Answered step by step

Verified Expert Solution

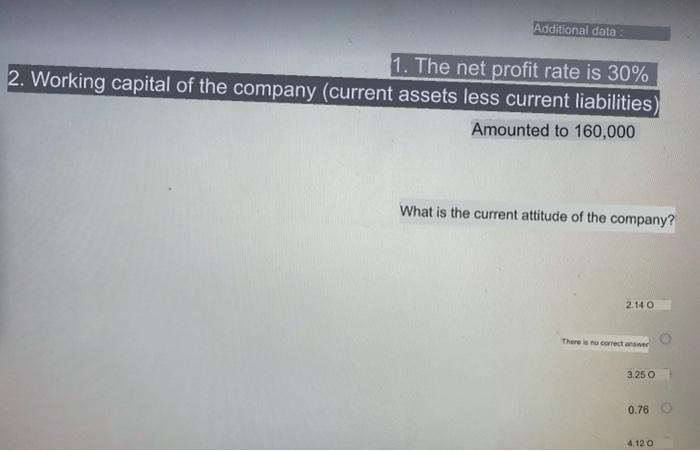

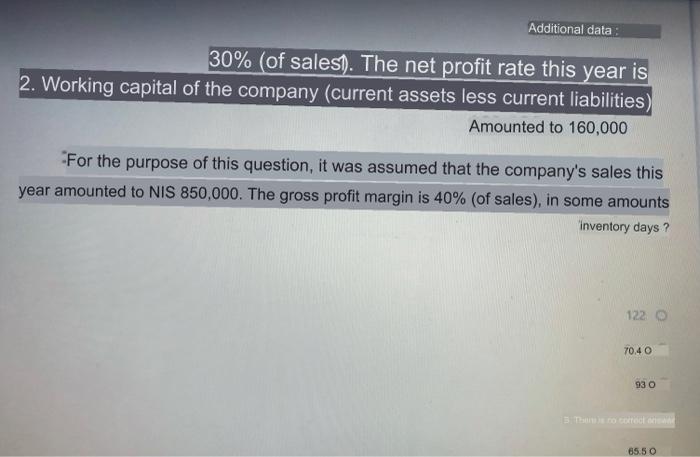

Question

1 Approved Answer

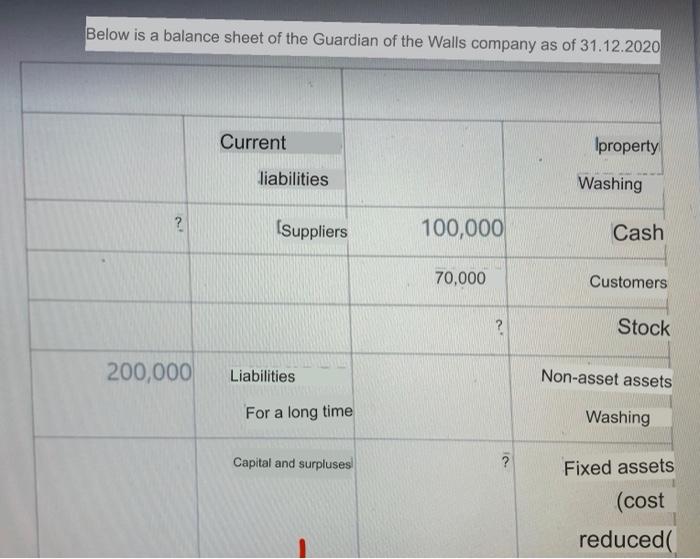

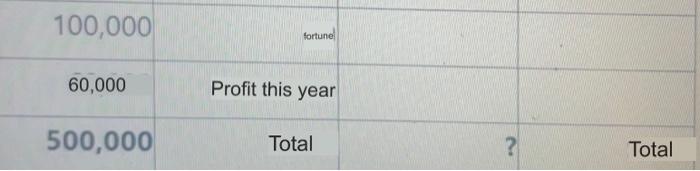

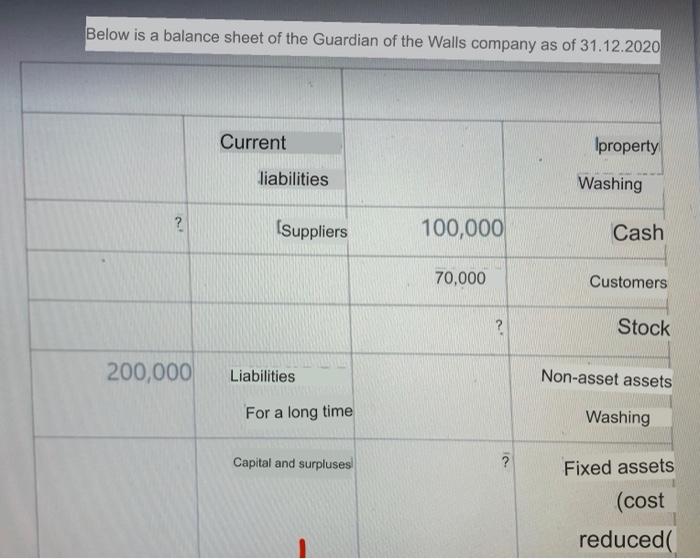

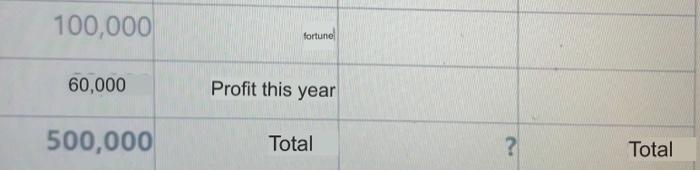

Below is a balance sheet of the Guardian of the Walls company as of 31.12.2020 Current Iproperty liabilities Washing ? (Suppliers 100,000 Cash 70,000 Customers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started