Question

Below are the same records of the HTM Corp (imaginary). According to the given information, please answer the following question. If the Income Statement structure

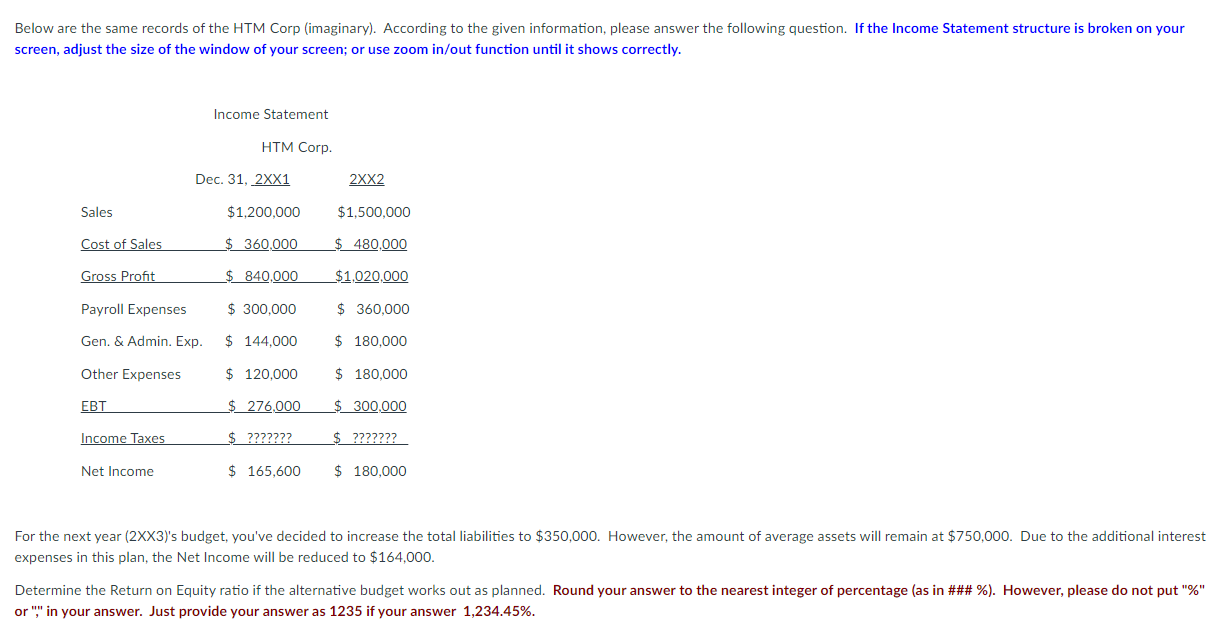

Below are the same records of the HTM Corp (imaginary). According to the given information, please answer the following question. If the Income Statement structure is broken on your screen, adjust the size of the window of your screen; or use zoom in/out function until it shows correctly.

Income Statement

HTM Corp.

Dec. 31, 2XX1 2XX2

Sales $1,200,000 $1,500,000

Cost of Sales $ 360,000 $ 480,000

Gross Profit $ 840,000 $1,020,000

Payroll Expenses $ 300,000 $ 360,000

Gen. & Admin. Exp. $ 144,000 $ 180,000

Other Expenses $ 120,000 $ 180,000

EBT $ 276,000 $ 300,000

Income Taxes $ ??????? $ ???????

Net Income $ 165,600 $ 180,000

For the next year (2XX3)'s budget, you've decided to increase the total liabilities to $350,000. However, the amount of average assets will remain at $750,000. Due to the additional interest expenses in this plan, the Net Income will be reduced to $164,000.

Determine the Return on Equity ratio if the alternative budget works out as planned. Round your answer to the nearest integer of percentage (as in ### %). However, please do not put "%" or "," in your answer. Just provide your answer as 1235 if your answer 1,234.45%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started