Answered step by step

Verified Expert Solution

Question

1 Approved Answer

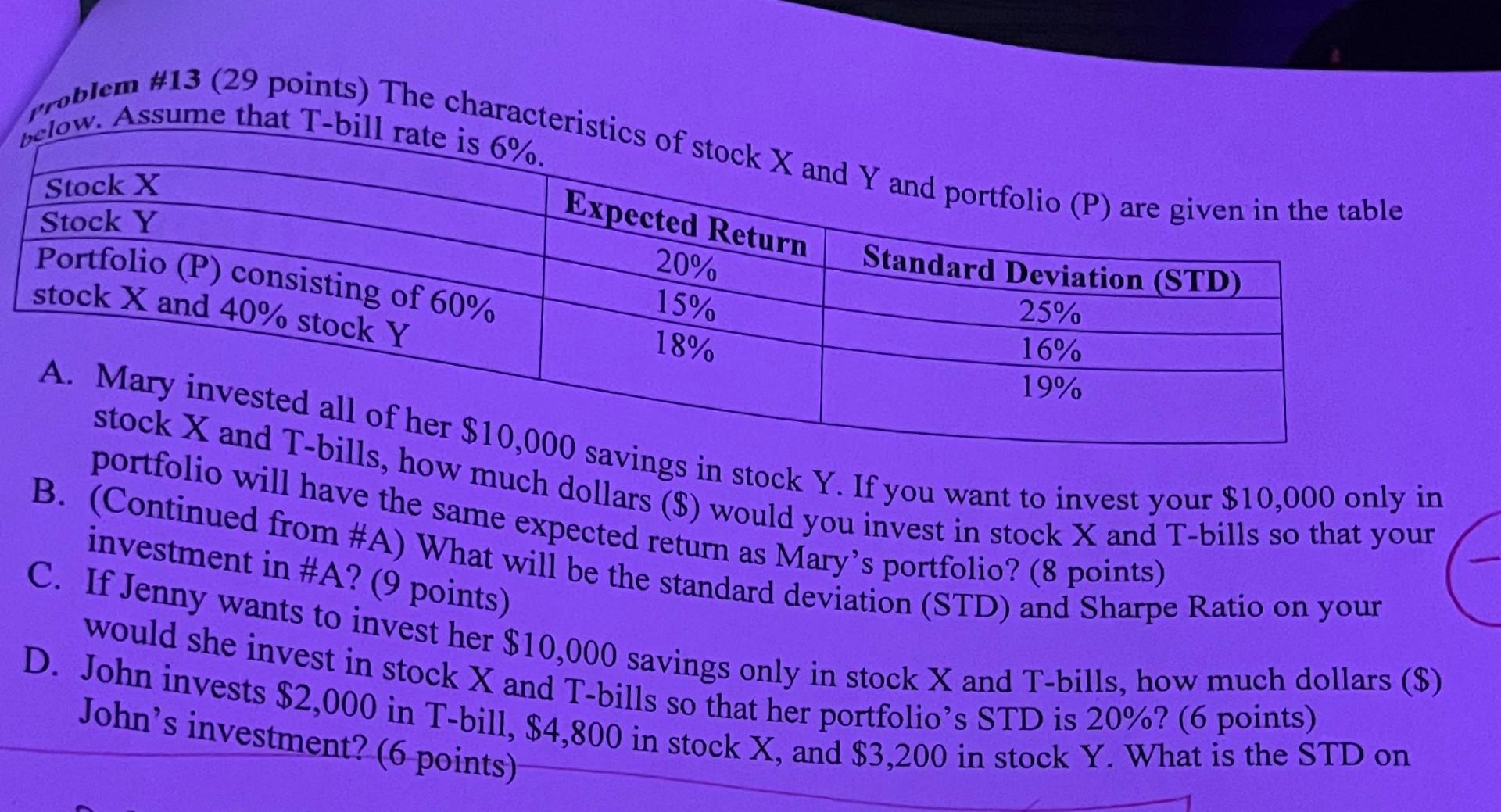

below. Assume that T-bill rate is 6%. problem #13 (29 points) The characteristics of stock X and Y and portfolio (P) are given in the

below. Assume that T-bill rate is 6%. problem #13 (29 points) The characteristics of stock X and Y and portfolio (P) are given in the table Stock X Stock Y Standard Deviation (STD) 25% 16% 19% diPortfolio (P) consisting of 60% stock X and 40% stock Y Expected Return 20% 15% 18% A. Mary invested all of her $10,000 savings in stock Y. If you want to invest your $10,000 only in stock X and T-bills, how much dollars ($) would you invest in stock X and T-bills so that your portfolio will have the same expected return as Mary's portfolio? (8 points) B. (Continued from #A) What will be the standard deviation (STD) and Sharpe Ratio on your C. If Jenny wants to invest her $10,000 savings only in stock X and T-bills, how much dollars ($) would she invest in stock X and T-bills so that her portfolio's STD is 20%? (6 points) D. John invests $2,000 in T-bill, $4,800 in stock X, and $3,200 in stock Y. What is the STD on investment in #A? (9 points) John's investment? (6 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started