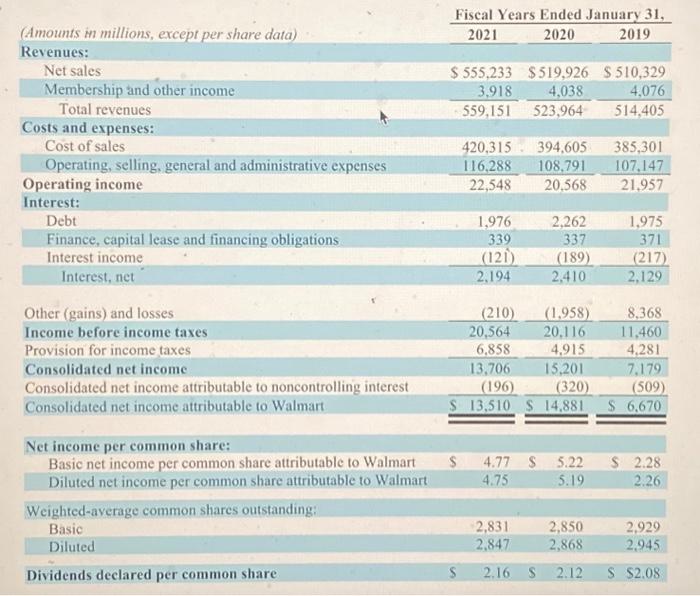

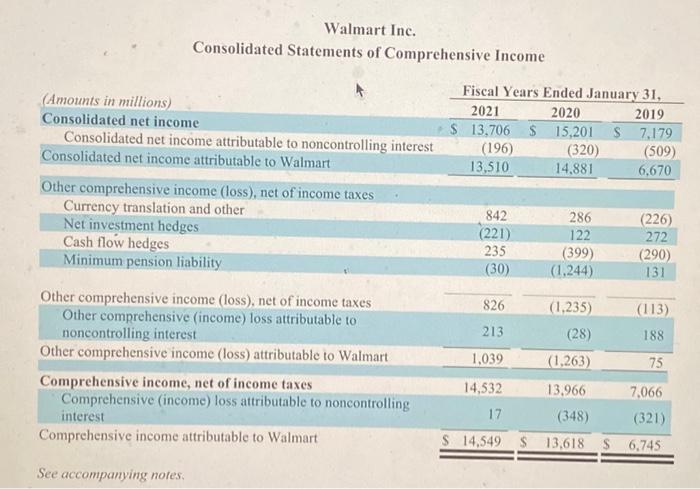

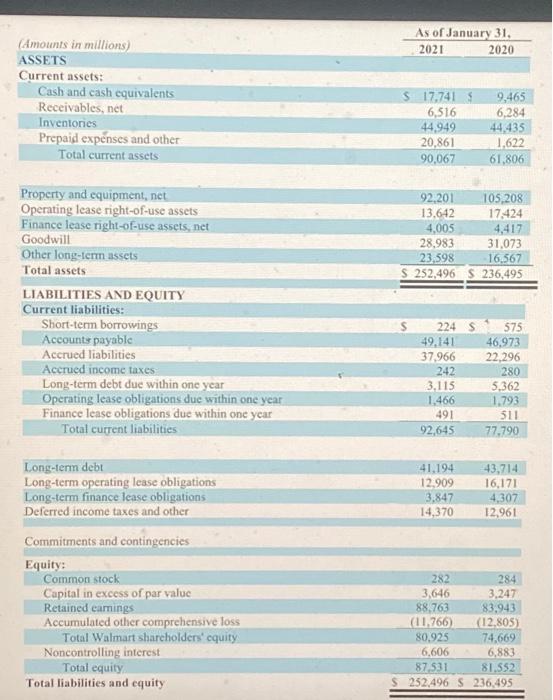

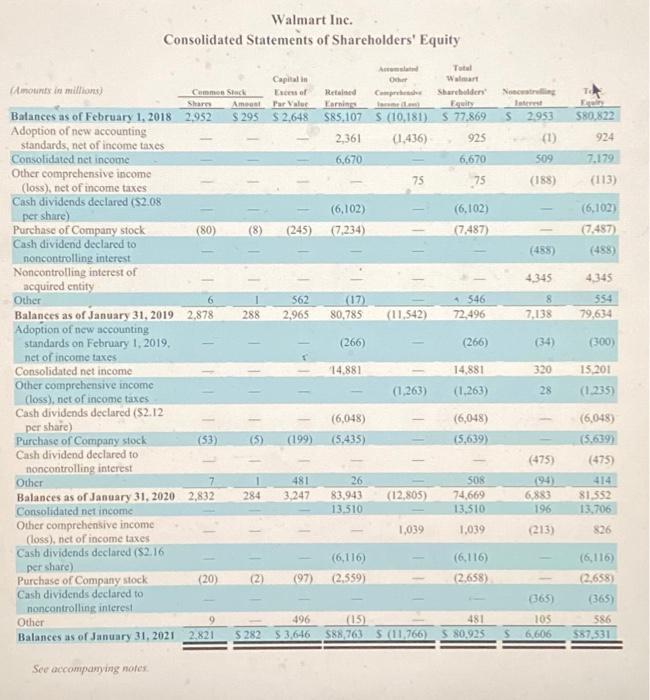

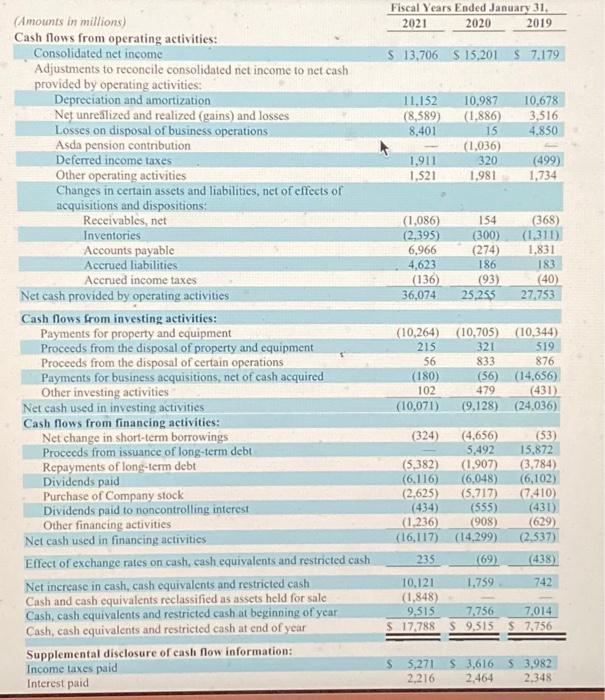

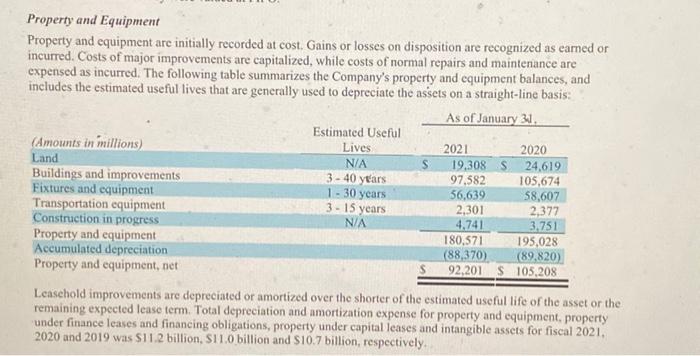

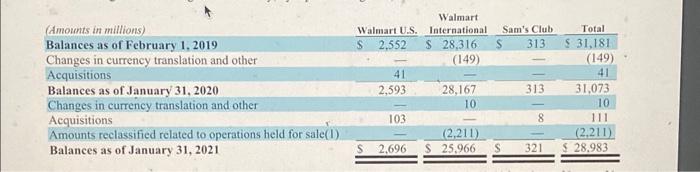

\begin{tabular}{lrrrr} Other (gains) and losses & & (210) & (1,958) & 8,368 \\ \hline Income before income taxes & 20,564 & 20,116 & 11,460 \\ Provision for income taxes & 6,858 & 4,915 & 4,281 \\ \hline Consolidated net income & 13,706 & 15,201 & 7,179 \\ \hline Consolidated net income attributable to noncontrolling interest & (196) & (320) & (509) \\ \hline Consolidated net income attributable to Walmart & $13,510 & $14,881 & $5.670 \\ \hline \end{tabular} Net income per common share: BasicnetincomepercommonshareattributabletoWalmartDilutednetincomepercommonshareattributabletoWalmart$4.774.75$5.225.19$2.262.28 Weighted-average common shares outstanding: Basic Diluted Dividends declared per common share $2.16$2.12$$2.08 Walmart Inc. Consolidated Statements of Comprehensive Income \begin{tabular}{lrrr} (Amounts in millions) & \multicolumn{3}{c}{ As of January 31, } \\ \cline { 2 - 4 } ASSETS & 2021 & 2020 \\ \hline Current assets: & & \\ Cash and cash equivalents & & 17,741 & 5,465 \\ Receivables, net & 6,516 & 6,284 \\ \hline Inventories & 44,949 & 44,435 \\ Prepaid expenses and other & 20,861 & 1,622 \\ \hline Total current assets & 90,067 & 61,806 \end{tabular} LIABILITIES AND EQUITY Current