Answered step by step

Verified Expert Solution

Question

1 Approved Answer

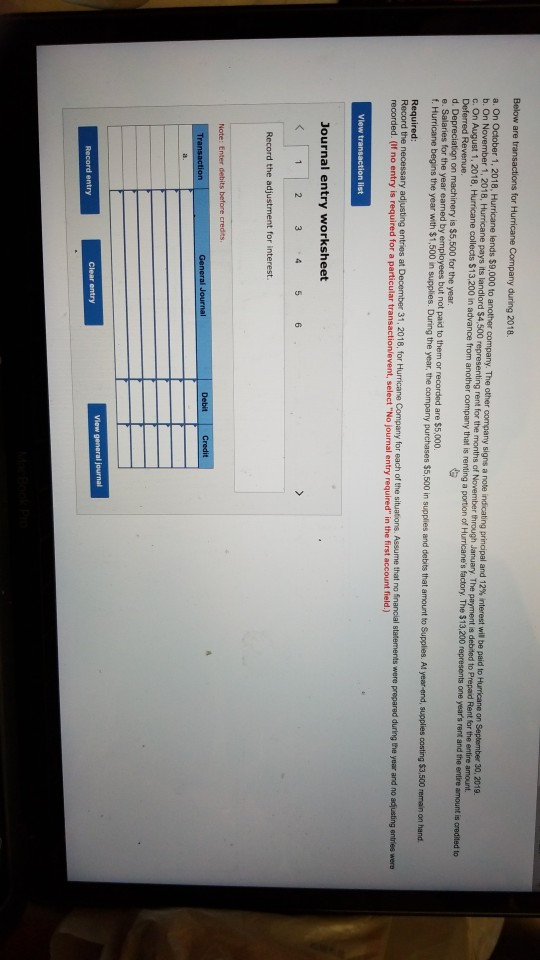

Below are transactions for Hurricane Company during 2018 a. On October 1, 2018, Hurricane lends $9,000 to another company. The other company signs a note

