Answered step by step

Verified Expert Solution

Question

1 Approved Answer

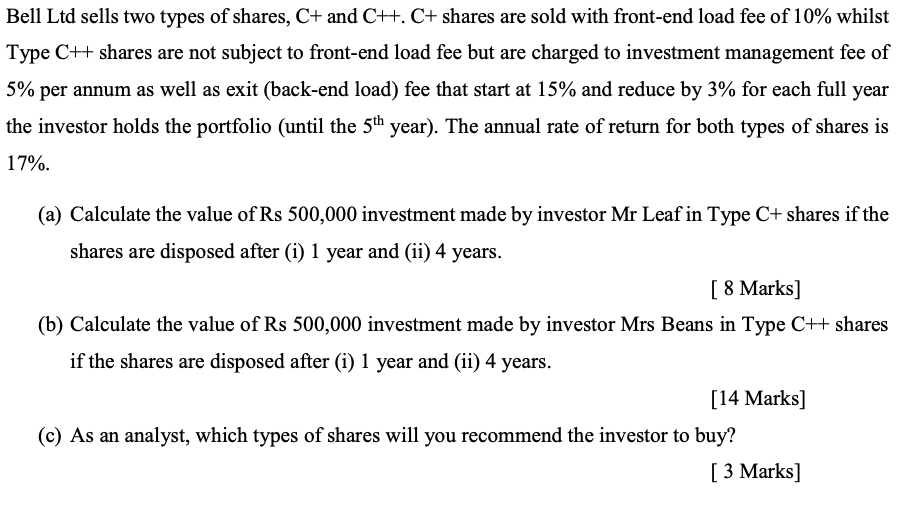

Bell Ltd sells two types of shares, C + and C + + . C + shares are sold with front - end load fee

Bell Ltd sells two types of shares, C and C C shares are sold with frontend load fee of whilst Type C shares are not subject to frontend load fee but are charged to investment management fee of per annum as well as exit backend load fee that start at and reduce by for each full year the investor holds the portfolio until the th year The annual rate of return for both types of shares is Bell Ltd sells two types of shares, and shares are sold with frontend load fee of whilst

Type shares are not subject to frontend load fee but are charged to investment management fee of

per annum as well as exit backend load fee that start at and reduce by for each full year

the investor holds the portfolio until the year The annual rate of return for both types of shares is

a Calculate the value of Rs investment made by investor Mr Leaf in Type shares if the

shares are disposed after i year and ii years.

Marks

b Calculate the value of Rs investment made by investor Mrs Beans in Type C shares

if the shares are disposed after i year and ii years.

Marks

c As an analyst, which types of shares will you recommend the investor to buy?

Marks

a Calculate the value of Rs investment made by investor Mr Leaf in Type C shares if the shares are disposed after i year and ii years.

Marks

b Calculate the value of Rs investment made by investor Mrs Beans in Type C shares

if the shares are disposed after i year and ii years.

Marks

c As an analyst, which types of shares will you recommend the investor to buy?

Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started