Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{lrr} Non-Curre nt Liabilities & & Interest Bearing Loans and Borrowing & 1,854,988 & - Lease liabilities & 11,379,383 & 10,957,940 Employee

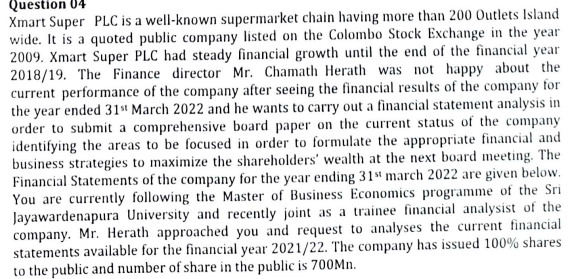

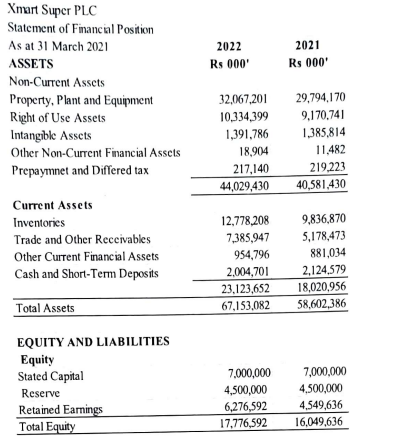

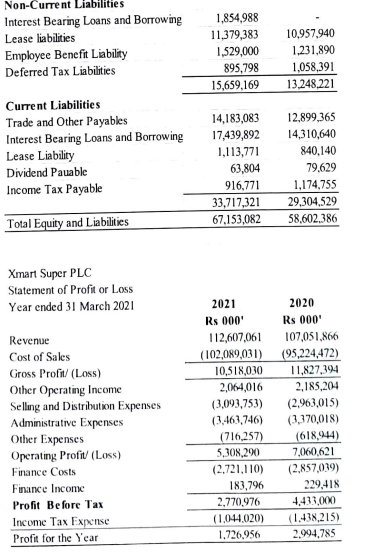

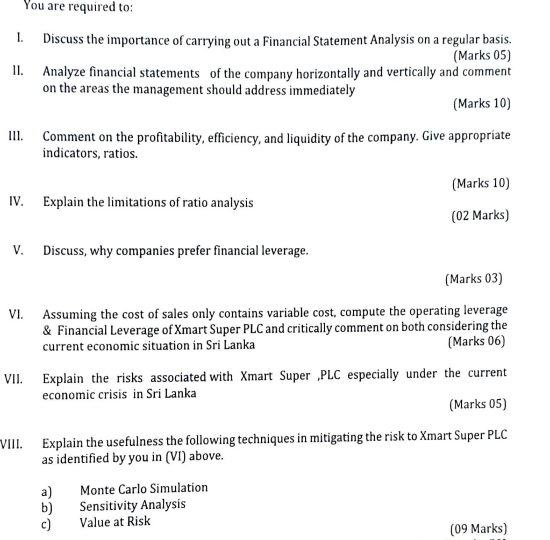

\begin{tabular}{lrr} Non-Curre nt Liabilities & & \\ Interest Bearing Loans and Borrowing & 1,854,988 & - \\ Lease liabilities & 11,379,383 & 10,957,940 \\ Employee Benefit Liability & 1,529,000 & 1,231,890 \\ Deferred Tax Liabilities & 895,798 & 1,058,391 \\ \cline { 2 - 3 } & 15,659,169 & 13,248,221 \\ \cline { 2 - 3 } Curre nt Liabilities & & \\ Trade and Other Payables & 14,183,083 & 12,899,365 \\ Interest Bearing Loans and Borrowing & 17,439,892 & 14,310,640 \\ Lease Liability & 1,113,771 & 840,140 \\ Dividend Pauable & 63,804 & 79,629 \\ Income Tax Payable & 916,771 & 1,174,755 \\ \hline Total Equity and Liabilities & 33,717,321 & 29,304,529 \\ \hline \end{tabular} Xmart Super PLC is a well-known supermarket chain having more than 200 Outlets Island wide. It is a quoted public company listed on the Colombo Stock Exchange in the year 2009. Xmart Super PLC had steady financial growth until the end of the financial year 2018/19. The Finance director Mr. Chamath Herath was not happy about the current performance of the company after seeing the financial results of the company for the year ended 31st March 2022 and he wants to carry out a financial statement analysis in order to submit a comprehensive board paper on the current status of the company identifying the areas to be focused in order to formulate the appropriate financial and business strategies to maximize the shareholders' wealth at the next board meeting. The Financial Statements of the company for the year ending 31st march 2022 are given below. You are currently following the Master of Business Economics programme of the Sri Jayawardenapura University and recently joint as a trainee financial analysist of the company. Mr. Herath approached you and request to analyses the current financial statements available for the financial year 2021/22. The company has issued 100% shares to the public and number of share in the public is 700Mn. You are required to: I. Discuss the importance of carrying out a Financial Statement Analysis on a regular basis. (Marks 05) II. Analyze financial statements of the company horizontally and vertically and comment on the areas the management should address immediately (Marks 10) III. Comment on the profitability, efficiency, and liquidity of the company. Give appropriate indicators, ratios. (Marks 10) IV. Explain the limitations of ratio analysis (02 Marks) V. Discuss, why companies prefer financial leverage. (Marks 03) VI. Assuming the cost of sales only contains variable cost, compute the operating leverage \& Financial Leverage of Xmart Super PLC and critically comment on both considering the current economic situation in Sri Lanka (Marks 06) VII. Explain the risks associated with Xmart Super ,PLC especially under the current economic crisis in Sri Lanka (Marks 05) VIII. Explain the usefulness the following techniques in mitigating the risk to Xmart Super PLC as identified by you in (VI) above. a) Monte Carlo Simulation b) Sensitivity Analysis c) Value at Risk (09 Marks) EQUITY AND LIABILITIES \begin{tabular}{lcc} Equity & & \\ Stated Capital & 7,000,000 & 7,000,000 \\ Reserve & 4,500,000 & 4,500,000 \\ Retained Earnings & 6,276,592 & 4,549,636 \\ \hline Total Equity & 17,776,592 & 16,049,636 \\ \hline \end{tabular} \begin{tabular}{lrr} Non-Curre nt Liabilities & & \\ Interest Bearing Loans and Borrowing & 1,854,988 & - \\ Lease liabilities & 11,379,383 & 10,957,940 \\ Employee Benefit Liability & 1,529,000 & 1,231,890 \\ Deferred Tax Liabilities & 895,798 & 1,058,391 \\ \cline { 2 - 3 } & 15,659,169 & 13,248,221 \\ \cline { 2 - 3 } Curre nt Liabilities & & \\ Trade and Other Payables & 14,183,083 & 12,899,365 \\ Interest Bearing Loans and Borrowing & 17,439,892 & 14,310,640 \\ Lease Liability & 1,113,771 & 840,140 \\ Dividend Pauable & 63,804 & 79,629 \\ Income Tax Payable & 916,771 & 1,174,755 \\ \hline Total Equity and Liabilities & 33,717,321 & 29,304,529 \\ \hline \end{tabular} Xmart Super PLC is a well-known supermarket chain having more than 200 Outlets Island wide. It is a quoted public company listed on the Colombo Stock Exchange in the year 2009. Xmart Super PLC had steady financial growth until the end of the financial year 2018/19. The Finance director Mr. Chamath Herath was not happy about the current performance of the company after seeing the financial results of the company for the year ended 31st March 2022 and he wants to carry out a financial statement analysis in order to submit a comprehensive board paper on the current status of the company identifying the areas to be focused in order to formulate the appropriate financial and business strategies to maximize the shareholders' wealth at the next board meeting. The Financial Statements of the company for the year ending 31st march 2022 are given below. You are currently following the Master of Business Economics programme of the Sri Jayawardenapura University and recently joint as a trainee financial analysist of the company. Mr. Herath approached you and request to analyses the current financial statements available for the financial year 2021/22. The company has issued 100% shares to the public and number of share in the public is 700Mn. You are required to: I. Discuss the importance of carrying out a Financial Statement Analysis on a regular basis. (Marks 05) II. Analyze financial statements of the company horizontally and vertically and comment on the areas the management should address immediately (Marks 10) III. Comment on the profitability, efficiency, and liquidity of the company. Give appropriate indicators, ratios. (Marks 10) IV. Explain the limitations of ratio analysis (02 Marks) V. Discuss, why companies prefer financial leverage. (Marks 03) VI. Assuming the cost of sales only contains variable cost, compute the operating leverage \& Financial Leverage of Xmart Super PLC and critically comment on both considering the current economic situation in Sri Lanka (Marks 06) VII. Explain the risks associated with Xmart Super ,PLC especially under the current economic crisis in Sri Lanka (Marks 05) VIII. Explain the usefulness the following techniques in mitigating the risk to Xmart Super PLC as identified by you in (VI) above. a) Monte Carlo Simulation b) Sensitivity Analysis c) Value at Risk (09 Marks) EQUITY AND LIABILITIES \begin{tabular}{lcc} Equity & & \\ Stated Capital & 7,000,000 & 7,000,000 \\ Reserve & 4,500,000 & 4,500,000 \\ Retained Earnings & 6,276,592 & 4,549,636 \\ \hline Total Equity & 17,776,592 & 16,049,636 \\ \hline \end{tabular}

