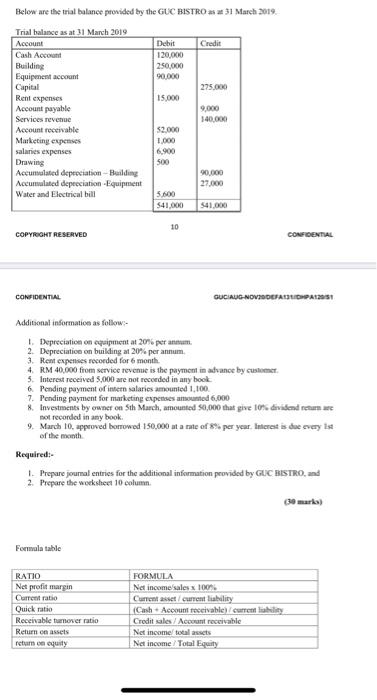

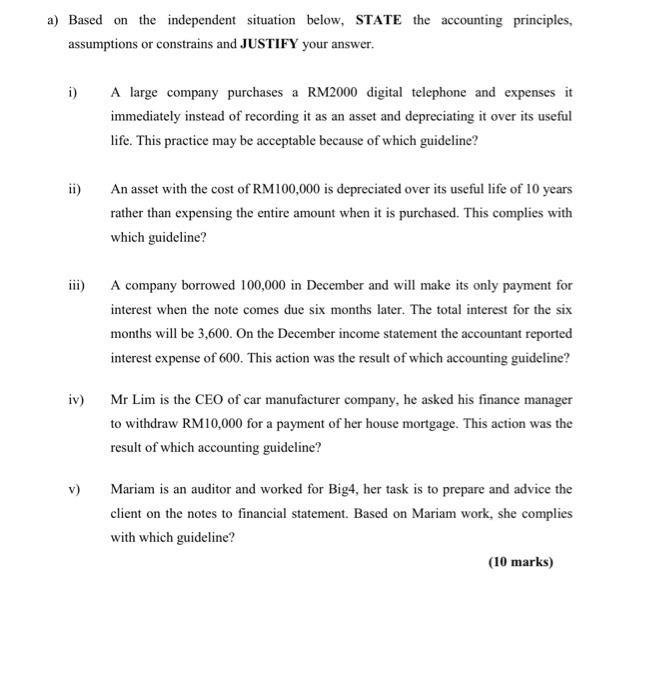

Below are the trial balance provided by the GUC BISTRO* * 31 March 2019 Trial balance as at 31 March 2019 Account Debit Credit Cash Account 120,000 Building 250,000 Equipment account 90.000 Capital 275.000 Rent expenses 15,000 Account payable 9,000 Services revenue 140.000 Account receivable $2.000 Marketing expenses 1.000 salaries expenses 6.900 Drawing 500 Accumulated depreciation - Building 90.000 Accumulated depreciation Equipment 27.000 Water and Electrical bill 5.000 541.000 541.000 10 COPYRIGHT RESERVED CONFIDENTIAL CONFIDENTIAL GUCIAUG-NOVINDEPASIDUPA12011 Additional information as follow- Depreciation on equipment at 20% per annum 2. Depreciation on building at 20% per annum 3. Rent expenses recorded for 6 month 4. RM 40.000 from service revenue is the payment in advance by customer 5. Interest received 5,000 are not recorded in any book 6. Pending payment of inter salaries amounted 1.100 7. Pending payment for marketing expenses amounted 6,000 * Investments by ownet on Sth March, amounted 50,000 that give 10% dividend return we 9. March 10, approved borrowed 150,000 at a rate of 8% per year Interest is due cvey is of the month Required: Prepare joumal entries for the additional information provided by GUC BISTRO and 2. Prepare the worksheet 10 column Formula table RATIO Net profit margin Current ratio Quick ratio Receivable turnover ratio Return on assets retum equity FORMULA Net income sales 100% Current asset current liability Cash Account teivable) currently Credit sales / Account receivable Net income total assets Net income/Total Equity a) Based on the independent situation below, STATE the accounting principles, assumptions or constrains and JUSTIFY your answer. i) A large company purchases a RM2000 digital telephone and expenses it immediately instead of recording it as an asset and depreciating it over its useful life. This practice may be acceptable because of which guideline? ii) An asset with the cost of RM100,000 is depreciated over its useful life of 10 years rather than expensing the entire amount when it is purchased. This complies with which guideline? A company borrowed 100,000 in December and will make its only payment for interest when the note comes due six months later. The total interest for the six months will be 3,600. On the December income statement the accountant reported interest expense of 600. This action was the result of which accounting guideline? iv) Mr Lim is the CEO of car manufacturer company, he asked his finance manager to withdraw RM10,000 for a payment of her house mortgage. This action was the result of which accounting guideline? v) Mariam is an auditor and worked for Big4, her task is to prepare and advice the client on the notes to financial statement. Based on Mariam work, she complies with which guideline? (10 marks)