Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BeGone manufactures spray cans of insect repellent. On August 1, the company had 15,680 units in the beginning WIP Inventory that were 100 percent

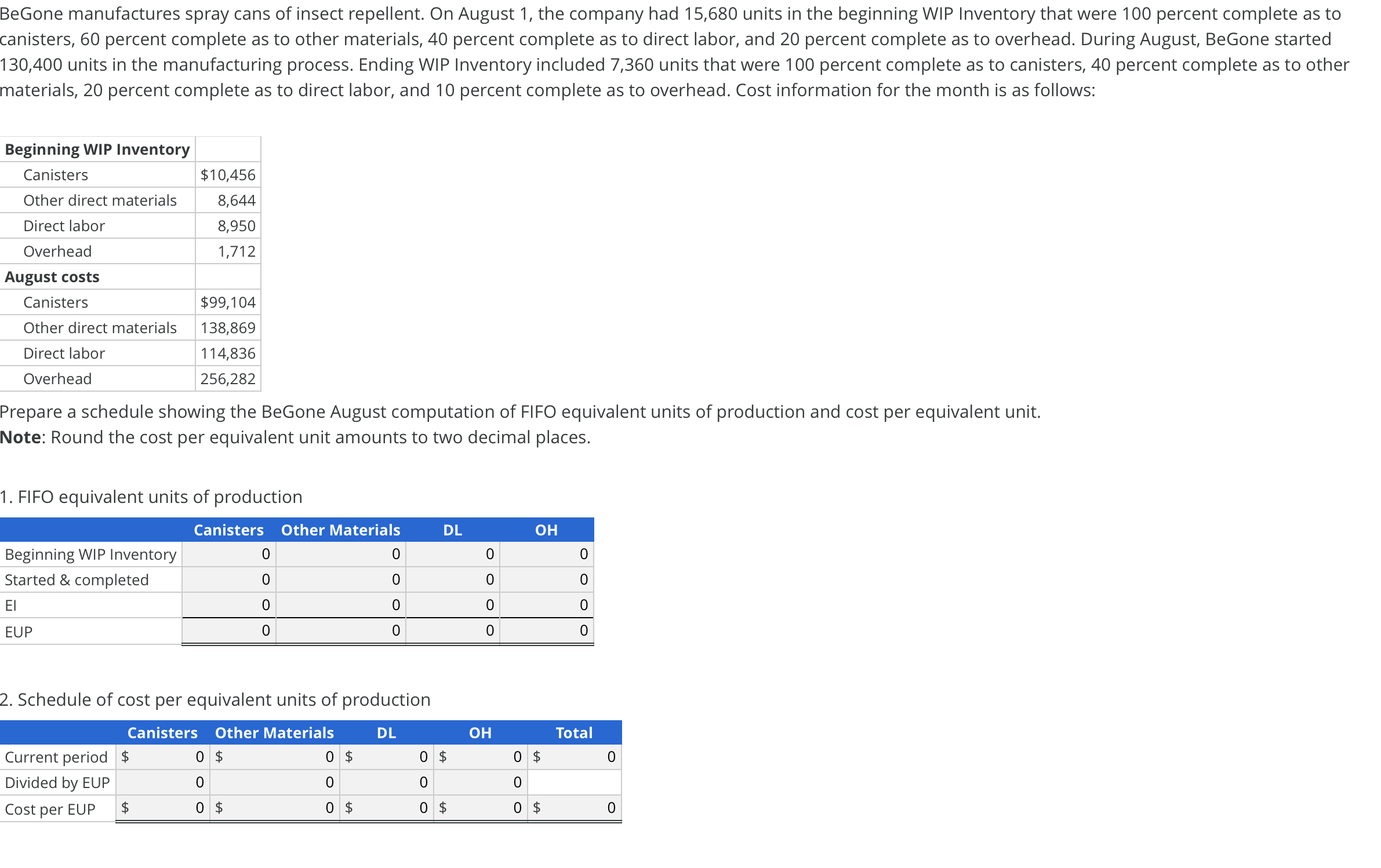

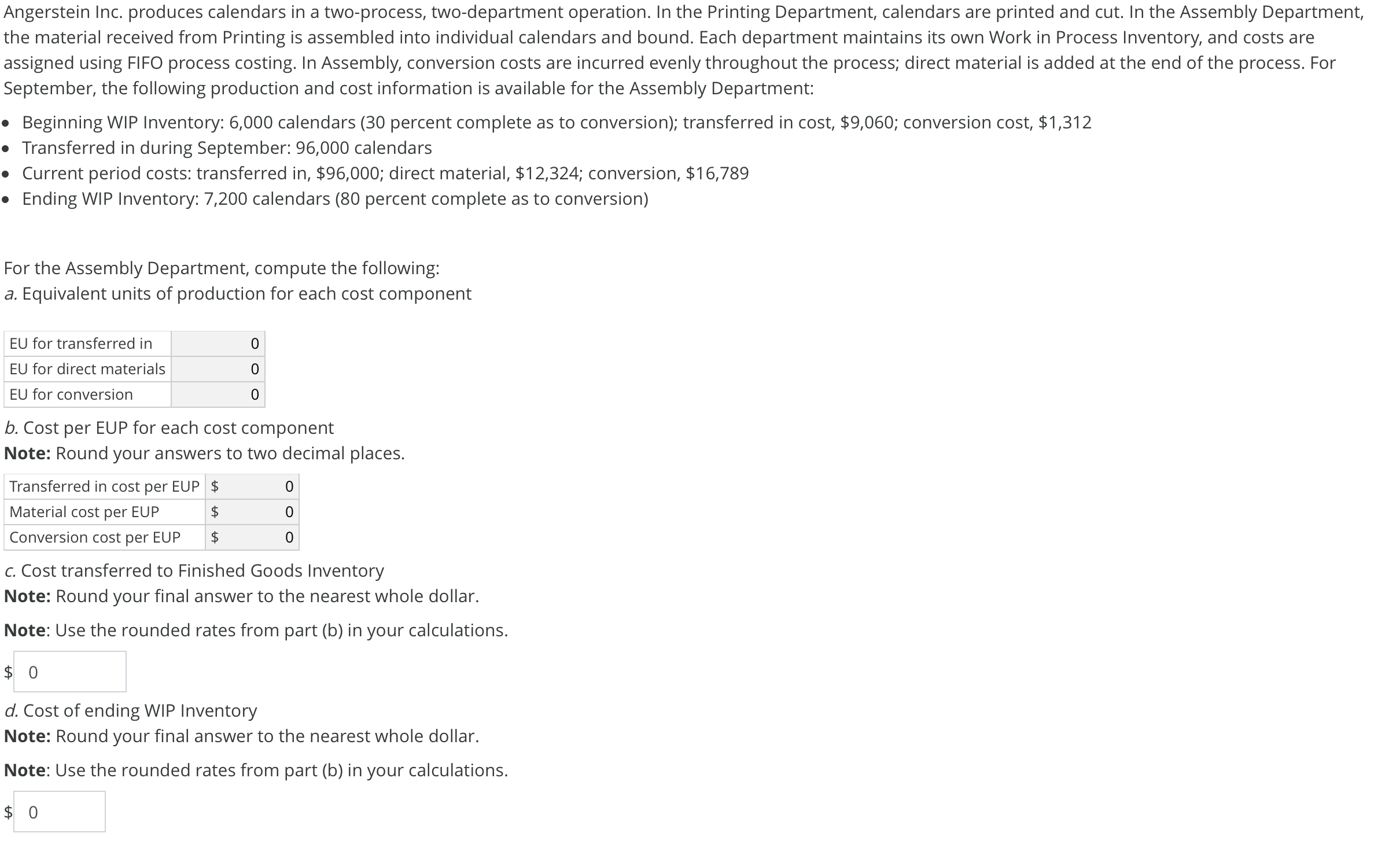

BeGone manufactures spray cans of insect repellent. On August 1, the company had 15,680 units in the beginning WIP Inventory that were 100 percent complete as to canisters, 60 percent complete as to other materials, 40 percent complete as to direct labor, and 20 percent complete as to overhead. During August, BeGone started 130,400 units in the manufacturing process. Ending WIP Inventory included 7,360 units that were 100 percent complete as to canisters, 40 percent complete as to other materials, 20 percent complete as to direct labor, and 10 percent complete as to overhead. Cost information for the month is as follows: Beginning WIP Inventory Canisters $10,456 Other direct materials 8,644 Direct labor 8,950 Overhead 1,712 August costs Canisters $99,104 Other direct materials 138,869 114,836 Direct labor Overhead 256,282 Prepare a schedule showing the BeGone August computation of FIFO equivalent units of production and cost per equivalent unit. Note: Round the cost per equivalent unit amounts to two decimal places. 1. FIFO equivalent units of production Canisters Other Materials DL OH Beginning WIP Inventory 0 0 0 0 Started & completed 0 0 0 0 0 0 0 0 EUP 0 0 0 0 2. Schedule of cost per equivalent units of production Canisters Other Materials DL OH Total Current period $ 0 $ 0 $ 0 $ 0 $ 0 Divided by EUP 0 0 0 0 Cost per EUP $ 0 $ 0 $ 0 $ 0 $ 0 Angerstein Inc. produces