Answered step by step

Verified Expert Solution

Question

1 Approved Answer

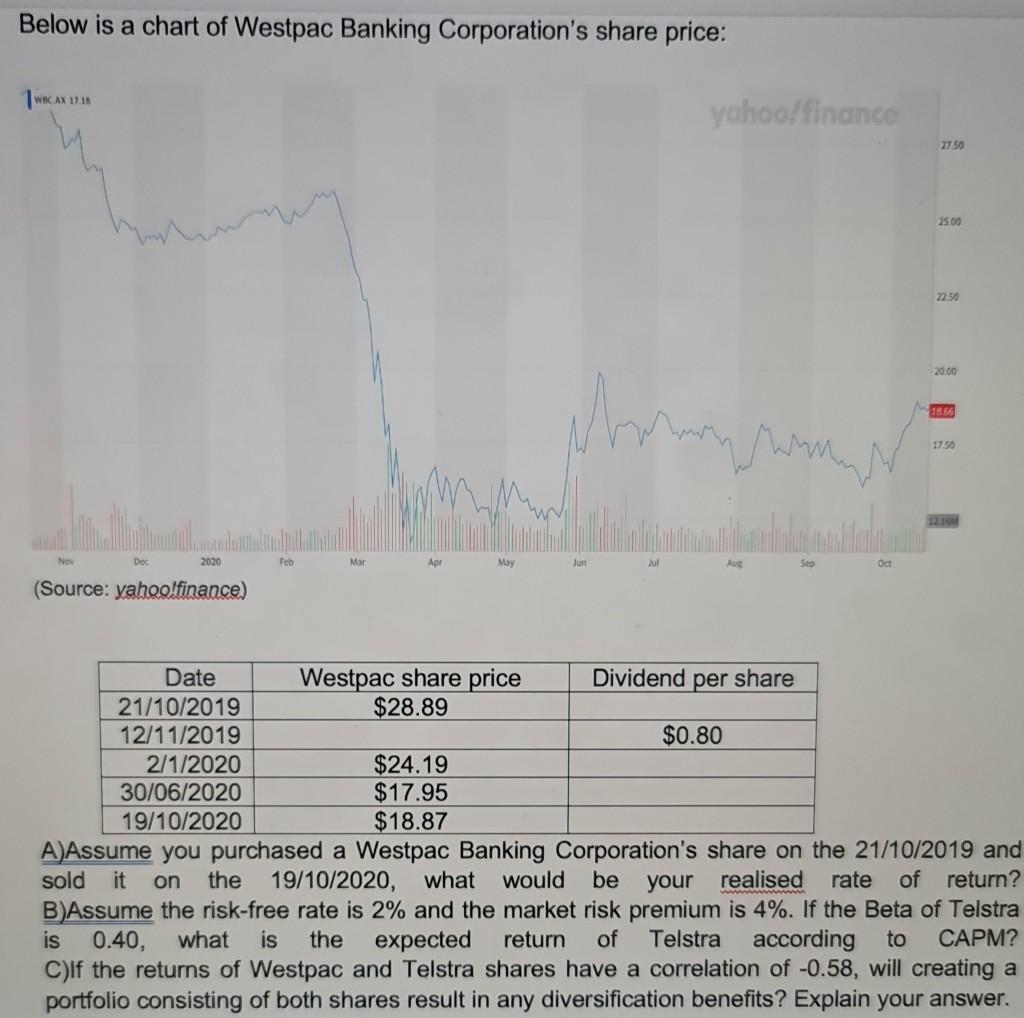

Below is a chart of Westpac Banking Corporation's share price: WACAXIAS yahoo/finance 2750 25.00 2250 2000 1866 www 17.50 Now Dec 2020 Feb Mar Apr

Below is a chart of Westpac Banking Corporation's share price: WACAXIAS yahoo/finance 2750 25.00 2250 2000 1866 www 17.50 Now Dec 2020 Feb Mar Apr May Jun Jul Sep Oct (Source: yahoo!finance) Date Westpac share price Dividend per share 21/10/2019 $28.89 12/11/2019 $0.80 2/1/2020 $24.19 30/06/2020 $17.95 19/10/2020 $18.87 A)Assume you purchased a Westpac Banking Corporation's share on the 21/10/2019 and sold it on the 19/10/2020, what would be your realised rate of return? B)Assume the risk-free rate is 2% and the market risk premium is 4%. If the Beta of Telstra is 0.40, what is the expected return of Telstra according to CAPM? C)If the returns of Westpac and Telstra shares have a correlation of -0.58, will creating a portfolio consisting of both shares result in any diversification benefits? Explain your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started