liabilities: \begin{tabular}{lrr} \hline Long-term debt & 41,194 & 43,714 \\ Long-term operating lease obligations & 12,909 & 16,171 \\ \hline Long-term finance lease obligations & 3,847 & 4,307 \\ Deferred income taxes and other & 14,370 & 12,961 \end{tabular} Commitments and contingencies Equity: \begin{tabular}{lrrr|} \hline Common stock & 282 & 284 \\ \hline Capital in excess of par value & 3,646 & 3,247 \\ \hline Retained camings & 88,763 & 83,943 \\ \hline Accumulated other comprehensive loss & (11,766) & (12,805) \\ \hline Total Walmart shareholders' cquity & 80,925 & 74,669 \\ \hline Noncontrolling interest & 6,606 & 6,883 \\ \hline Total equity & 87,531 & 81,552 \\ \hline Total liabilities and equity & $252,496$236,495 \\ \hline \hline \end{tabular} WVolwart Ino Supplemental disclosure of cash flow information: Income taxes paid Interest paid Property and Equipment Property and equipment are initially recorded at cost. Gains or losses on disposition are recognized as earned or incurred. Costs of major improvements are capitalized, while costs of normal repairs and maintenance are expensed as incurred. The following table summarizes the Company's property and equipment balances, and includes the estimated useful lives that are generally used to depreciate the assets on a straight-line basis: Leasehold improvements are depreciated or amortized over the shorter of the estimated useful life of the asset or the remaining expected lease term. Total depreciation and amortization