Answered step by step

Verified Expert Solution

Question

1 Approved Answer

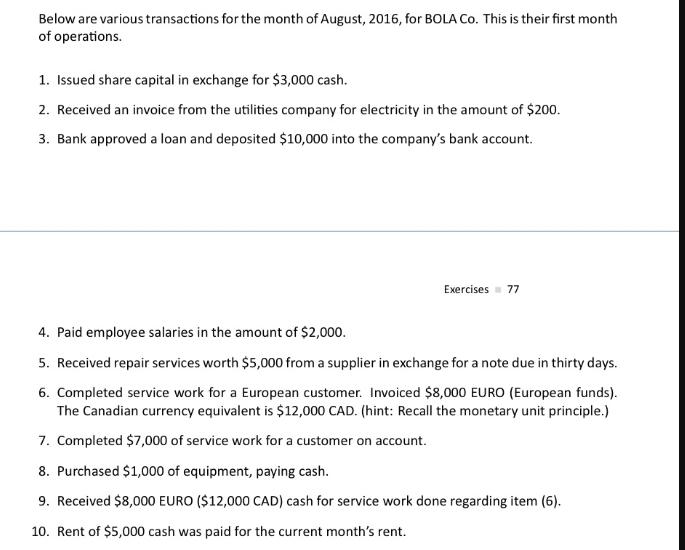

Below are various transactions for the month of August, 2016, for BOLA Co. This is their first month of operations. 1. Issued share capital

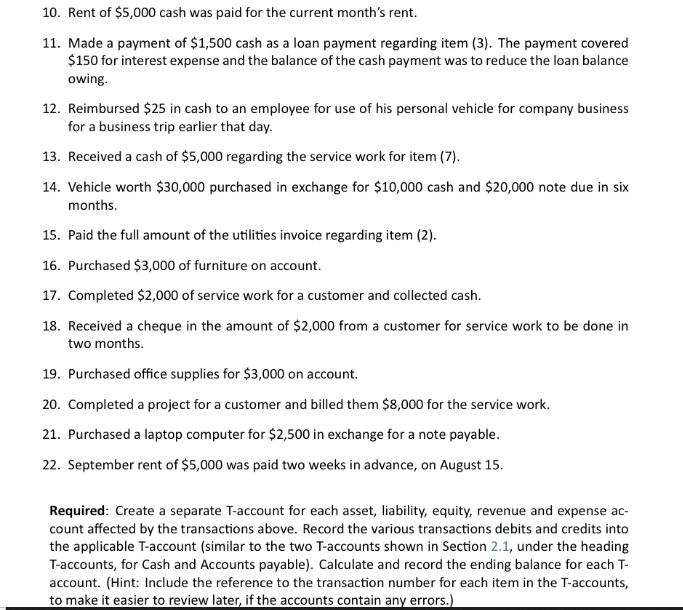

Below are various transactions for the month of August, 2016, for BOLA Co. This is their first month of operations. 1. Issued share capital in exchange for $3,000 cash. 2. Received an invoice from the utilities company for electricity in the amount of $200. 3. Bank approved a loan and deposited $10,000 into the company's bank account. Exercises 77 4. Paid employee salaries in the amount of $2,000. 5. Received repair services worth $5,000 from a supplier in exchange for a note due in thirty days. 6. Completed service work for a European customer. Invoiced $8,000 EURO (European funds). The Canadian currency equivalent is $12,000 CAD. (hint: Recall the monetary unit principle.) 7. Completed $7,000 of service work for a customer on account. 8. Purchased $1,000 of equipment, paying cash. 9. Received $8,000 EURO ($12,000 CAD) cash for service work done regarding item (6). 10. Rent of $5,000 cash was paid for the current month's rent. 10. Rent of $5,000 cash was paid for the current month's rent. 11. Made a payment of $1,500 cash as a loan payment regarding item (3). The payment covered $150 for interest expense and the balance of the cash payment was to reduce the loan balance owing. 12. Reimbursed $25 in cash to an employee for use of his personal vehicle for company business for a business trip earlier that day. 13. Received a cash of $5,000 regarding the service work for item (7). 14. Vehicle worth $30,000 purchased in exchange for $10,000 cash and $20,000 note due in six months. 15. Paid the full amount of the utilities invoice regarding item (2). 16. Purchased $3,000 of furniture on account. 17. Completed $2,000 of service work for a customer and collected cash. 18. Received a cheque in the amount of $2,000 from a customer for service work to be done in two months. 19. Purchased office supplies for $3,000 on account. 20. Completed a project for a customer and billed them $8,000 for the service work. 21. Purchased a laptop computer for $2,500 in exchange for a note payable. 22. September rent of $5,000 was paid two weeks in advance, on August 15. Required: Create a separate T-account for each asset, liability, equity, revenue and expense ac- count affected by the transactions above. Record the various transactions debits and credits into the applicable T-account (similar to the two T-accounts shown in Section 2.1, under the heading T-accounts, for Cash and Accounts payable). Calculate and record the ending balance for each T- account. (Hint: Include the reference to the transaction number for each item in the T-accounts, to make it easier to review later, if the accounts contain any errors.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started