Question

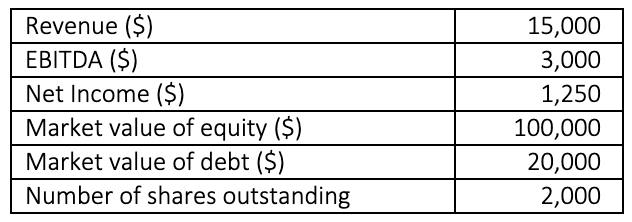

Below are summary financials for Mistral, a wind turbine maker. All numbers below are in millions. 1)Based on the data above, what is Mistrals price-to-earnings

Below are summary financials for Mistral, a wind turbine maker. All numbers below are in millions.

1)Based on the data above, what is Mistrals price-to-earnings (P/E) ratio?

a)100

b)40

c)60

d)80

2)Based on the data above, what is Mistrals enterprise value-to-EBITDA (EV/EBITDA) ratio?

a)40

b)60

c)85

d)100

3)An analyst is worried that Mistral is misvalued by the market. Based on extensive research, they determine the following:

Free cash flow to the firm will be 2,500 for 2022, will grow by 15% in 2023, and then 5% per year subsequently, as the firm enters a steady state.

The firms WACC is 8%.

Assuming the information above is correct, is Mistrals stock

a)Under-valued

b)Over-valued

c)Neither under- no over- valued.

\begin{tabular}{|l|r|} \hline Revenue (\$) & 15,000 \\ \hline EBITDA (\$) & 3,000 \\ \hline Net Income (\$) & 1,250 \\ \hline Market value of equity (\$) & 100,000 \\ \hline Market value of debt (\$) & 20,000 \\ \hline Number of shares outstanding & 2,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started