expense for property and equipment, property under finance leases and financing obligations, property under capital leases and intangible assets for fiscal 2021, 2020 and 2019 was $11.2 billion, $11.0 billion and $10.7 billion, respectively. Walmart (dmounts in millions) Balances as of February 1, 2019 Changes in currency translation and other Acquisitions Balances as of January 31,2020 Changes in currency translation and other Acquisitions Amounts reclassified related to operations held for sale(I) Balances as of January 31, 2021 (1) Represents goodwill associated with operations in the U.K. and Japan which are classified as held for sale as of January 31 . 2021. Refer to the financial statements and footnotes of Walmart given in ARpendix C. All dollar amounts are in millions. Required: 1. What is the amount of cash Walmart paid for interest during the most recent fiscal year? 2. What is the amount of long-term debt that Walmart issued during the most recent fiscal year? 3. What is the amount of Walmart's long-term debt that will mature in fiscal year 2024 ? See Footnote 6. 4. What is the amount of cash Walmart paid to retire long-term debt during the most recent fiscal year? 5. For the most recent fiscal year, compute the debt-to-equity ratio for Walmart. Complete this question by entering your answers in the tabs below. What is the amount of cash Walmart paid for interest during the most recent fiscal year? Note: Enter your answer in millions (i.e., 10,000,000 should be entered as 10 )