Answered step by step

Verified Expert Solution

Question

1 Approved Answer

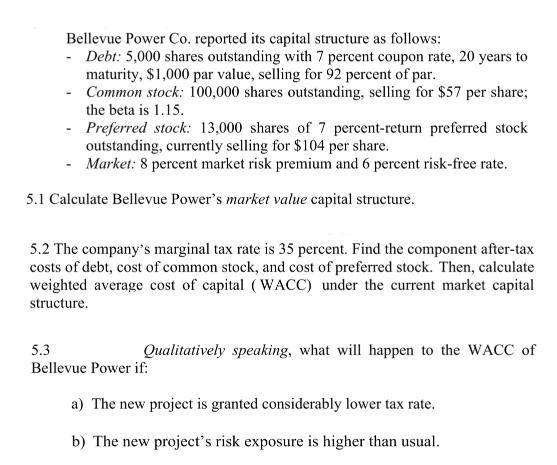

Bellevue Power Co. reported its capital structure as follows: - Debt: 5,000 shares outstanding with 7 percent coupon rate, 20 years to maturity, $1,000

Bellevue Power Co. reported its capital structure as follows: - Debt: 5,000 shares outstanding with 7 percent coupon rate, 20 years to maturity, $1,000 par value, selling for 92 percent of par. Common stock: 100,000 shares outstanding, selling for $57 per share; the beta is 1.15. Preferred stock: 13,000 shares of 7 percent-return preferred stock outstanding, currently selling for $104 per share. - Market: 8 percent market risk premium and 6 percent risk-free rate. 5.1 Calculate Bellevue Power's market value capital structure. 5.2 The company's marginal tax rate is 35 percent. Find the component after-tax costs of debt, cost of common stock, and cost of preferred stock. Then, calculate weighted average cost of capital (WACC) under the current market capital structure. 5.3 Bellevue Power if: Qualitatively speaking, what will happen to the WACC of a) The new project is granted considerably lower tax rate. b) The new project's risk exposure is higher than usual.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

51 Calculation of Bellevue Powers Market Value Capital Structure Debt Number of shares outstanding 5000 Coupon rate 7 Years to maturity 20 Par value 1000 Selling price 92 of par value Market value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started