Answered step by step

Verified Expert Solution

Question

1 Approved Answer

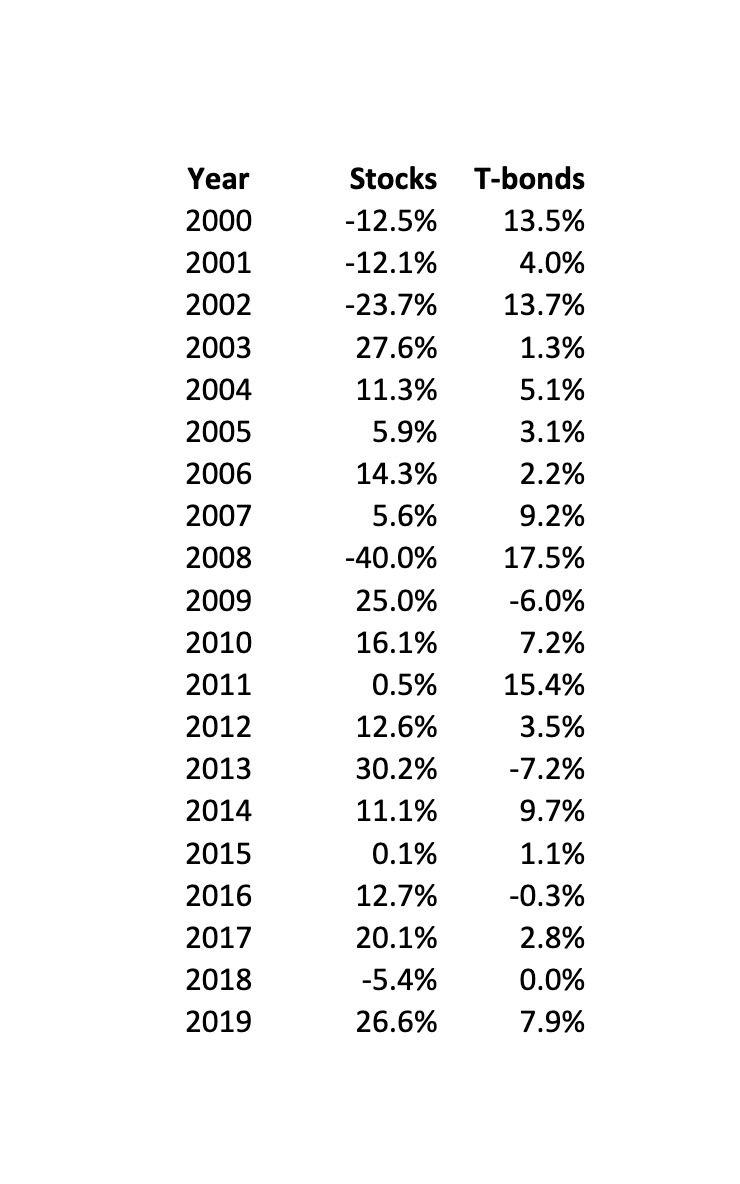

begin{tabular}{rrr} Year & Stocks & T-bonds 2000 & 12.5% & 13.5% 2001 & 12.1% & 4.0% 2002 & 23.7% & 13.7%

\begin{tabular}{rrr} Year & Stocks & T-bonds \\ 2000 & 12.5% & 13.5% \\ 2001 & 12.1% & 4.0% \\ 2002 & 23.7% & 13.7% \\ 2003 & 27.6% & 1.3% \\ 2004 & 11.3% & 5.1% \\ 2005 & 5.9% & 3.1% \\ 2006 & 14.3% & 2.2% \\ 2007 & 5.6% & 9.2% \\ 2008 & 40.0% & 17.5% \\ 2009 & 25.0% & 6.0% \\ 2010 & 16.1% & 7.2% \\ 2011 & 0.5% & 15.4% \\ 2012 & 12.6% & 3.5% \\ 2013 & 30.2% & 7.2% \\ 2014 & 11.1% & 9.7% \\ 2015 & 0.1% & 1.1% \\ 2016 & 12.7% & 0.3% \\ 2017 & 20.1% & 2.8% \\ 2018 & 5.4% & 0.0% \\ 2019 & 26.6% & 7.9% \end{tabular} Analyze the risk-return trade-off that would have characterized portfolios constructed from Stocks and Treasury bonds over the last 20 years. Use Excel to answer the following: (15 points) a. What were the average rate of return and standard deviation of each asset? (Hint: use AVERAGE and STDEV.S functions) b. What was the correlation coefficient of their annual returns? (Hint: use CORREL function) c. What would have been the average return and standard deviation of the portfolios with differing weights in the two assets? (Hint: consider weights in stocks starting at 0 and increment by 0.1 up to 1.0) d. What were the average return and standard deviation of the minimum-variance combination of stocks and bonds? e. Graph the investment opportunity set based on your answers in part (c) above

\begin{tabular}{rrr} Year & Stocks & T-bonds \\ 2000 & 12.5% & 13.5% \\ 2001 & 12.1% & 4.0% \\ 2002 & 23.7% & 13.7% \\ 2003 & 27.6% & 1.3% \\ 2004 & 11.3% & 5.1% \\ 2005 & 5.9% & 3.1% \\ 2006 & 14.3% & 2.2% \\ 2007 & 5.6% & 9.2% \\ 2008 & 40.0% & 17.5% \\ 2009 & 25.0% & 6.0% \\ 2010 & 16.1% & 7.2% \\ 2011 & 0.5% & 15.4% \\ 2012 & 12.6% & 3.5% \\ 2013 & 30.2% & 7.2% \\ 2014 & 11.1% & 9.7% \\ 2015 & 0.1% & 1.1% \\ 2016 & 12.7% & 0.3% \\ 2017 & 20.1% & 2.8% \\ 2018 & 5.4% & 0.0% \\ 2019 & 26.6% & 7.9% \end{tabular} Analyze the risk-return trade-off that would have characterized portfolios constructed from Stocks and Treasury bonds over the last 20 years. Use Excel to answer the following: (15 points) a. What were the average rate of return and standard deviation of each asset? (Hint: use AVERAGE and STDEV.S functions) b. What was the correlation coefficient of their annual returns? (Hint: use CORREL function) c. What would have been the average return and standard deviation of the portfolios with differing weights in the two assets? (Hint: consider weights in stocks starting at 0 and increment by 0.1 up to 1.0) d. What were the average return and standard deviation of the minimum-variance combination of stocks and bonds? e. Graph the investment opportunity set based on your answers in part (c) above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started