900 \\ Investments (ST) & 300 & 350 \\ Loans from Bank (ST) & 900 & 1100 \\ Payables & 3000 & 3300 \\ Property, Plant, Equipment & 7250 & 8800 \\ Receivables & 400 & 200 \\ Research and Development & 900 & 1300 \\ Revenues & 12000 & 10500 \\ Salaries & 1000 & 1000 \\ Sales and Distribution & 500 & 100 \\ Shareholders' Equity & 200 & 100 \\ \hline \end{tabular} 1) What was Corpus' investment in PPE in 2022? 2) Using your answers to Q2 (P\&L) and Q4 (taxes) on Assignment \#1 .... a) Compute NOPAT for Corpus for 2022 . b) Determine the difference (in \$) between NOPAT and EBT in 2022. c) Challenge Question: The difference between NOPAT and EBT involves which two other accounts? 3) Calculate the payables-to-intangibles ratio for 2022. What does this ratio tell you about Corpus' financial stability? 4) Imagine Corpus has a valued customer, Incorporeal Corporation, that is struggling financially. (In fact, the CEO of Corpus is the sister of the CEO on Incorporeal.) Incorporeal is in such bad shape that it doesn't qualify for bank loans anymore. Therefore, Corpus decides to extend extremely favourable credit terms (2/10 net 365) to Incorporeal. The plan here is that while Corpus doesn't expect the actual level of sales to Incorporeal to increase, it won't be collecting payment from Incorporeal. To finance these generous credit terms for Incorporeal, Corpus takes out a bank loan for itself. How will this affect Corpus' Receivable Turnover? 5) Why is EBT so much lower in 2022 ? (EBT 22 is roughly only 20% of EBT21.) \begin{tabular}{|c|c|c|} \hline 2) & Statement of Profit and Loss & \\ \hline & 2021 & 2022 \\ \hline Revenue & 12000 & 10500 \\ \hline -CoGS & (7200) & (6300) \\ \hline Gross of Profit & 4800 & 4200 \\ \hline Operating Expenses: & & \\ \hline Administration & 275 & 220 \\ \hline Depreciation & 725 & 657 \\ \hline Research and Development & 900 & 1300 \\ \hline Salaries & 1000 & 1000 \\ \hline Sale and Distribution & 500 & 100 \\ \hline Total operating expenses & 3400 & 3277 \\ \hline EBIT & 1400 & 923 \\ \hline -Interest & (800) & (810) \\ \hline EBT & 600 & 113 \\ \hline \end{tabular} 1) Assets: Current Assets \begin{tabular}{c} Cash \\ ST Investment \\ Receivable \\ Inventories \\ \hline Total Current Assets \end{tabular} Non- current Assets: \begin{tabular}{lrr} \multicolumn{1}{c}{ PPE (Property, plant, equipment) } & 7250 & 8800 \\ \multicolumn{1}{c}{ Intangible } & 500 & 700 \\ Total non-current Assets: & 7750 & 9500 \\ Total assets: & 9650 & 11500 \end{tabular} Liabilities: Current Liabilities: \begin{tabular}{ccc} Payable & 3000 & 3300 \\ ST Debt (Bank loan) & 900 & 1100 \\ Total current liabilities & 3900 & 4400 \\ Non-current liabilities: & & \\ LT Debt (Bonds) & 5550 & 7000 \\ \hline Total non-current liabilities & 5550 & 7000 \\ Total Liabilities & 9450 & 11400 \end{tabular} 2021 2022 550 350 200 900 2000 1900 8800 700 9500 11500 1100 4400 70007000 11400 200 100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started