Answered step by step

Verified Expert Solution

Question

1 Approved Answer

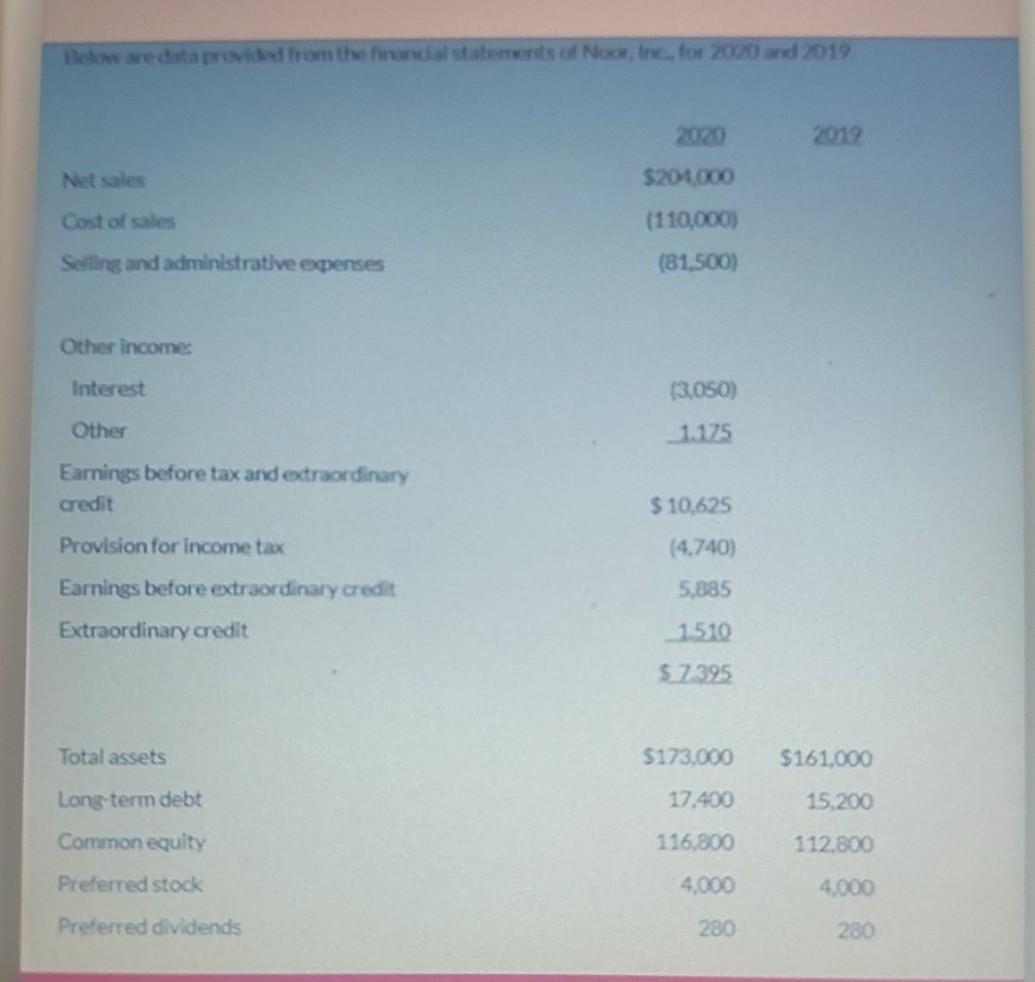

Below are data from the financial statements of Noor, Inc. for 2020 and 2019 2019 Net sales 5204.000 Cost of sales (110,000) (81,500) Selling and

Below are data from the financial statements of Noor, Inc. for 2020 and 2019 2019 Net sales 5204.000 Cost of sales (110,000) (81,500) Selling and administrative epenses Other Income Interest (3,050) Other 1.175 Earnings before tax and extraordinary credit $10.625 Provision for income tax (4.740) 5.885 Earnings before extraordinary credit Extraordinary credit 1510 5.72395 Total assets $173,000 $161.000 Long term debt 17.400 15.200 Common equity 116.800 112.800 Preferred stock 4,000 4,000 Preferred dividends 280 280 Below are data from the financial statements of Noor, Inc. for 2020 and 2019 2019 Net sales 5204.000 Cost of sales (110,000) (81,500) Selling and administrative epenses Other Income Interest (3,050) Other 1.175 Earnings before tax and extraordinary credit $10.625 Provision for income tax (4.740) 5.885 Earnings before extraordinary credit Extraordinary credit 1510 5.72395 Total assets $173,000 $161.000 Long term debt 17.400 15.200 Common equity 116.800 112.800 Preferred stock 4,000 4,000 Preferred dividends 280 280

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started