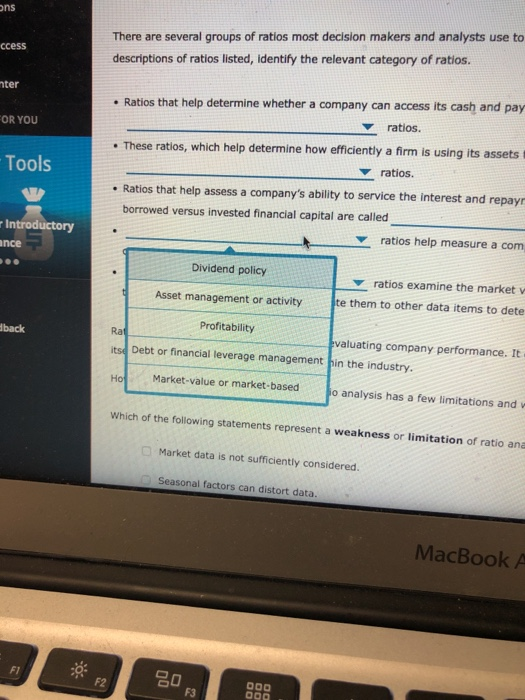

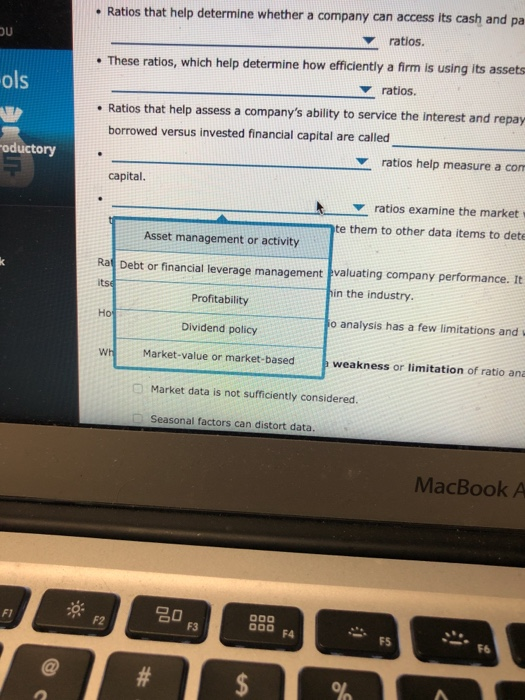

below are pictures of each drop down window!

