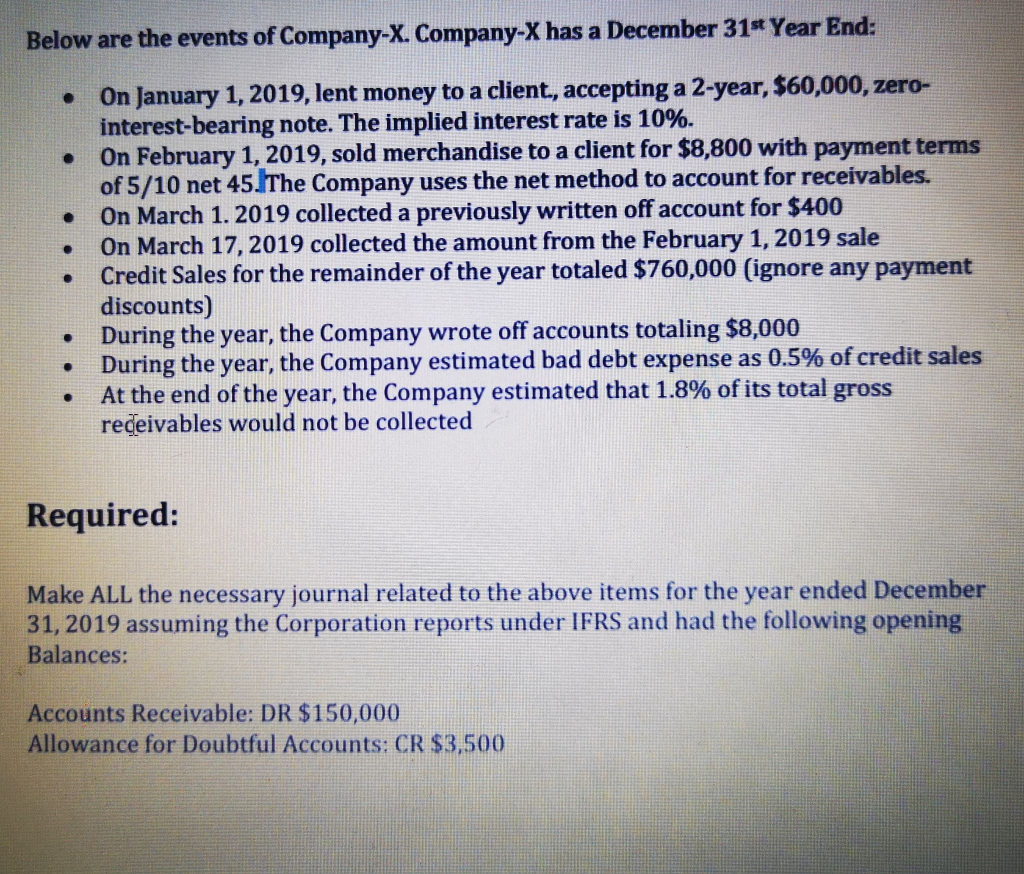

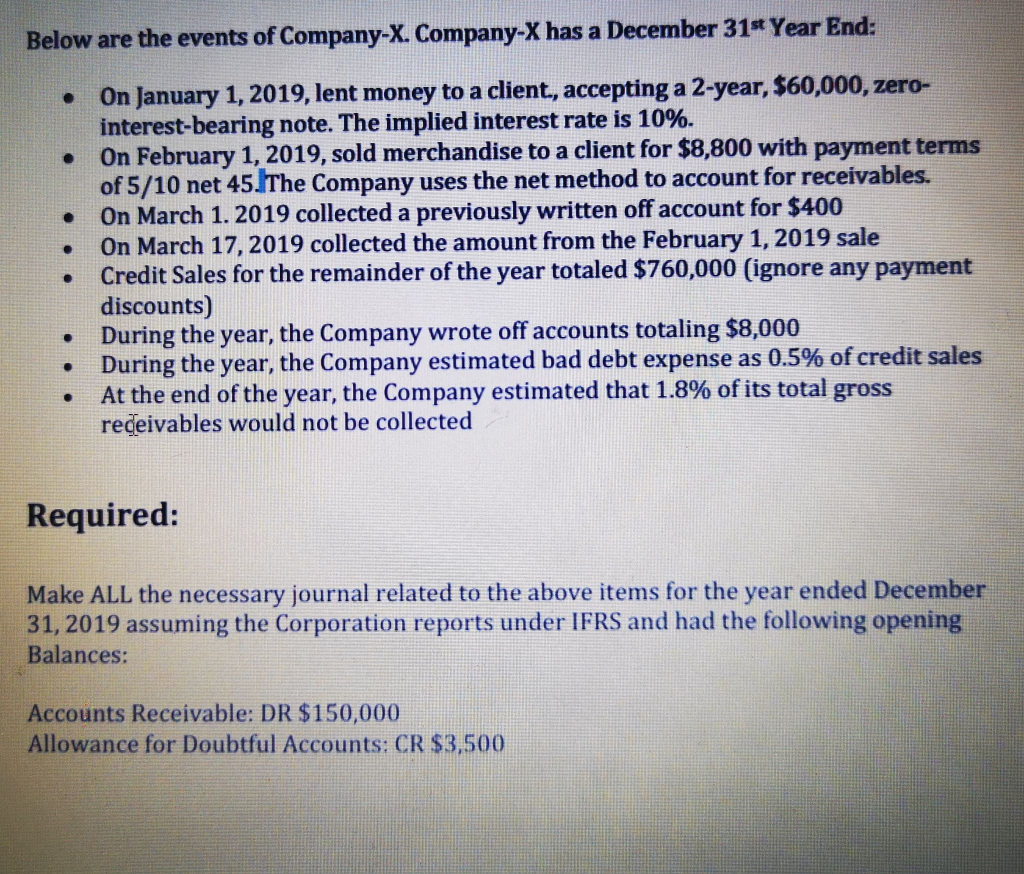

Below are the events of Company-X. Company-X has a December 31st Year End: . . . On January 1, 2019, lent money to a client, accepting a 2-year, $60,000, zero- interest-bearing note. The implied interest rate is 10%. On February 1, 2019, sold merchandise to a client for $8,800 with payment terms of 5/10 net 45. The Company uses the net method to account for receivables. On March 1. 2019 collected a previously written off account for $400 On March 17, 2019 collected the amount from the February 1, 2019 sale Credit Sales for the remainder of the year totaled $760,000 (ignore any payment discounts) During the year, the Company wrote off accounts totaling $8,000 During the year, the Company estimated bad debt expense as 0.5% of credit sales At the end of the year, the Company estimated that 1.8% of its total gross receivables would not be collected . Required: Make ALL the necessary journal related to the above items for the year ended December 31, 2019 assuming the Corporation reports under IFRS and had the following opening Balances: Accounts Receivable: DR $150,000 Allowance for Doubtful Accounts: CR $3,500 Below are the events of Company-X. Company-X has a December 31st Year End: . . . On January 1, 2019, lent money to a client, accepting a 2-year, $60,000, zero- interest-bearing note. The implied interest rate is 10%. On February 1, 2019, sold merchandise to a client for $8,800 with payment terms of 5/10 net 45. The Company uses the net method to account for receivables. On March 1. 2019 collected a previously written off account for $400 On March 17, 2019 collected the amount from the February 1, 2019 sale Credit Sales for the remainder of the year totaled $760,000 (ignore any payment discounts) During the year, the Company wrote off accounts totaling $8,000 During the year, the Company estimated bad debt expense as 0.5% of credit sales At the end of the year, the Company estimated that 1.8% of its total gross receivables would not be collected . Required: Make ALL the necessary journal related to the above items for the year ended December 31, 2019 assuming the Corporation reports under IFRS and had the following opening Balances: Accounts Receivable: DR $150,000 Allowance for Doubtful Accounts: CR $3,500