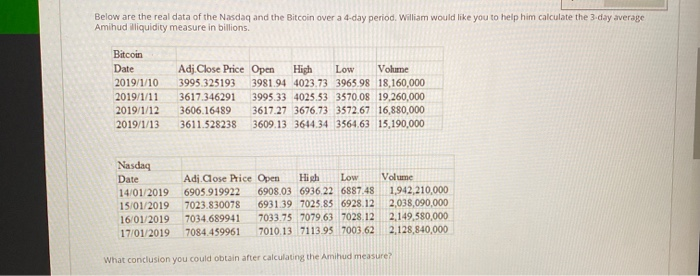

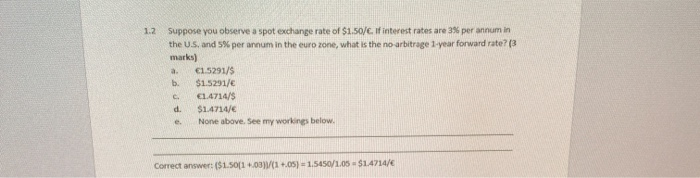

Below are the real data of the Nasdaq and the Bitcoin over a 4-day period. William would like you to help him calculate the 3-day average Amihud liquidity measure in billions Bitcoin Date 2019/1/10 2019/1/11 2019/1/12 2019/1/13 Adj.Close Price Open High Low Volume 3995325193 3981.94 4023.73 3965.98 18,160,000 3617.346291 3995 33 4025.53 3570.08 19.260,000 3606.16489 3617.27 3676.73 3572.67 16,880,000 3611.528238 3609.13 3644.34 3564.63 15,190,000 Nasdaq Date 14/01/2019 15/01/2019 16/01/2019 17/01/2019 Adj.Close Price Open High Low 6905919922 6908.03 6936.22 6887.48 7023.830078 6931.397025.85 6928.12 7034.689941 7033.75 7079.63 7028.12 7084.459961 7010.1 7113.95 7003 62 Volume 1,942,210,000 2,038,090,000 2.149,580,000 2.128,840,000 What conclusion you could obtain after calculating the Aminud measure? a. 1.2 Suppose you observe a spot exchange rate of $1.50/6. If interest rates are 3% per annum in the U.S. and 5% per annum in the euro zone, what is the no-arbitrage 1-year forward rate? (3 marks) 1.5291/5 b. $1.5291/6 1.4714/5 d. $1.47148 None above. See my workings below. e. Correct answer: ($1.50[1.03)/(1+.05) 1.5450/1.05 - $14714/ Below are the real data of the Nasdaq and the Bitcoin over a 4-day period. William would like you to help him calculate the 3-day average Amihud liquidity measure in billions Bitcoin Date 2019/1/10 2019/1/11 2019/1/12 2019/1/13 Adj.Close Price Open High Low Volume 3995325193 3981.94 4023.73 3965.98 18,160,000 3617.346291 3995 33 4025.53 3570.08 19.260,000 3606.16489 3617.27 3676.73 3572.67 16,880,000 3611.528238 3609.13 3644.34 3564.63 15,190,000 Nasdaq Date 14/01/2019 15/01/2019 16/01/2019 17/01/2019 Adj.Close Price Open High Low 6905919922 6908.03 6936.22 6887.48 7023.830078 6931.397025.85 6928.12 7034.689941 7033.75 7079.63 7028.12 7084.459961 7010.1 7113.95 7003 62 Volume 1,942,210,000 2,038,090,000 2.149,580,000 2.128,840,000 What conclusion you could obtain after calculating the Aminud measure? a. 1.2 Suppose you observe a spot exchange rate of $1.50/6. If interest rates are 3% per annum in the U.S. and 5% per annum in the euro zone, what is the no-arbitrage 1-year forward rate? (3 marks) 1.5291/5 b. $1.5291/6 1.4714/5 d. $1.47148 None above. See my workings below. e. Correct answer: ($1.50[1.03)/(1+.05) 1.5450/1.05 - $14714/