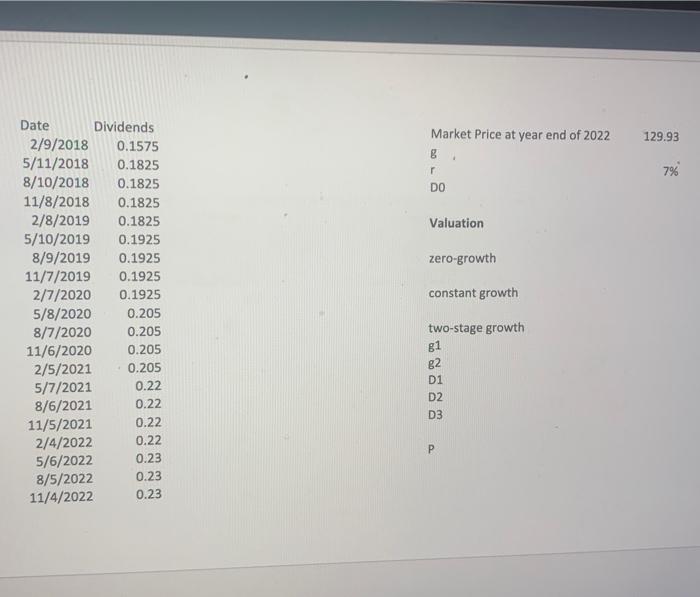

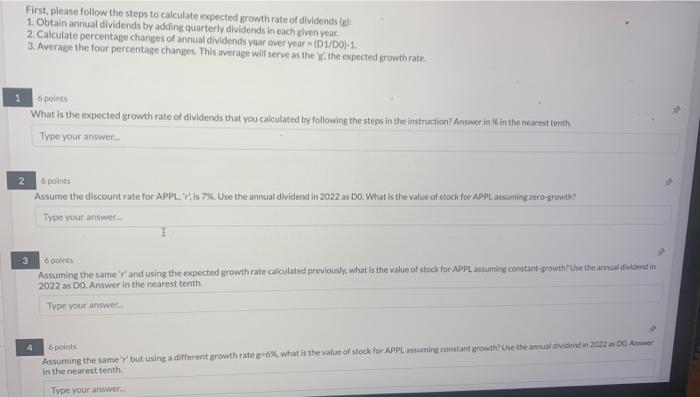

\begin{tabular}{r|rll} \multicolumn{1}{r|}{ Date } & Dividends & & Market Price at year end of 2022 \\ 2/9/2018 & 0.1575 & 129.93 \\ 5/11/2018 & 0.1825 & Do \\ 8/10/2018 & 0.1825 & \\ 11/8/2018 & 0.1825 & Valuation \\ 2/8/2019 & 0.1825 & \\ 5/10/2019 & 0.1925 & zero-growth \\ 8/9/2019 & 0.1925 & \\ 11/7/2019 & 0.1925 & constant growth \\ 2/7/2020 & 0.1925 & \\ 5/8/2020 & 0.205 & two-stage growth \\ 8/7/2020 & 0.205 & g1 \\ 11/6/2020 & 0.205 & g2 \\ 2/5/2021 & 0.205 & D1 \\ 5/7/2021 & 0.22 & D2 \\ 8/6/2021 & 0.22 & D3 \\ 11/5/2021 & 0.22 & P \\ 2/4/2022 & 0.22 & 0.23 & \\ 5/6/2022 & 0.23 & 0.23 & \\ 8/5/2022 & 0/2022 & 0.25 & \end{tabular} First, please follow the steps to calculate expected growth rate of dividends (g). 1. Obtain anrual dividends by addine quarterly dividends in each given vear. 2. Calculate percentage changes of annual dlvidends yoar over year = (D 1/DO)1. 3. Average the four percentage changes. This average will serve as the 'g', the erpected growthrate. 10 What is the expected growth rate of dividends that you calculated by following the steps in the instruction? Arrwer in % in the nearest tenth. Tvise your ariswer 28 polint Assume the discount rate for APPL, 'Tils 7\%. Use the annual dividend in 2022 as DQ. What is the value of stoch for APPL assuming zero-growth? Type your answer- 3 (6points Assuming the same'tr' and using the expected growth rate calculated previously, what is the value of stock for APpl assuming conitant-jrowtil 2022DDO. Answer in the nearest tenth TVpe your answer. 46 Gpainta in the nearest tenth \begin{tabular}{r|rll} \multicolumn{1}{r|}{ Date } & Dividends & & Market Price at year end of 2022 \\ 2/9/2018 & 0.1575 & 129.93 \\ 5/11/2018 & 0.1825 & Do \\ 8/10/2018 & 0.1825 & \\ 11/8/2018 & 0.1825 & Valuation \\ 2/8/2019 & 0.1825 & \\ 5/10/2019 & 0.1925 & zero-growth \\ 8/9/2019 & 0.1925 & \\ 11/7/2019 & 0.1925 & constant growth \\ 2/7/2020 & 0.1925 & \\ 5/8/2020 & 0.205 & two-stage growth \\ 8/7/2020 & 0.205 & g1 \\ 11/6/2020 & 0.205 & g2 \\ 2/5/2021 & 0.205 & D1 \\ 5/7/2021 & 0.22 & D2 \\ 8/6/2021 & 0.22 & D3 \\ 11/5/2021 & 0.22 & P \\ 2/4/2022 & 0.22 & 0.23 & \\ 5/6/2022 & 0.23 & 0.23 & \\ 8/5/2022 & 0/2022 & 0.25 & \end{tabular} First, please follow the steps to calculate expected growth rate of dividends (g). 1. Obtain anrual dividends by addine quarterly dividends in each given vear. 2. Calculate percentage changes of annual dlvidends yoar over year = (D 1/DO)1. 3. Average the four percentage changes. This average will serve as the 'g', the erpected growthrate. 10 What is the expected growth rate of dividends that you calculated by following the steps in the instruction? Arrwer in % in the nearest tenth. Tvise your ariswer 28 polint Assume the discount rate for APPL, 'Tils 7\%. Use the annual dividend in 2022 as DQ. What is the value of stoch for APPL assuming zero-growth? Type your answer- 3 (6points Assuming the same'tr' and using the expected growth rate calculated previously, what is the value of stock for APpl assuming conitant-jrowtil 2022DDO. Answer in the nearest tenth TVpe your answer. 46 Gpainta in the nearest tenth