\begin{tabular}{lrr} Non-Curre nt Liabilities & & \\ Interest Bearing Loans and Borrowing & 1,854,988 & - \\ Lease liabilities & 11,379,383 & 10,957,940 \\ Employee Benefit Liability & 1,529,000 & 1,231,890 \\ Deferred Tax Liabilities & 895,798 & 1,058,391 \\ \cline { 2 - 3 } & 15,659,169 & 13,248,221 \\ \cline { 2 - 3 } Curre nt Liabilities & & \\ Trade and Other Payables & 14,183,083 & 12,899,365 \\ Interest Bearing Loans and Borrowing & 17,439,892 & 14,310,640 \\ Lease Liability & 1,113,771 & 840,140 \\ Dividend Pauable & 63,804 & 79,629 \\ Income Tax Payable & 916,771 & 1,174,755 \\ \hline Total Equity and Liabilities & 33,717,321 & 29,304,529 \\ \hline \end{tabular} Xmart Super PLC is a well-known supermarket chain having more than 200 Outlets Island wide. It is a quoted public company listed on the Colombo Stock Exchange in the year 2009. Xmart Super PLC had steady financial growth until the end of the financial year 2018/19. The Finance director Mr. Chamath Herath was not happy about the current performance of the company after seeing the financial results of the company for the year ended 31st March 2022 and he wants to carry out a financial statement analysis in order to submit a comprehensive board paper on the current status of the company identifying the areas to be focused in order to formulate the appropriate financial and business strategies to maximize the shareholders' wealth at the next board meeting. The Financial Statements of the company for the year ending 31st march 2022 are given below. You are currently following the Master of Business Economics programme of the Sri Jayawardenapura University and recently joint as a trainee financial analysist of the company. Mr. Herath approached you and request to analyses the current financial statements available for the financial year 2021/22. The company has issued 100% shares to the public and number of share in the public is 700Mn. You are required to: I. Discuss the importance of carrying out a Financial Statement Analysis on a regular basis. (Marks 05) II. Analyze financial statements of the company horizontally and vertically and comment on the areas the management should address immediately (Marks 10) III. Comment on the profitability, efficiency, and liquidity of the company. Give appropriate indicators, ratios. (Marks 10) IV. Explain the limitations of ratio analysis (02 Marks) V. Discuss, why companies prefer financial leverage. (Marks 03) VI. Assuming the cost of sales only contains variable cost, compute the operating leverage \& Financial Leverage of Xmart Super PLC and critically comment on both considering the current economic situation in Sri Lanka (Marks 06) VII. Explain the risks associated with Xmart Super ,PLC especially under the current economic crisis in Sri Lanka (Marks 05) VIII. Explain the usefulness the following techniques in mitigating the risk to Xmart Super PLC as identified by you in (VI) above. a) Monte Carlo Simulation b) Sensitivity Analysis c) Value at Risk (09 Marks) EQUITY AND LIABILITIES \begin{tabular}{lcc} Equity & & \\ Stated Capital & 7,000,000 & 7,000,000 \\ Reserve & 4,500,000 & 4,500,000 \\ Retained Earnings & 6,276,592 & 4,549,636 \\ \hline