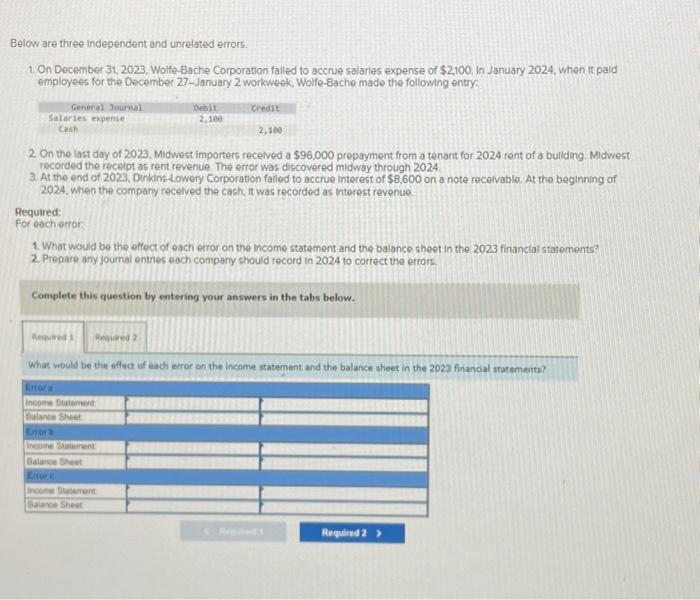

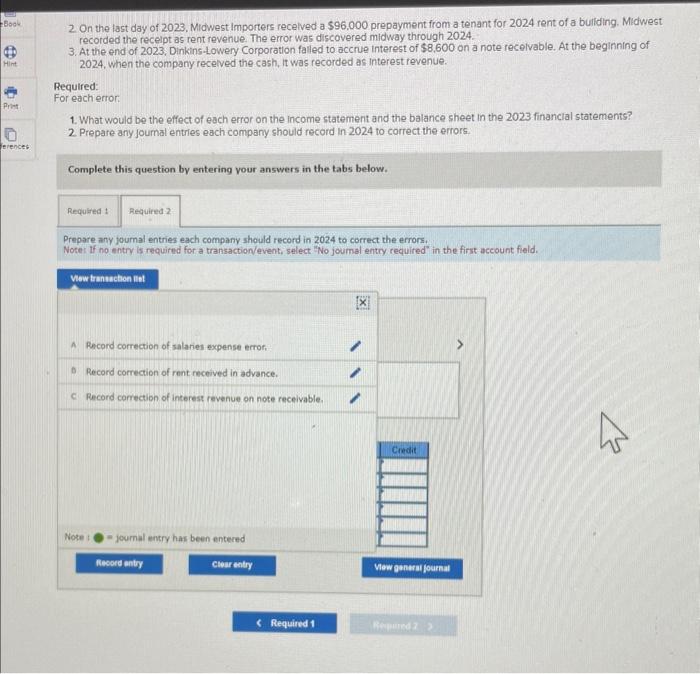

Below are three independent and unrelated errors. 1. On December 31, 2023. Wolfe-Bache Corporation failed to accrue salarles expense of $2100, In January 2024, when it paid employees for the December 27 -January 2 workweek. Wolfe-6ache made the following entry? 2 On the last day of 2023 . Midwest importers recelved a $96.000 prepayment from a tenant for 2024 rent of a buliding Midwest recorded the recelpt as rent revenue. The error was discovered midway through 2024. 3. At the end of 2023, Dinkinstowery Corporation falied to accrue interest of $8,600 on a note receivable. At the beginning of 2024 , when the compary recelved the cash, it was recorded as interest revenue. Required: For each error 1. What would be the effect of each error on the income statement and the balance sheet in the 2023 financlal stafements? 2 Prepare any joumal entres each company should record in 2024 to correct the errors. Complete this question by entering your answers in the tabs below. What would be the effect of each error on the income statement and the balance sheet in the 2023 financial sratements? 2 On the last day of 2023 , Midwest importers recelved a $96,000 prepayment from a tenant for 2024 rent of a buliding. Midwest recorded the recelpt as rent revenue. The error was discovered midway through 2024. 3. At the end of 2023. Dinkinstowery Corporation falled to accrue interest of $8,600 on a note recelvable. At the beginning of 2024, when the company recelved the cash, it was recorded as interest revenue. Required: For eacherror: 1. What would be the effect of each error on the income statement and the balance sheet in the 2023 financial statements? 2. Prepare any joumal entries each company should record in 2024 to correct the errors. Complete this question by entering vour answers in the tabs below. Prepare any joumal entries each company should record in 2024 to correct the errors. Noter if no entry is required for a transactionlevent, select "No joumal entry required in the first account field. A Record correction of salaries expense error: B. Record correction of rent received in advance. c. Record correction of interest revenue on note receivable. Note : Q = joumal entry has been entered