Answered step by step

Verified Expert Solution

Question

1 Approved Answer

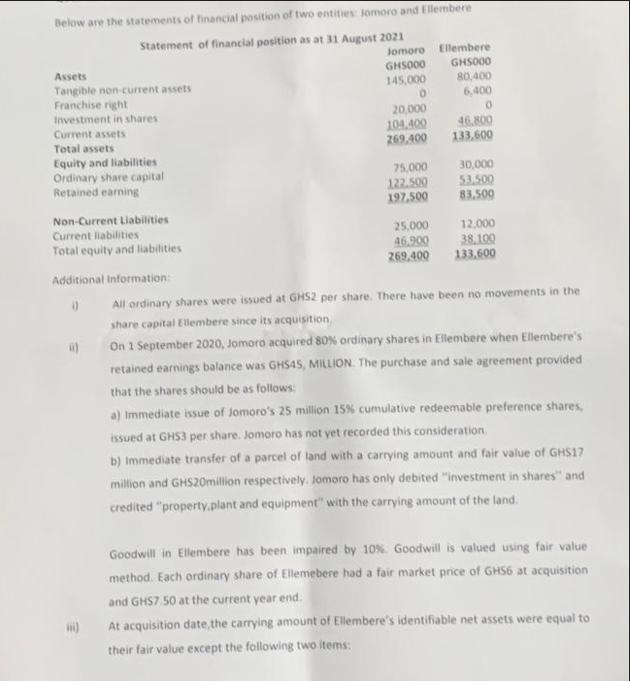

Below are the statements of financial position of two entities Jomoro and Ellembere Statement of financial position as at 31 August 2021 Assets Tangible

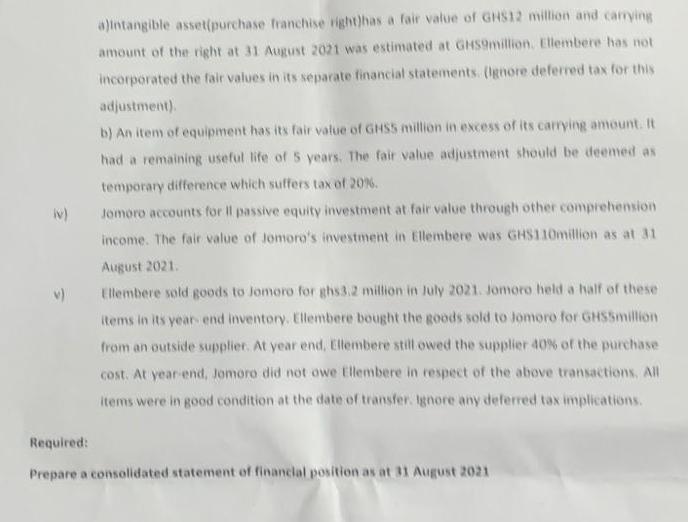

Below are the statements of financial position of two entities Jomoro and Ellembere Statement of financial position as at 31 August 2021 Assets Tangible non-current assets Franchise right Investment in shares Current assets Total assets Equity and liabilities Ordinary share capital Retained earning Non-Current Liabilities Current liabilities Total equity and liabilities Additional Information: 0 (ii) Jomoro Ellembere GH5000 145,000 0 20,000 104.400 269,400 75,000 122.500 197.500 25,000 46.900 269,400 GHS000 80,400 6,400 0 46.800 133.600 30,000 53.500 83,500 12,000 38.100 133.600 All ordinary shares were issued at GHS2 per share. There have been no movements in the share capital Ellembere since its acquisition, On 1 September 2020, Jomoro acquired 80% ordinary shares in Ellembere when Ellembere's retained earnings balance was GHS45, MILLION. The purchase and sale agreement provided that the shares should be as follows: a) Immediate issue of Jomoro's 25 million 15% cumulative redeemable preference shares, issued at GHS3 per share. Jomoro has not yet recorded this consideration. b) Immediate transfer of a parcel of land with a carrying amount and fair value of GHS17 million and GHS20million respectively. Jomoro has only debited "investment in shares" and credited "property.plant and equipment" with the carrying amount of the land. Goodwill in Ellembere has been impaired by 10%. Goodwill is valued using fair value method. Each ordinary share of Ellemebere had a fair market price of GHS6 at acquisition and GHS7.50 at the current year end. At acquisition date, the carrying amount of Ellembere's identifiable net assets were equal to their fair value except the following two items: iv) v) a)Intangible asset(purchase franchise right)has a fair value of GHS12 million and carrying amount of the right at 31 August 2021 was estimated at GHS9million. Ellembere has not incorporated the fair values in its separate financial statements (Ignore deferred tax for this adjustment). b) An item of equipment has its fair value of GHSS million in excess of its carrying amount. It had a remaining useful life of 5 years. The fair value adjustment should be deemed as temporary difference which suffers tax of 20%. Jomoro accounts for Il passive equity investment at fair value through other comprehension income. The fair value of Jomoro's investment in Ellembere was GHS110million as at 31 August 2021. Ellembere sold goods to Jomoro for ghs3.2 million in July 2021. Jomoro held a half of these items in its year end inventory. Ellembere bought the goods sold to Jomoro for GHSSmillion from an outside supplier. At year end, Ellembere still owed the supplier 40% of the purchase cost. At year-end, Jomoro did not owe Ellembere in respect of the above transactions. All items were in good condition at the date of transfer. Ignore any deferred tax implications. Required: Prepare a consolidated statement of financial position as at 31 August 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is the consolidated statement of financial position as at 31 August 2021 Consolidated Statement ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started