Question

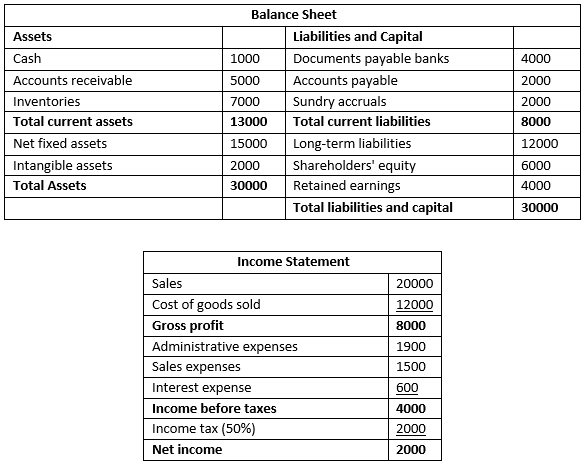

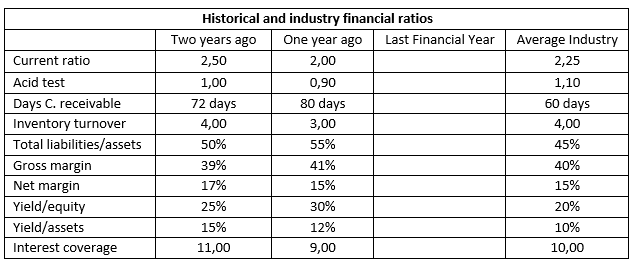

Below are the income statement and balance sheet for the last fiscal year for XYZ Inc. Also presented are selected financial ratios calculated over the

Below are the income statement and balance sheet for the last fiscal year for XYZ Inc. Also presented are selected financial ratios calculated over the last two fiscal years and the average for the industry in which the company operates (note that the figures for days receivables, inventory turnover, return on equity, and return on assets have been estimated based on year-end balance sheet data in all cases). You have recently been hired as the CFO of this company and are interested in performing an evaluation of the company's recent financial performance. Based on the data provided, calculate the ratios shown for the last fiscal year. What is your assessment of the company's performance?

Show the entire procedure performed and formulas used.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started