Answered step by step

Verified Expert Solution

Question

1 Approved Answer

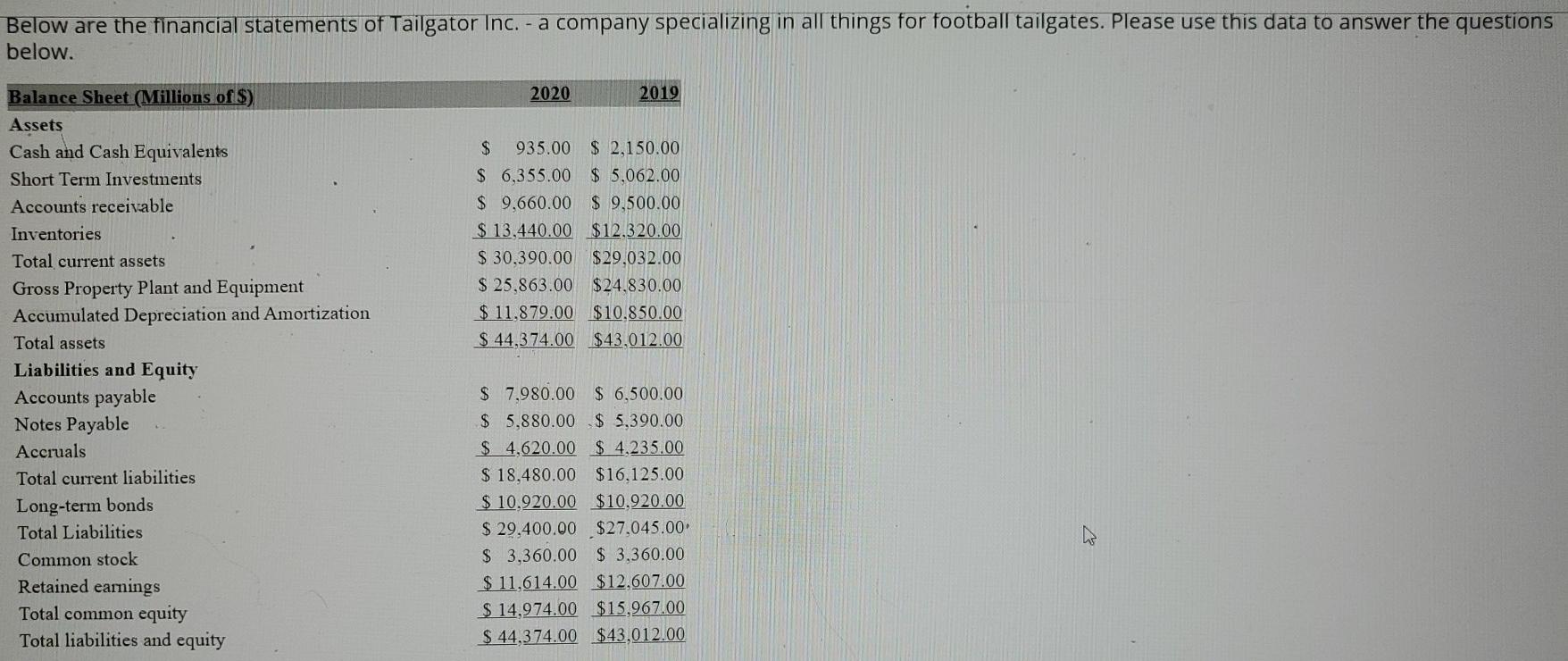

Below are the financial statements of Tailgator Inc. - a company specializing in all things for football tailgates. Please use this data to answer the

