Answered step by step

Verified Expert Solution

Question

1 Approved Answer

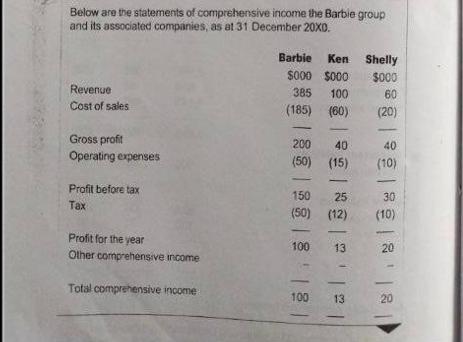

Below are the statements of comprehensive income the Barbie group and its associated companies, as at 31 December 20X0. Revenue Cost of sales Gross

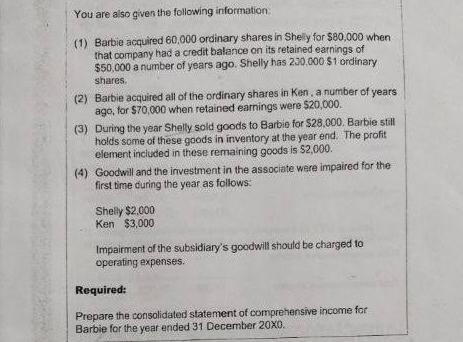

Below are the statements of comprehensive income the Barbie group and its associated companies, as at 31 December 20X0. Revenue Cost of sales Gross profit Operating expenses Profit before tax Tax Profit for the year Other comprehensive income Total comprehensive income Barbie Ken Shelly $000 $000 $000 60 (20) 385 (185) | 88 (50) | 88 | 8 | 150 100 8 | (0) - 0 15) - 25 (1) - 15 | | 18 1 | 40 (50) (12) 13 13 40 (10) 30 (10) 20 20 You are also given the following information (1) Barbie acquired 60,000 ordinary shares in Shelly for $80,000 when that company had a credit balance on its retained earnings of $50,000 a number of years ago. Shelly has 230,000 $1 ordinary shares. (2) Barbie acquired all of the ordinary shares in Ken, a number of years ago, for $70,000 when retained earnings were $20,000. (3) During the year Shelly sold goods to Barbie for $28,000. Barbie still holds some of these goods in inventory at the year end. The profit element included in these remaining goods is $2,000. (4) Goodwill and the investment in the associate were impaired for the first time during the year as follows: Shelly $2,000 Ken $3,000 Impairment of the subsidiary's goodwill should be charged to operating expenses. Required: Prepare the consolidated statement of comprehensive income for Barbie for the year ended 31 December 20X0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started