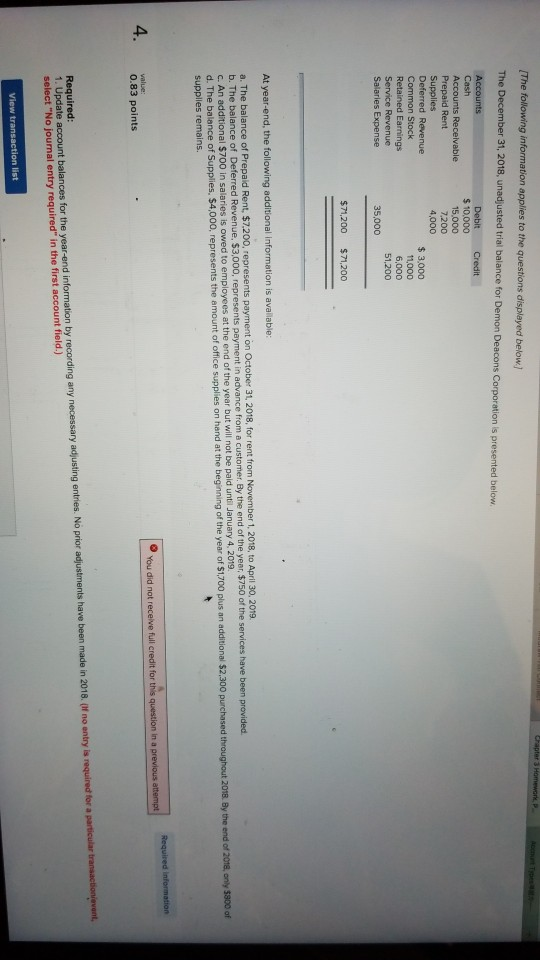

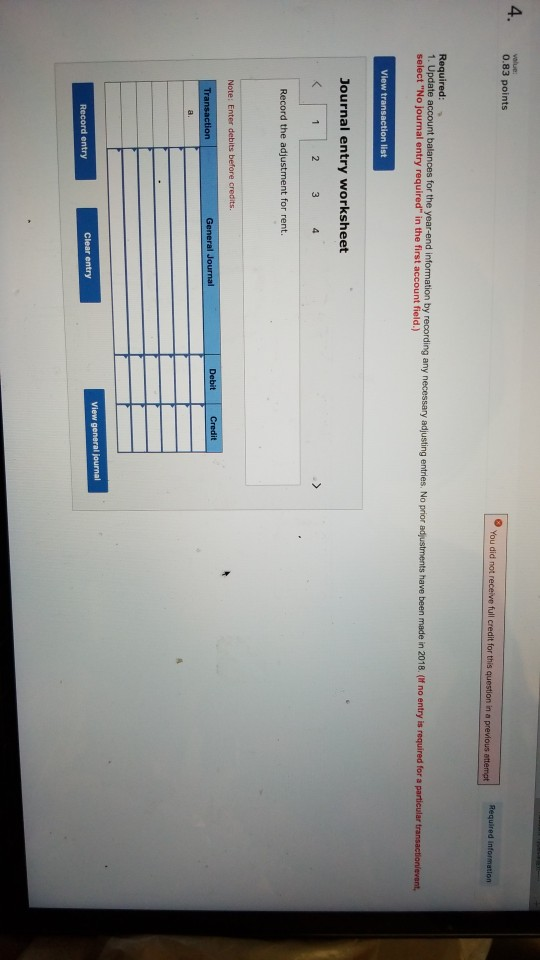

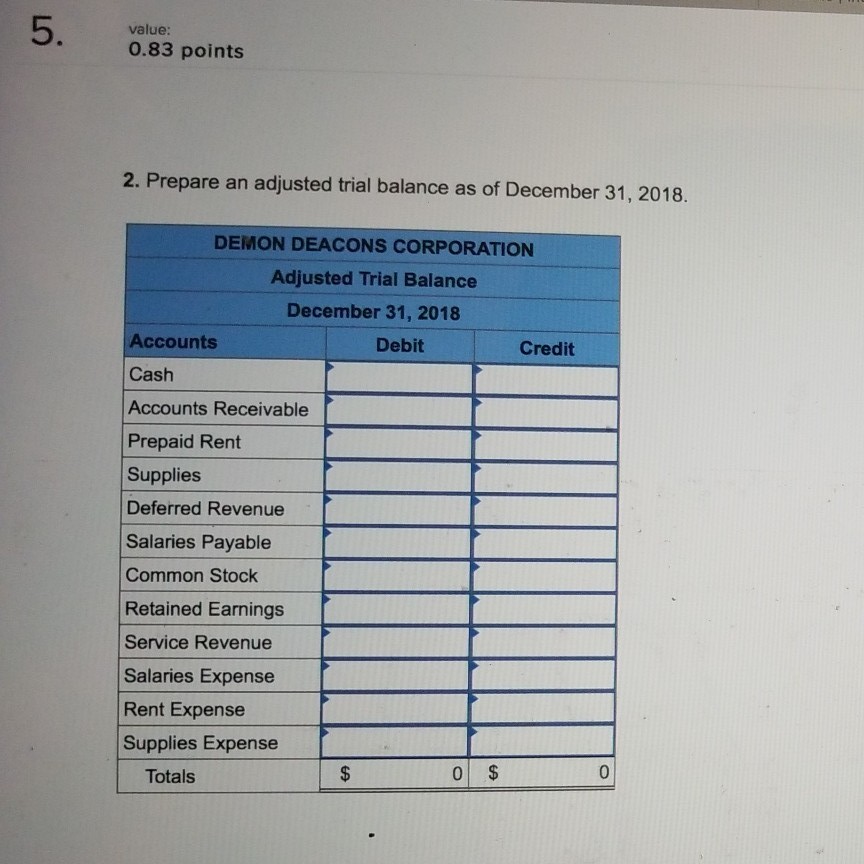

Below are transactions for Hurricane Company during 2018 a. On October 1, 2018, Hurricane lends $9,000 to another company. The other company signs a note indicating principal and 12% interest will be paid to Hurricane on September 30, 2018 b. On November 1, 2018, Hurricane pays its landlord $4,500 representing rent for the months of November through January. The payment is debited to Prepaid Rent for the entire amount c. On August 1, 2018. Hurricane collects $13,200 in advance from another company that is renting a portion of Hurricane's factory. The $13,200 represents one year's rent and the entire amount is credited to Deferred Revenue d. Depreciation on machinery is $5,500 for the year. e. Salaries for the year earned by employees but not paid to them or recorded are $5,000 f. Hurricane begins the year with $1,500 in supplies. During the year, the company purchases $5,500 in supplies and debits that amount to Supplies. At year-end, supplies costing $3,500 remain on hand Required: Record the necessary adjusting entries at December 31, 2018, for Hurricane Company for each of the situations. Assume that no financial statements were prepared during the year and no adjusting entries were recorded. (if no entry is required for a particular transaction event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 6 Record the adjustment for interest. Note: Enter debits before credits Transaction General Journal Debit Credit Clear entry View general Journal Record entry Chapter 3 HomewLP The following information applies to the questions displayed below! The December 31, 2018, unadjusted trial balance for Demon Deacons Corporation is presented below Accounts Debit Credit Cash $ 10,000 Accounts Receivable 15,000 Prepaid Rent 7,200 Supplies 4,000 Deferred Revenue $ 3.000 Common Stock 11,000 Retained Earnings 6,000 Service Revenue 51,200 Salaries Expense 35,000 $71,200 $71,200 At year-end, the following additional Information is available: a. The balance of Prepaid Rent, $7,200, represents payment on October 31, 2018, for rent from November 1, 2018, to April 30, 2019. b. The balance of Deferred Revenue, $3,000, represents payment in advance from a customer. By the end of the year, $750 of the services have been provided. c. An additional $700 in salaries is owed to employees at the end of the year but will not be paid until January 4, 2019. d. The balance of Supplies, $4,000, represents the amount of office supplies on hand at the beginning of the year of $1,700 plus an additional $2,300 purchased throughout 2018. By the end of 2018, only 5800 of supplies remains. Required information You did not receive full credit for this question in a previous attempt 4. value: 0.83 points Required: 1. Update account balances for the year-end information by recording any necessary adjusting entries. No prior adjustments have been made in 2018. (If no entry is required for a particular transacomer select "No journal entry required in the first account field.) View transaction list 5. value: 0.83 points 2. Prepare an adjusted trial balance as of December 31, 2018. DEMON DEACONS CORPORATION Adjusted Trial Balance December 31, 2018 Accounts Debit Credit Cash Accounts Receivable Prepaid Rent | Supplies Deferred Revenue Salaries Payable Common Stock Retained Earnings Service Revenue Salaries Expense Rent Expense Supplies Expense Totals $ 0 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started