Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bellflower Ltd is a construction company and also provides travel services. The construction activities of Bellflower Ltd are subject to standard rated VAT, however

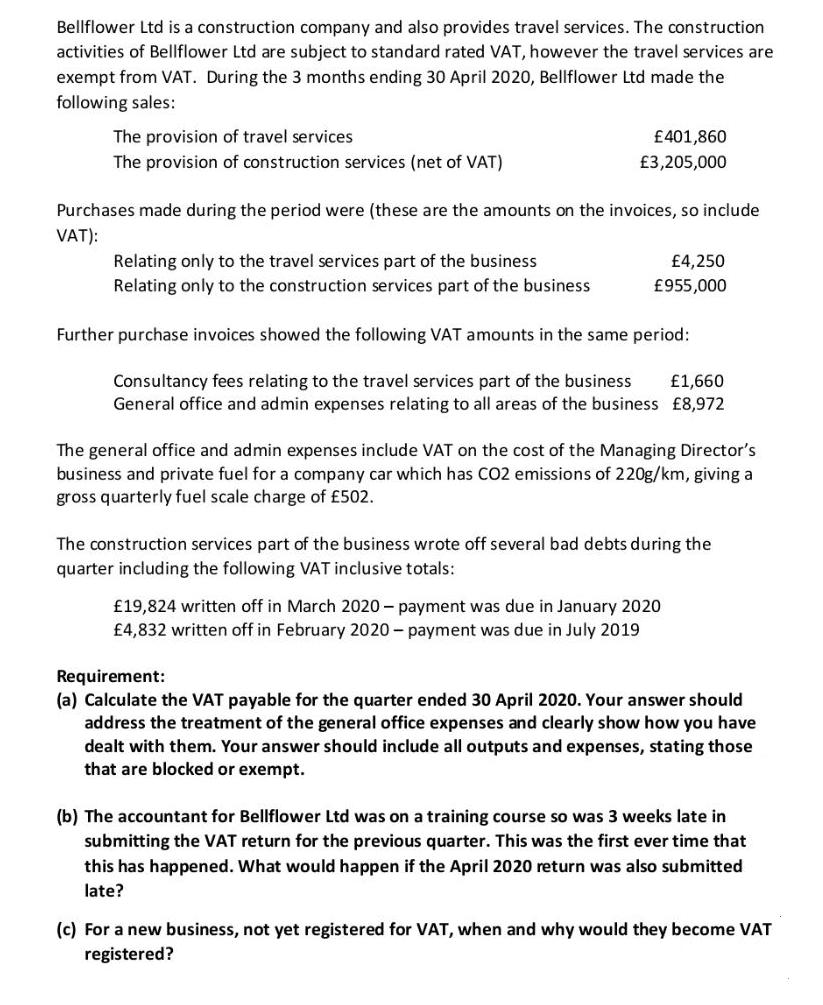

Bellflower Ltd is a construction company and also provides travel services. The construction activities of Bellflower Ltd are subject to standard rated VAT, however the travel services are exempt from VAT. During the 3 months ending 30 April 2020, Bellflower Ltd made the following sales: The provision of travel services 401,860 3,205,000 The provision of construction services (net of VAT) Purchases made during the period were (these are the amounts on the invoices, so include VAT): Relating only to the travel services part of the business. 4,250 955,000 Relating only to the construction services part of the business Further purchase invoices showed the following VAT amounts in the same period: Consultancy fees relating to the travel services part of the business 1,660 General office and admin expenses relating to all areas of the business 8,972 The general office and admin expenses include VAT on the cost of the Managing Director's business and private fuel for a company car which has CO2 emissions of 220g/km, giving a gross quarterly fuel scale charge of 502. The construction services part of the business wrote off several bad debts during the quarter including the following VAT inclusive totals: 19,824 written off in March 2020 - payment was due in January 2020 4,832 written off in February 2020-payment was due in July 2019 Requirement: (a) Calculate the VAT payable for the quarter ended 30 April 2020. Your answer should address the treatment of the general office expenses and clearly show how you have dealt with them. Your answer should include all outputs and expenses, stating those that are blocked or exempt. (b) The accountant for Bellflower Ltd was on a training course so was 3 weeks late in submitting the VAT return for the previous quarter. This was the first ever time that this has happened. What would happen if the April 2020 return was also submitted late? (c) For a new business, not yet registered for VAT, when and why would they become VAT registered?

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Outputs The provision of travel services 401860 exempt The provision of construct...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started