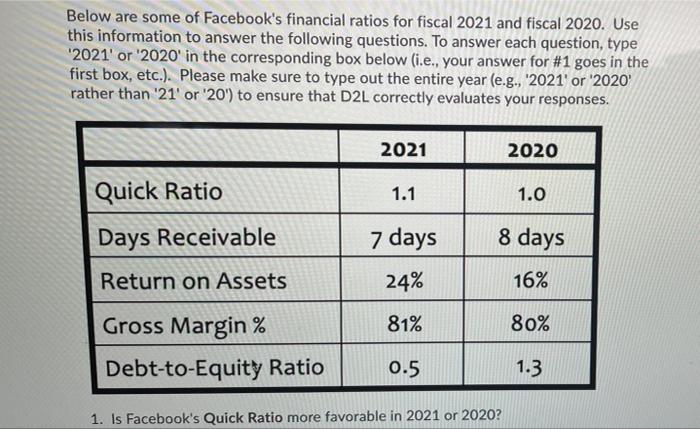

Below are some of Facebook's financial ratios for fiscal 2021 and fiscal 2020. Use this information to answer the following questions. To answer each

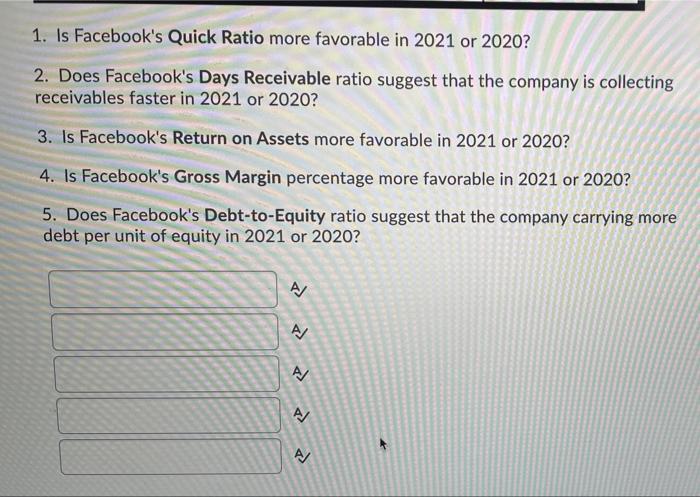

Below are some of Facebook's financial ratios for fiscal 2021 and fiscal 2020. Use this information to answer the following questions. To answer each question, type '2021' or '2020' in the corresponding box below (i.e., your answer for #1 goes in the first box, etc.). Please make sure to type out the entire year (e.g., '2021' or '2020' rather than '21' or '20') to ensure that D2L correctly evaluates your responses. 2021 2020 Quick Ratio 1.1 1.0 Days Receivable 7 days 8 days Return on Assets 24% 16% Gross Margin % 81% 80% Debt-to-Equity Ratio 0.5 1.3 1. Is Facebook's Quick Ratio more favorable in 2021 or 2020? 1. Is Facebook's Quick Ratio more favorable in 2021 or 2020? 2. Does Facebook's Days Receivable ratio suggest that the company is collecting receivables faster in 2021 or 2020? 3. Is Facebook's Return on Assets more favorable in 2021 or 2020? 4. Is Facebook's Gross Margin percentage more favorable in 2021 or 2020? 5. Does Facebook's Debt-to-Equity ratio suggest that the company carrying more debt per unit of equity in 2021 or 2020?

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 2021 Facebook has 01 more liquid assets that can be converted in...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started