Answered step by step

Verified Expert Solution

Question

1 Approved Answer

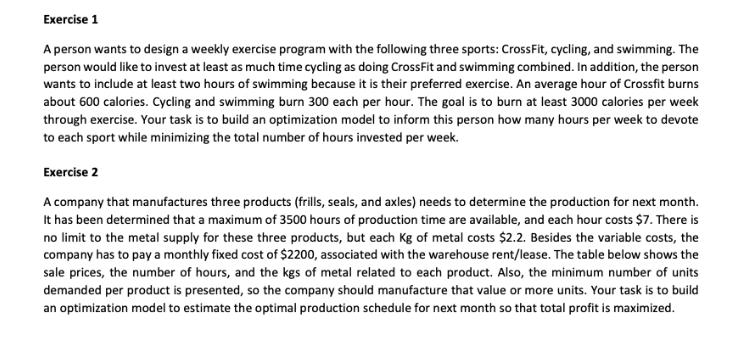

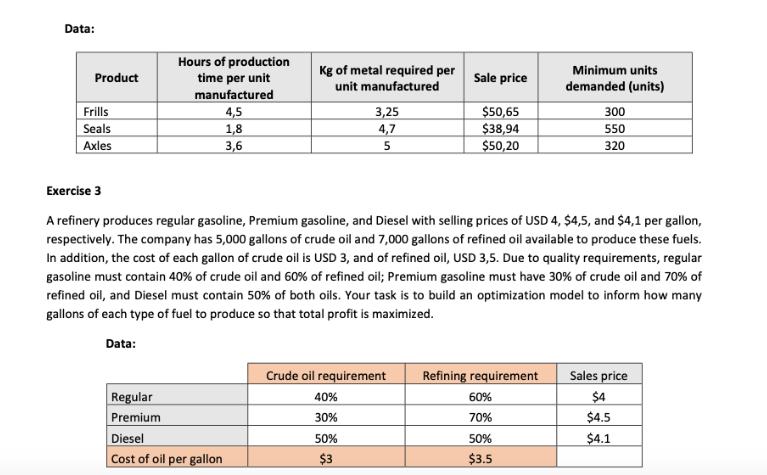

Below are 3 reference sample questions with solution answers and the work provided for reference on how to do Problem 1 above. TechSave Inc. is

Below are 3 reference sample questions with solution answers and the work provided for reference on how to do Problem 1 above.

Below are 3 reference sample questions with solution answers and the work provided for reference on how to do Problem 1 above.

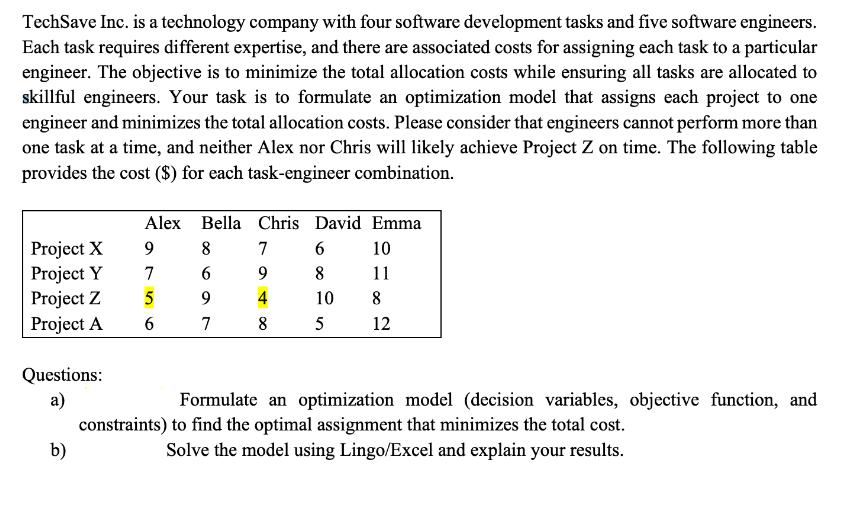

TechSave Inc. is a technology company with four software development tasks and five software engineers. Each task requires different expertise, and there are associated costs for assigning each task to a particular engineer. The objective is to minimize the total allocation costs while ensuring all tasks are allocated to skillful engineers. Your task is to formulate an optimization model that assigns each project to one engineer and minimizes the total allocation costs. Please consider that engineers cannot perform more than one task at a time, and neither Alex nor Chris will likely achieve Project Z on time. The following table provides the cost ($) for each task-engineer combination. Project X Project Y Project Z Project A Questions: a) b) Alex Bella Chris David Emma 9 7 6 10 7 9 8 11 5 4 10 8 6 8 5 8 6 9 7 12 Formulate an optimization model (decision variables, objective function, and constraints) to find the optimal assignment that minimizes the total cost. Solve the model using Lingo/Excel and explain your results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Formulation of the optimization model for the task allocation problem D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started