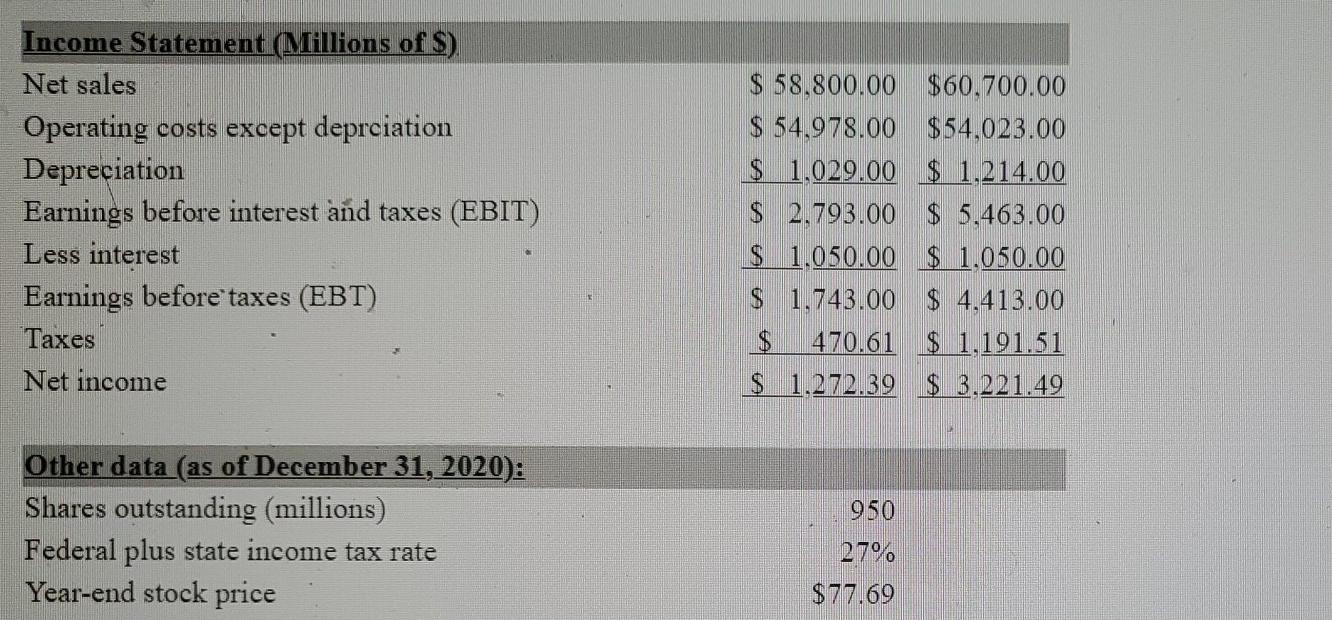

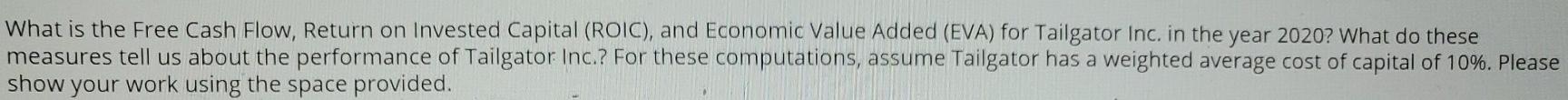

Below are the financial statements of Tailgator Inc. - a company specializing in all things for football tailgates. Please use this data to answer the questions below. 2020 2019 $ 935.00 $ 2.150.00 $ 6,355.00 $ 5,062.00 $ 9,660.00 $ 9,500.00 $ 13.440.00 $12.320.00 $ 30,390.00 $29.032.00 $ 25,863.00 $24.830.00 $ 11.879.00 $10.850.00 $ 44,374.00 $43,012.00 Balance Sheet (Millions of $) Assets Cash and Cash Equivalents Short Term Investments Accounts receivable Inventories Total current assets Gross Property Plant and Equipment Accumulated Depreciation and Amortization Total assets Liabilities and Equity Accounts payable Notes Payable Accruals Total current liabilities Long-term bonds Total Liabilities Common stock Retained earnings Total common equity Total liabilities and equity $ 7,980.00 $ 6,500.00 $ 5,880.00 $ 5,390.00 $ 4,620.00 $ 4,235.00 $ 18,480.00 $16,125.00 $ 10,920.00 $10.920.00 $ 29,400.00 $27,045.00 $ 3,360.00 $ 3,360.00 $ 11,614.00 $12.607.00 $ 14,974.00 $15.967.00 $ 44,374.00 $43,012.00 Income Statement (Millions of S) Net sales Operating costs except deprciation Depreciation Earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes Net income $ 58,800.00 $60.700.00 $ 54,978.00 $54,023.00 $ 1.029.00 $ 1.214.00 $ 2.793.00 $ 5.463.00 $ 1.050.00 $ 1.050.00 $ 1.743.00 $ 4.413.00 470.61 $ 1,191.51 $ 1.272.39 $ 3.221.49 Other data (as of December 31, 2020): Shares outstanding (millions) Federal plus state income tax rate Year-end stock price 950 27% $77.69 What is the Free Cash Flow, Return on invested Capital (ROIC), and Economic Value Added (EVA) for Tailgator Inc. in the year 2020? What do these measures tell us about the performance of Tailgator Inc.? For these computations, assume Tailgator has a weighted average cost of capital of 10%. Please show your work using the space provided

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started