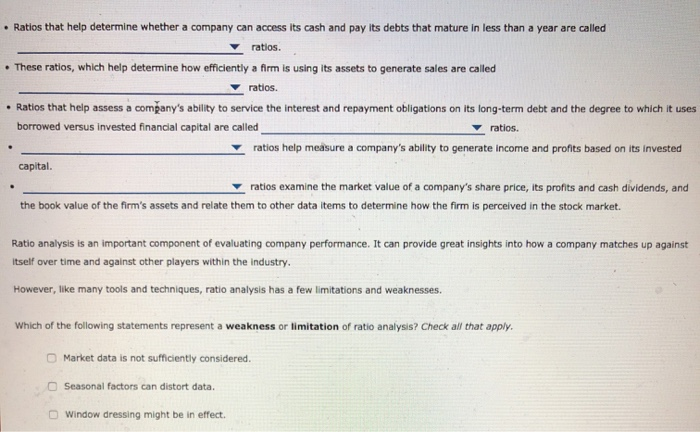

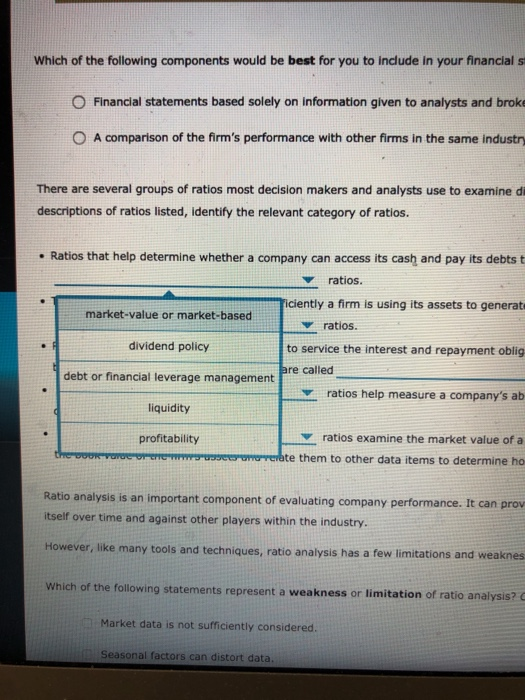

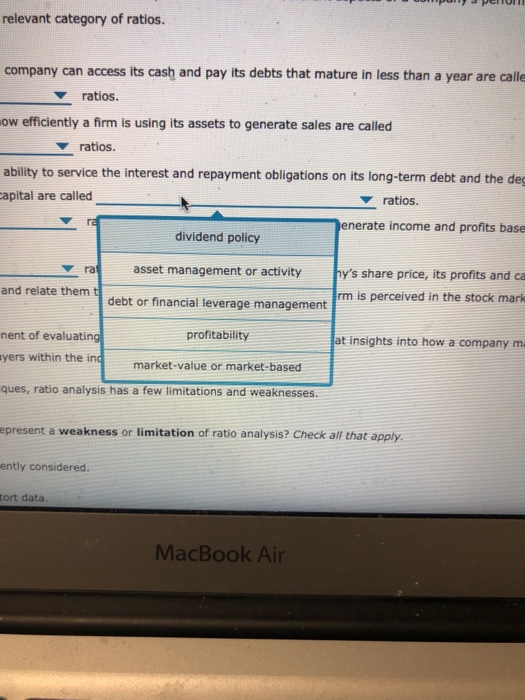

1. Ratio analysis A company reports accounting data in its financial statements. This data is used for financial analyses that provide insights into a company's strengths, weaknesses, performance in specific areas, and trends in performance. These analyses are often used to compare a company's performance to that of its competitors, or to its past or expected future performance. Such insight helps managers and analysts improve their decision making. Consider the following scenario: You work for a brokerage firm. Your boss asked you to analyze Blue Parrot Manufacturing's performance for the past three years and to write a report that includes a benchmarking of the company's performance Which of the following components would be best for you to include in your financial statement analysis? Financial statements based solely on information given to analysts and brokerage firms O A comparison of the firm's performance with other firms in the same industry based on their financial ratios . Ratios that help determine whether a company can access its cash and pay its debts that mature in less than a year are called ratios. . These ratios, which help determine how efficiently a firm is using its assets to generate sales are called ratios. Ratios that help assess a company's ability to service the interest and repayment obligations on its long-term debt and the degree to which it uses borrowed versus invested financial capital are called ratios. ratios help measure a company's ability to generate income and profits based on its invested capital. ratios examine the market value of a company's share price, its profits and cash dividends, and the book value of the firm's assets and relate them to other data items to determine how the firm is perceived in the stock market. Ratio analysis is an important component of evaluating company performance. It can provide great insights into how a company matches up against itself over time and against other players within the industry. However, like many tools and techniques, ratio analysis has a few limitations and weaknesses. Which of the following statements represent a weakness or limitation of ratio analysis? Check all that apply. Market data is not sufficiently considered. O Seasonal factors can distort data. Window dressing might be in effect. Which of the following components would be best for you to include in your financials Financial statements based solely on information given to analysts and broke O A comparison of the firm's performance with other firms in the same industr There are several groups of ratios most decision makers and analysts use to examined descriptions of ratios listed, identify the relevant category of ratios. Ratios that help determine whether a company can access its cash and pay its debts t ratios. Ticiently a firm is using its assets to generat market value or market-based ratios. dividend policy to service the interest and repayment oblig are called debt or financial leverage management ratios help measure a company's ab liquidity profitability ratios examine the market value of a norerate them to other data items to determine ho Ratio analysis is an important component of evaluating company performance. It can prov. itself over time and against other players within the industry. However, like many tools and techniques, ratio analysis has a few limitations and weaknes Which of the following statements represent a weakness or limitation of ratio analysis? Market data is not sufficiently considered. Seasonal factors can distort data. ) pelo II relevant category of ratios. company can access its cash and pay its debts that mature in less than a year are calle ratios. now efficiently a firm is using its assets to generate sales are called ratios. ability to service the interest and repayment obligations on its long-term debt and the deg capital are called ratios. enerate income and profits base dividend policy asset management or activity hy's share price, its profits and ca and relate them t 1 debt or financial leverage management rm is perceived in the stock mark profitability nent of evaluating ayers within the ind at insights into how a company m. market value or market-based ques, ratio analysis has a few limitations and weaknesses. represent a weakness or limitation of ratio analysis? Check all that apply. ently considered. tort data. MacBook Air Ons ccess There are several groups of ratios most decision makers and analysts use to descriptions of ratios listed, identify the relevant category of ratios. nter . Ratios that help determine whether a company can access its cash and pay ratios. FOR YOU "Tools . These ratios, which help determine how efficiently a firm is using its assets ratios. Ratios that help assess a company's ability to service the interest and repayr borrowed versus invested financial capital are called ratios help measure a com Introductory ance Dividend policy Asset management or activity ratios examine the market te them to other data items to dete back Profitability evaluating company performance. It itse Debt or financial leverage management in the industry. Hol Market value or market-based jo analysis has a few limitations and Which of the following statements represent a weakness or limitation of ratio ana Market data is not sufficiently considered. Seasonal factors can distort data. MacBook A 202 ols Ratios that help determine whether a company can access its cash and pa ratios. These ratios, which help determine how efficiently a firm is using its assets ratios. . Ratios that help assess a company's ability to service the interest and repay borrowed versus invested financial capital are called ratios help measure a com capital. Foductory ratios examine the market te them to other data items to dete Asset management or activity Debt or financial leverage management Evaluating company performance. It hin the industry. Profitability ho analysis has a few limitations and Dividend policy Ho Market value or market-based weakness or limitation of ratio ana Market data is not sufficiently considered. Seasonal factors can distort data. MacBook A 803