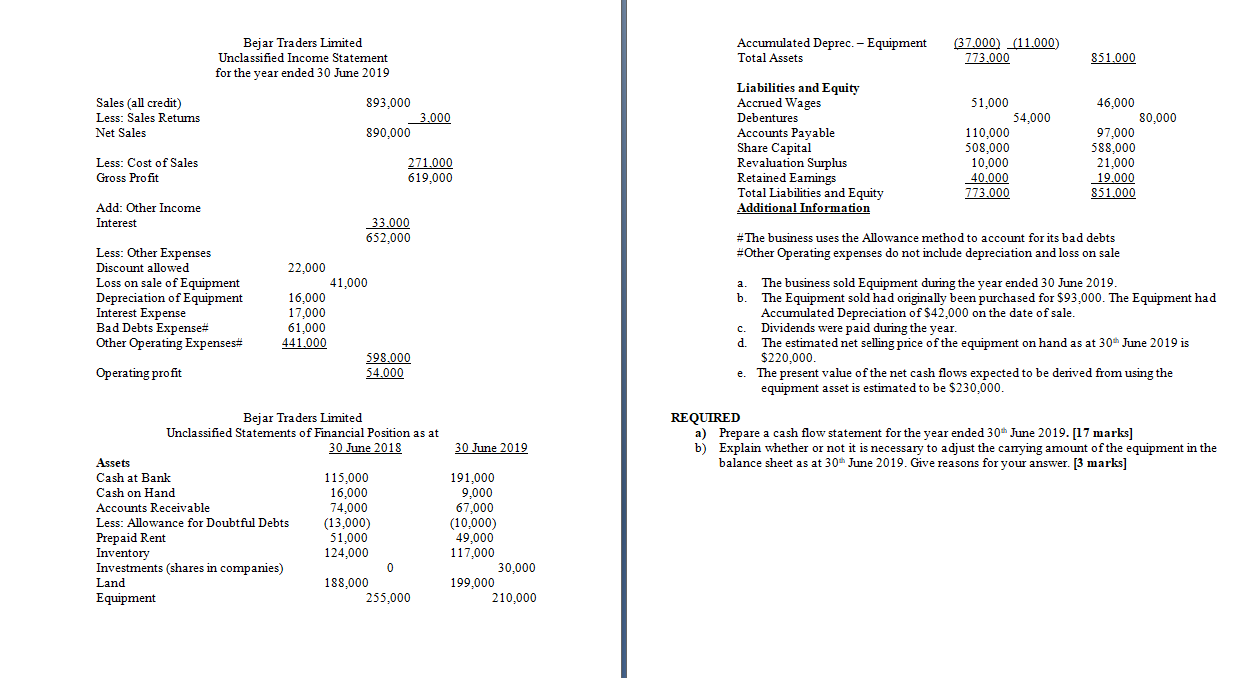

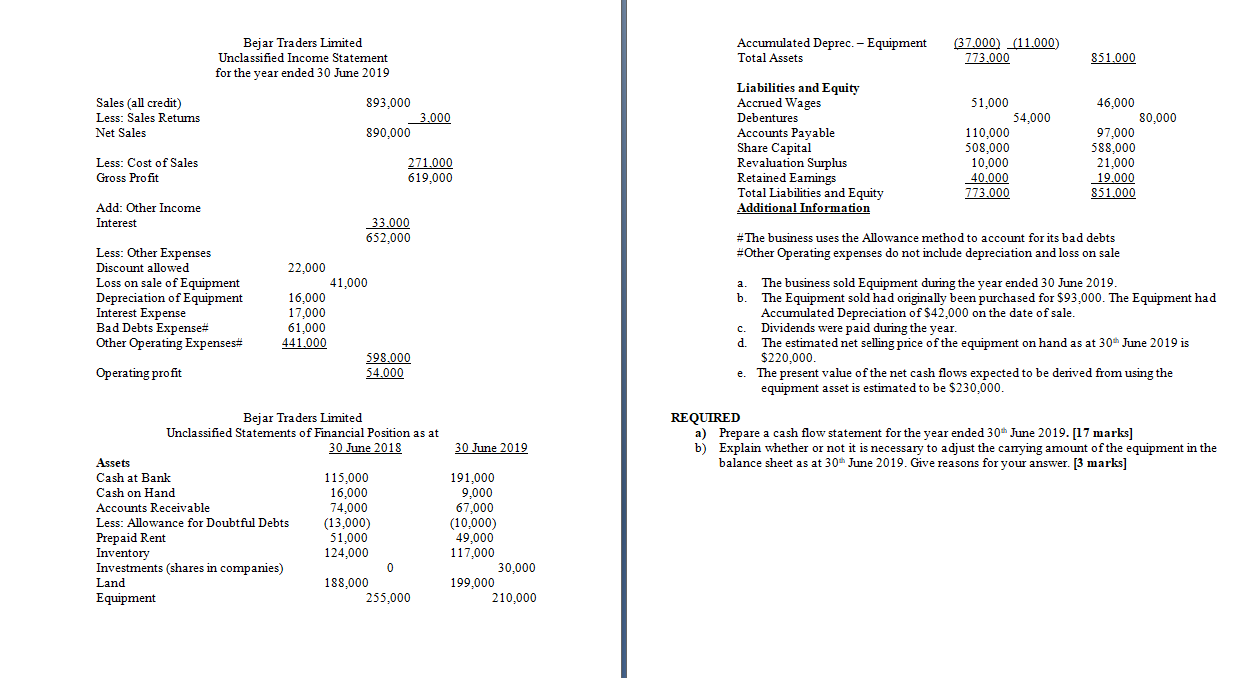

Bejar Traders Limited Unclassified Income Statement for the year ended 30 June 2019 Accumulated Deprec. - Equipment Total Assets (37.000) (11.000) 773.000 851,000 893,000 Sales (all credit) Less: Sales Retums Net Sales 3.000 890,000 Liabilities and Equity Accrued Wages Debentures Accounts Payable Share Capital Revaluation Surplus Retained Eamings Total Liabilities and Equity Additional Information 51,000 54,000 110,000 508,000 10,000 40.000 773.000 46,000 80,000 97,000 588,000 21,000 19.000 851,000 Less: Cost of Sales Gross Profit 271,000 619,000 Add: Other Income Interest 33.000 652,000 #The business uses the Allowance method to account for its bad debts #Other Operating expenses do not include depreciation and loss on sale Less: Other Expenses Discount allowed Loss on sale of Equipment Depreciation of Equipment Interest Expense Bad Debts Expense Other Operating Expenses 22,000 41,000 16,000 17,000 61,000 441.000 598.000 54.000 Operating profit a. The business sold Equipment during the year ended 30 June 2019. b. The Equipment sold had originally been purchased for $93,000. The Equipment had Accumulated Depreciation of $42,000 on the date of sale. c. Dividends were paid during the year. d. The estimated net selling price of the equipment on hand as at 30 June 2019 is $220,000 e. The present value of the net cash flows expected to be derived from using the equipment asset is estimated to be $230,000. REQUIRED a) Prepare a cash flow statement for the year ended 30 June 2019. [17 marks] b) Explain whether or not it is necessary to adjust the carrying amount of the equipment in the balance sheet as at 30 June 2019. Give reasons for your answer. [3 marks] 30 June 2019 Bejar Traders Limited Unclassified Statements of Financial Position as at 30 June 2018 Assets Cash at Bank 115,000 Cash on Hand 16,000 Accounts Receivable 74,000 Less: Allowance for Doubtful Debts (13,000) Prepaid Rent 51,000 Inventory 124,000 Investments (shares in companies) Land 188,000 Equipment 255,000 191,000 9,000 67,000 (10,000) 49,000 117,000 30,000 199,000 210,000 Bejar Traders Limited Unclassified Income Statement for the year ended 30 June 2019 Accumulated Deprec. - Equipment Total Assets (37.000) (11.000) 773.000 851,000 893,000 Sales (all credit) Less: Sales Retums Net Sales 3.000 890,000 Liabilities and Equity Accrued Wages Debentures Accounts Payable Share Capital Revaluation Surplus Retained Eamings Total Liabilities and Equity Additional Information 51,000 54,000 110,000 508,000 10,000 40.000 773.000 46,000 80,000 97,000 588,000 21,000 19.000 851,000 Less: Cost of Sales Gross Profit 271,000 619,000 Add: Other Income Interest 33.000 652,000 #The business uses the Allowance method to account for its bad debts #Other Operating expenses do not include depreciation and loss on sale Less: Other Expenses Discount allowed Loss on sale of Equipment Depreciation of Equipment Interest Expense Bad Debts Expense Other Operating Expenses 22,000 41,000 16,000 17,000 61,000 441.000 598.000 54.000 Operating profit a. The business sold Equipment during the year ended 30 June 2019. b. The Equipment sold had originally been purchased for $93,000. The Equipment had Accumulated Depreciation of $42,000 on the date of sale. c. Dividends were paid during the year. d. The estimated net selling price of the equipment on hand as at 30 June 2019 is $220,000 e. The present value of the net cash flows expected to be derived from using the equipment asset is estimated to be $230,000. REQUIRED a) Prepare a cash flow statement for the year ended 30 June 2019. [17 marks] b) Explain whether or not it is necessary to adjust the carrying amount of the equipment in the balance sheet as at 30 June 2019. Give reasons for your answer. [3 marks] 30 June 2019 Bejar Traders Limited Unclassified Statements of Financial Position as at 30 June 2018 Assets Cash at Bank 115,000 Cash on Hand 16,000 Accounts Receivable 74,000 Less: Allowance for Doubtful Debts (13,000) Prepaid Rent 51,000 Inventory 124,000 Investments (shares in companies) Land 188,000 Equipment 255,000 191,000 9,000 67,000 (10,000) 49,000 117,000 30,000 199,000 210,000