Total Equity & 17,776,592 & 16,049,636 \\ \hline \end{tabular} \begin{tabular}{lrr} Non-Curre nt Liabilities & & \\ Interest Bearing Loans and Borrowing & 1,854,988 & - \\ Lease liabilities & 11,379,383 & 10,957,940 \\ Employee Benefit Liability & 1,529,000 & 1,231,890 \\ Deferred Tax Liabilities & 895,798 & 1,058,391 \\ \cline { 2 - 3 } & 15,659,169 & 13,248,221 \\ \cline { 2 - 3 } Curre nt Liabilities & & \\ Trade and Other Payables & 14,183,083 & 12,899,365 \\ Interest Bearing Loans and Borrowing & 17,439,892 & 14,310,640 \\ Lease Liability & 1,113,771 & 840,140 \\ Dividend Pauable & 63,804 & 79,629 \\ Income Tax Payable & 916,771 & 1,174,755 \\ \hline Total Equity and Liabilities & 33,717,321 & 29,304,529 \\ \hline \end{tabular} Xmart Super PLC is a well-known supermarket chain having more than 200 Outlets Island wide. It is a quoted public company listed on the Colombo Stock Exchange in the year 2009. Xmart Super PLC had steady financial growth until the end of the financial year 2018/19. The Finance director Mr. Chamath Herath was not happy about the current performance of the company after seeing the financial results of the company for the year ended 31st March 2022 and he wants to carry out a financial statement analysis in order to submit a comprehensive board paper on the current status of the company identifying the areas to be focused in order to formulate the appropriate financial and business strategies to maximize the shareholders' wealth at the next board meeting. The Financial Statements of the company for the year ending 31st march 2022 are given below. You are currently following the Master of Business Economics programme of the Sri Jayawardenapura University and recently joint as a trainee financial analysist of the company. Mr. Herath approached you and request to analyses the current financial statements available for the financial year 2021/22. The company has issued 100% shares to the public and number of share in the public is 700Mn. You are required to: I. Discuss the importance of carrying out a Financial Statement Analysis on a regular basis. (Marks 05) II. Analyze financial statements of the company horizontally and vertically and comment on the areas the management should address immediately (Marks 10) III. Comment on the profitability, efficiency, and liquidity of the company. Give appropriate indicators, ratios. (Marks 10) IV. Explain the limitations of ratio analysis (02 Marks) V. Discuss, why companies prefer financial leverage. (Marks 03) VI. Assuming the cost of sales only contains variable cost, compute the operating leverage \& Financial Leverage of Xmart Super PLC and critically comment on both considering the current economic situation in Sri Lanka (Marks 06) VII. Explain the risks associated with Xmart Super ,PLC especially under the current economic crisis in Sri Lanka (Marks 05) VIII. Explain the usefulness the following techniques in mitigating the risk to Xmart Super PLC as identified by you in (VI) above. a) Monte Carlo Simulation b) Sensitivity Analysis c) Value at Risk (09 Marks) EQUITY AND LIABILITIES \begin{tabular}{lcc} Equity & & \\ Stated Capital & 7,000,000 & 7,000,000 \\ Reserve & 4,500,000 & 4,500,000 \\ Retained Earnings & 6,276,592 & 4,549,636 \\ \hline Total Equity & 17,776,592 & 16,049,636 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started