Question: Below is a comparative balance sheet for Summer Days Corporation: Current assets: Cash$ 140,000$ 90,000 Short-term investments 90,00080,000 Accounts receivable, net350,000220,000 Inventory 500,000430,000 Prepaid expenses30,00030,000

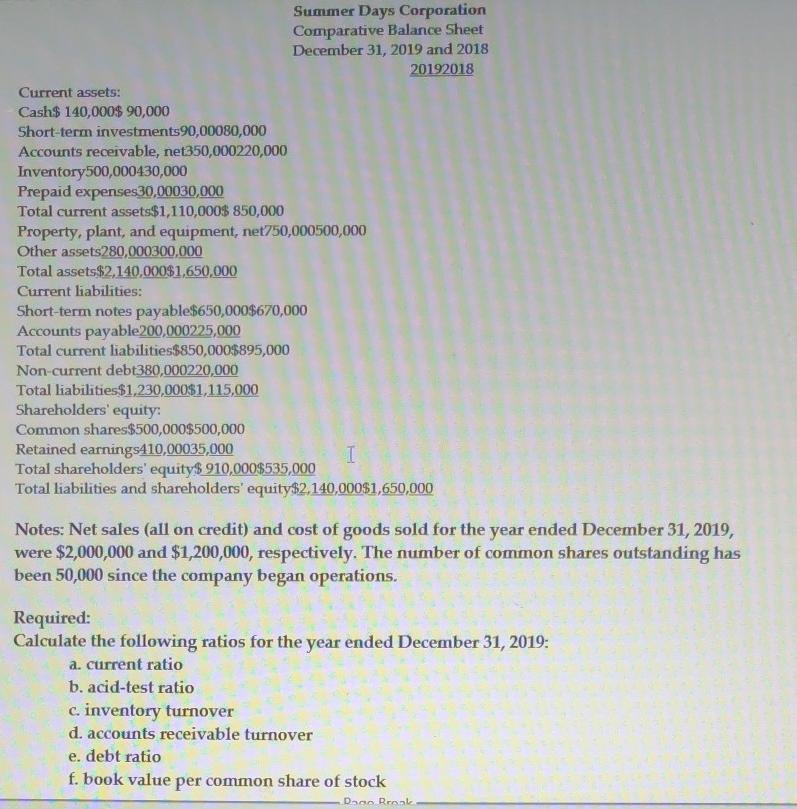

Below is a comparative balance sheet for Summer Days Corporation:

Current assets: Cash$ 140,000$ 90,000 Short-term investments 90,00080,000 Accounts receivable, net350,000220,000 Inventory 500,000430,000 Prepaid expenses30,00030,000 Total current assets$1,110,000$ 850,000 Property, plant, and equipment, net750,000500,000 Other assets280,000300,000 Total assets$2,140,000$1,650,000 Summer Days Corporation Comparative Balance Sheet December 31, 2019 and 2018 20192018 Current liabilities: Short-term notes payable$650,000$670,000 Accounts payable200,000225,000 Total current liabilities$850,000$895,000 Non-current debt380,000220,000 Total liabilities $1,230,000$1,115,000 Shareholders' equity: Common shares$500,000$500,000 Retained earnings410,00035,000 I Total shareholders' equity$ 910,000$535,000 Total liabilities and shareholders' equity$2,140,000$1,650,000 Notes: Net sales (all on credit) and cost of goods sold for the year ended December 31, 2019, were $2,000,000 and $1,200,000, respectively. The number of common shares outstanding has been 50,000 since the company began operations. Required: Calculate the following ratios for the year ended December 31, 2019: a. current ratio b. acid-test ratio c. inventory turnover d. accounts receivable turnover e. debt ratio f. book value per common share of stock Dago Rroak

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

The image displays a comparative balance sheet for Summer Days Corporation for the years ending on December 31 2019 and December 31 2018 To calculate the requested financial ratios for the year ended ... View full answer

Get step-by-step solutions from verified subject matter experts