Question

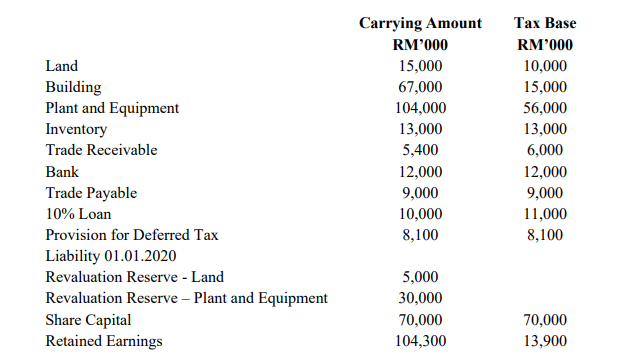

Below are the financial statement and tax bases for Jaya Bhd as at 31 December 2020: Additional information: 1. On 31 December 2020, Jaya revalued

Below are the financial statement and tax bases for Jaya Bhd as at 31 December 2020:

Additional information:

1. On 31 December 2020, Jaya revalued land and some of the plant. Fair value of the land and plant were RM5 million and RM30 million respectively, more than its carrying amount.

2. Jaya provides for general provision for doubtful debts of 10%. Tax rule recognises bad debts only.

3. Jaya raised a loan during the year and recorded it net of transaction costs. The transaction costs are allowable for tax in the year in which the loan is raised.

4. Income tax had changed from 30% to 25%.

5. Real property gain tax is 5%.

Required:

a) Calculate the deferred tax expense for Jaya for the year.

b) Prepare the extract of Statement of Financial Position for the year ended 31 December 2020.

Land Building Plant and Equipment Inventory Trade Receivable Bank Trade Payable 10% Loan Provision for Deferred Tax Liability 01.01.2020 Revaluation Reserve - Land Revaluation Reserve - Plant and Equipment Share Capital Retained Earnings Carrying Amount RM'000 15,000 67,000 104,000 13,000 5,400 12,000 9,000 10,000 8,100 Tax Base RM'000 10,000 15,000 56,000 13,000 6,000 12,000 9,000 11,000 8,100 5,000 30,000 70,000 104,300 70,000 13,900Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started