calendars in a two-process, two-department operation. In the Printing Department, calendars are printed and cut. In the Assembly Department, the material received from Printing is assembled into individual calendars and bound. Each department maintains its own Work in Process Inventory, and costs are assigned using FIFO process costing. In Assembly, conversion costs are incurred evenly throughout the process; direct material is added at the end of the process. For September, the following production and cost information is available for the Assembly Department: Beginning WIP Inventory: 6,000 calendars (30 percent complete as to conversion); transferred in cost, $9,060; conversion cost, $1,312 Transferred in during September: 96,000 calendars Current period costs: transferred in, $96,000; direct material, $12,324; conversion, $16,789 Ending WIP Inventory: 7,200 calendars (80 percent complete as to conversion) For the Assembly Department, compute the following: a. Equivalent units of production for each cost component EU for transferred in EU for direct materials EU for conversion 0 0 0 b. Cost per EUP for each cost component Note: Round your answers to two decimal places. Transferred in cost per EUP $ 0 Material cost per EUP $ 0 Conversion cost per EUP $ 0 c. Cost transferred to Finished Goods Inventory Note: Round your final answer to the nearest whole dollar. Note: Use the rounded rates from part (b) in your calculations. $ 0 d. Cost of ending WIP Inventory Note: Round your final answer to the nearest whole dollar. Note: Use the rounded rates from part (b) in your calculations. $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started