Answered step by step

Verified Expert Solution

Question

1 Approved Answer

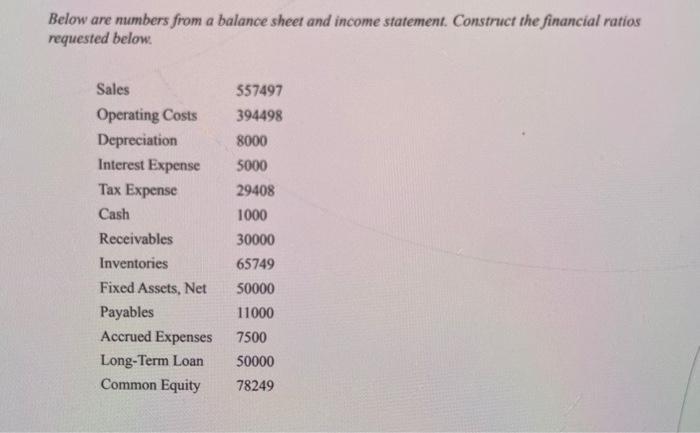

Below are numbers from a balance sheet and income statement. Construct the financial ratios requested below. Sales Operating Costs Depreciation Interest Expense Tax Expense

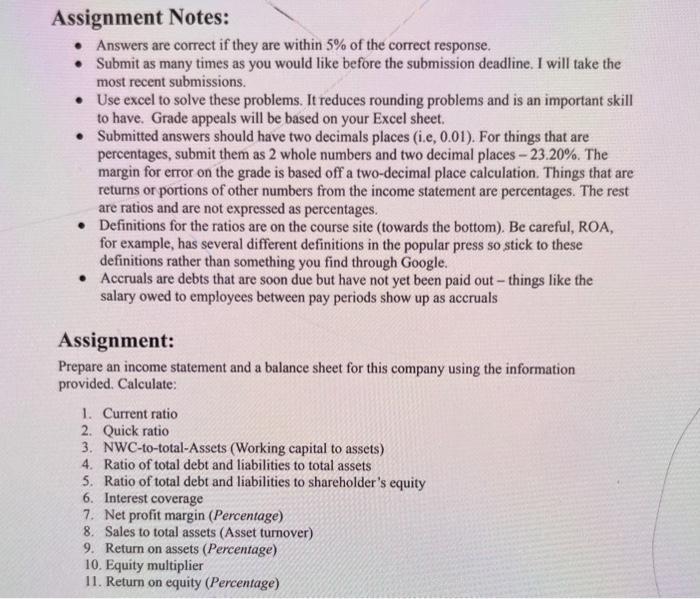

Below are numbers from a balance sheet and income statement. Construct the financial ratios requested below. Sales Operating Costs Depreciation Interest Expense Tax Expense Cash Receivables Inventories Fixed Assets, Net Payables Accrued Expenses Long-Term Loan Common Equity 557497 394498 8000 5000 29408 1000 30000 65749 50000 11000 7500 50000 78249 Assignment Notes: Answers are correct if they are within 5% of the correct response. Submit as many times as you would like before the submission deadline. I will take the most recent submissions. Use excel to solve these problems. It reduces rounding problems and is an important skill to have. Grade appeals will be based on your Excel sheet. Submitted answers should have two decimals places (i.e, 0.01). For things that are percentages, submit them as 2 whole numbers and two decimal places-23.20%. The margin for error on the grade is based off a two-decimal place calculation. Things that are returns or portions of other numbers from the income statement are percentages. The rest are ratios and are not expressed as percentages. Definitions for the ratios are on the course site (towards the bottom). Be careful, ROA, for example, has several different definitions in the popular press so stick to these definitions rather than something you find through Google. Accruals are debts that are soon due but have not yet been paid out-things like the salary owed to employees between pay periods show up as accruals Assignment: Prepare an income statement and a balance sheet for this company using the information provided. Calculate: 1. Current ratio 2. Quick ratio 3. NWC-to-total-Assets (Working capital to assets) 4. Ratio of total debt and liabilities to total assets 5. Ratio of total debt and liabilities to shareholder's equity 6. Interest coverage 7. Net profit margin (Percentage) 8. Sales to total assets (Asset turnover) 9. Return on assets (Percentage) 10. Equity multiplier 11. Return on equity (Percentage)

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started