Below are the accounts for Mason's Landscaping and Snow Removal: Bank Service Fees Earned Accounts Receivable Rent Expense Supplies Insurance Expense Prepaid Insurance Supplies

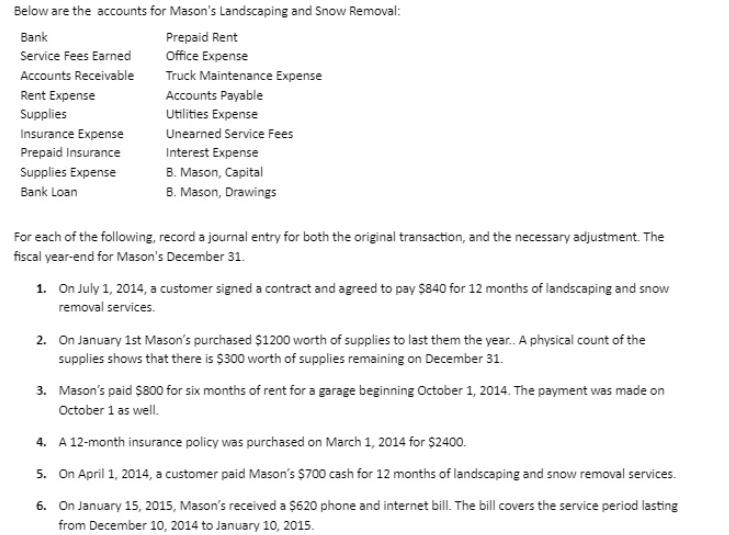

Below are the accounts for Mason's Landscaping and Snow Removal: Bank Service Fees Earned Accounts Receivable Rent Expense Supplies Insurance Expense Prepaid Insurance Supplies Expense Bank Loan Prepaid Rent Office Expense Truck Maintenance Expense Accounts Payable Utilities Expense Unearned Service Fees Interest Expense B. Mason, Capital B. Mason, Drawings For each of the following, record a journal entry for both the original transaction, and the necessary adjustment. The fiscal year-end for Mason's December 31. 1. On July 1, 2014, a customer signed a contract and agreed to pay $840 for 12 months of landscaping and snow removal services. 2. On January 1st Mason's purchased $1200 worth of supplies to last them the year.. A physical count of the supplies shows that there is $300 worth of supplies remaining on December 31. 3. Mason's paid $800 for six months of rent for a garage beginning October 1, 2014. The payment was made on October 1 as well. 4. A 12-month insurance policy was purchased on March 1, 2014 for $2400. 5. On April 1, 2014, a customer paid Mason's $700 cash for 12 months of landscaping and snow removal services. 6. On January 15, 2015, Mason's received a $620 phone and internet bill. The bill covers the service period lasting from December 10, 2014 to January 10, 2015.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal Entries for Masons Landscaping and Snow Removal 1 Landscaping and Snow Removal Contract Original Transaction July 1 2014 Debit Prepaid Rent 84...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e92bcbfb6b_954507.pdf

180 KBs PDF File

663e92bcbfb6b_954507.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started