Answered step by step

Verified Expert Solution

Question

1 Approved Answer

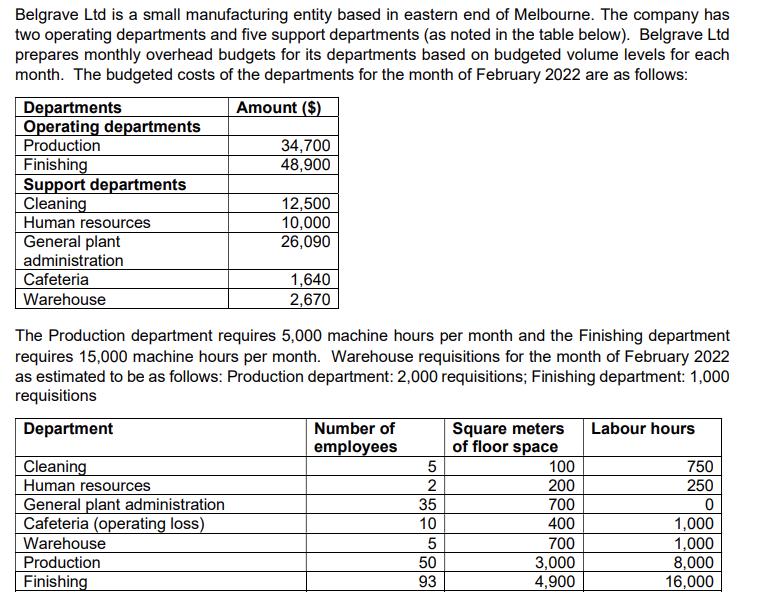

Belgrave Ltd is a small manufacturing entity based in eastern end of Melbourne. The company has two operating departments and five support departments (as

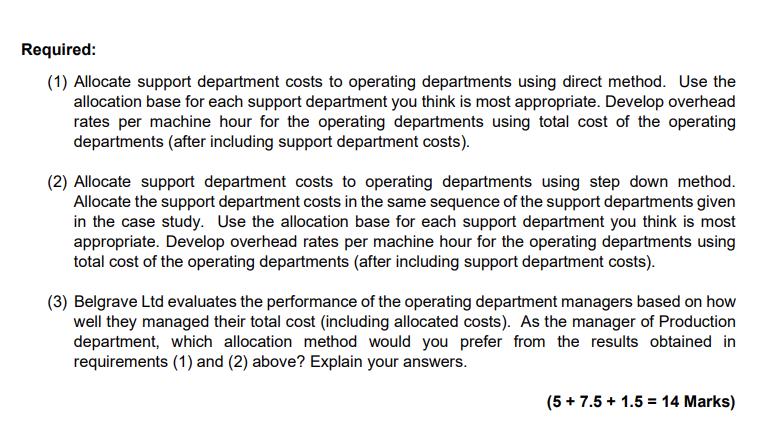

Belgrave Ltd is a small manufacturing entity based in eastern end of Melbourne. The company has two operating departments and five support departments (as noted in the table below). Belgrave Ltd prepares monthly overhead budgets for its departments based on budgeted volume levels for each month. The budgeted costs of the departments for the month of February 2022 are as follows: Amount ($) Departments Operating departments Production Finishing Support departments Cleaning Human resources General plant administration Cafeteria Warehouse Cleaning Human resources General plant administration Cafeteria (operating loss) Warehouse 34,700 48,900 Production Finishing 12,500 10,000 26,090 The Production department requires 5,000 machine hours per month and the Finishing department requires 15,000 machine hours per month. Warehouse requisitions for the month of February 2022 as estimated to be as follows: Production department: 2,000 requisitions; Finishing department: 1,000 requisitions Department 1,640 2,670 Number of employees 5 2 35 10 5 50 93 Square meters Labour hours of floor space 100 200 700 400 700 3,000 4,900 750 250 0 1,000 1,000 8,000 16,000 Required: (1) Allocate support department costs to operating departments using direct method. Use the allocation base for each support department you think is most appropriate. Develop overhead rates per machine hour for the operating departments using total cost of the operating departments (after including support department costs). (2) Allocate support department costs to operating departments using step down method. Allocate the support department costs in the same sequence of the support departments given in the case study. Use the allocation base for each support department you think is most appropriate. Develop overhead rates per machine hour for the operating departments using total cost of the operating departments (after including support department costs). (3) Belgrave Ltd evaluates the performance of the operating department managers based on how well they managed their total cost (including allocated costs). As the manager of Production department, which allocation method would you prefer from the results obtained in requirements (1) and (2) above? Explain your answers. (5+ 7.5 +1.5 = 14 Marks)

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Direct Method of Cost Allocation Type of Cost Cost allocation driver Production Finishing 34700 48...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started