Answered step by step

Verified Expert Solution

Question

1 Approved Answer

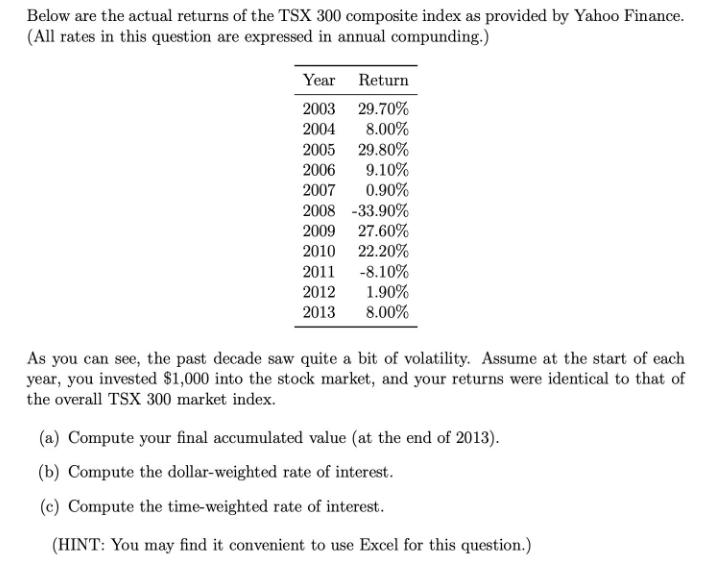

Below are the actual returns of the TSX 300 composite index as provided by Yahoo Finance. (All rates in this question are expressed in

Below are the actual returns of the TSX 300 composite index as provided by Yahoo Finance. (All rates in this question are expressed in annual compunding.) Year 2003 2004 Return 29.70% 8.00% 2005 29.80% 2006 9.10% 2007 0.90% 2008 -33.90% 2009 27.60% 2010 22.20% 2011 -8.10% 2012 1.90% 2013 8.00% As you can see, the past decade saw quite a bit of volatility. Assume at the start of each year, you invested $1,000 into the stock market, and your returns were identical to that of the overall TSX 300 market index. (a) Compute your final accumulated value (at the end of 2013). (b) Compute the dollar-weighted rate of interest. (c) Compute the time-weighted rate of interest. (HINT: You may find it convenient to use Excel for this question.)

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To compute the final ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started