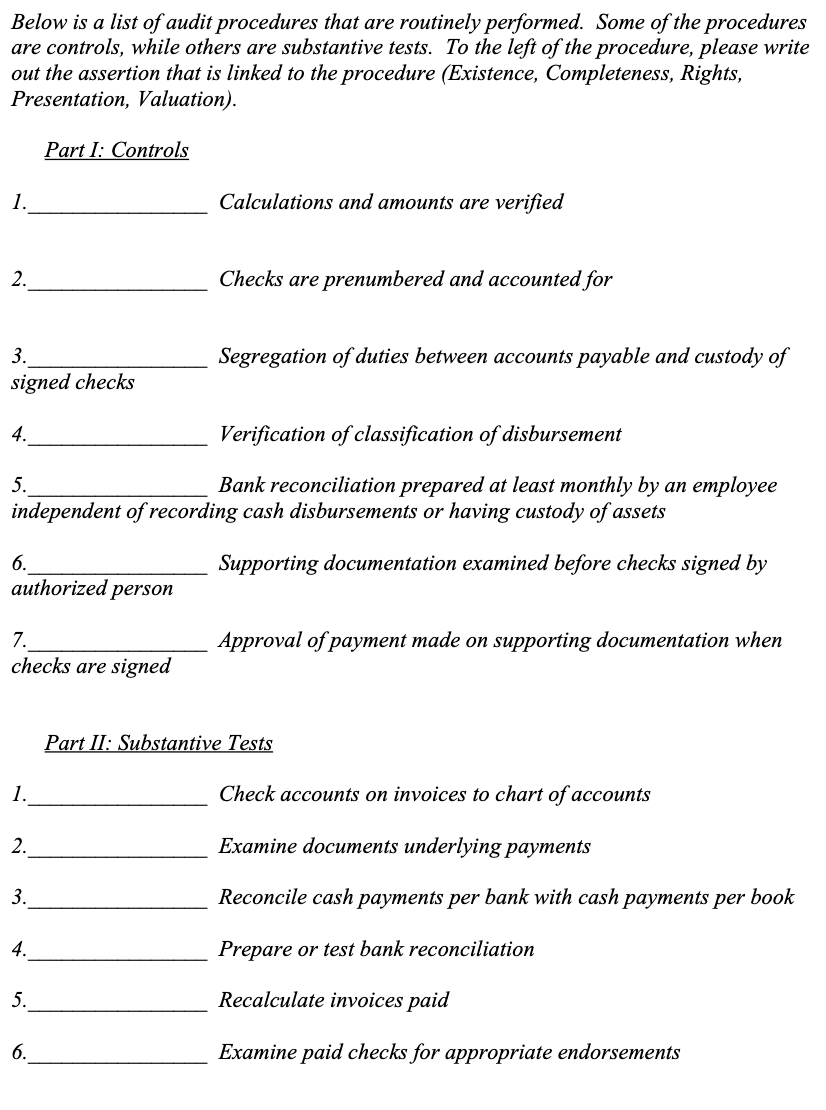

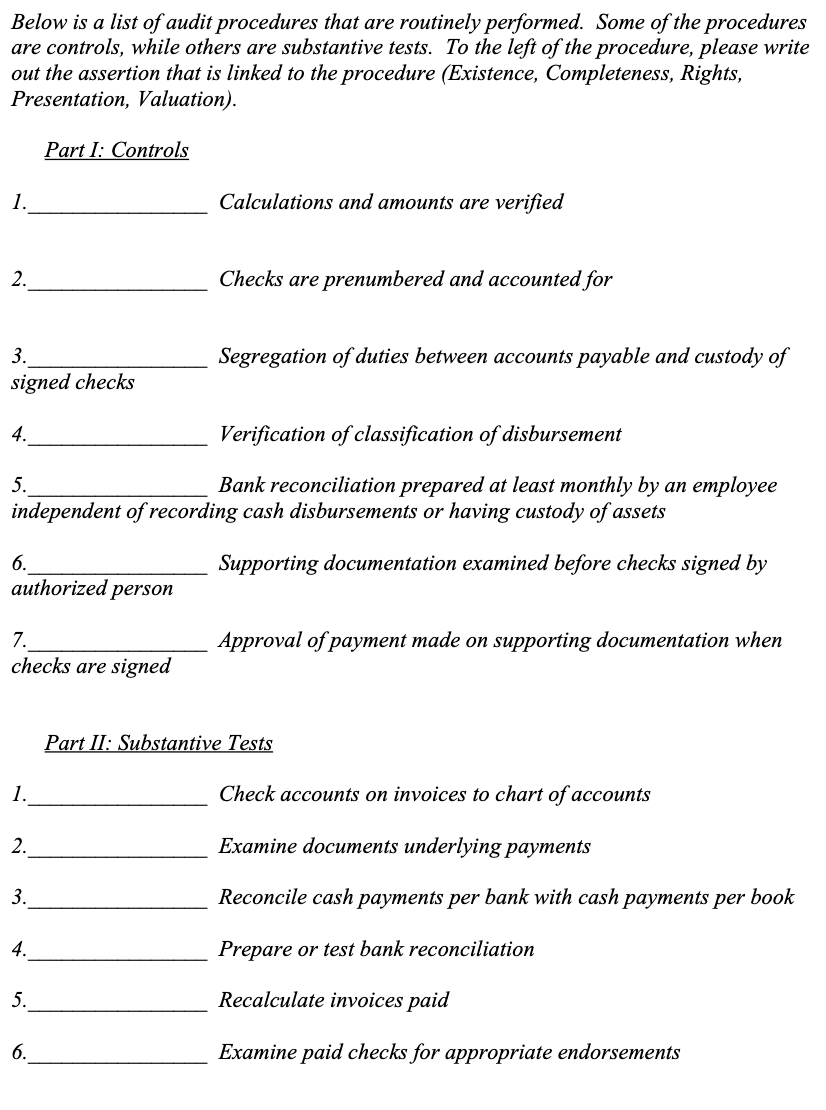

Below is a list of audit procedures that are routinely performed. Some of the procedures are controls, while others are substantive tests. To the left of the procedure, please write out the assertion that is linked to the procedure (Existence, Completeness, Rights, Presentation, Valuation). Part I: Controls 1. Calculations and amounts are verified 2. Checks are prenumbered and accounted for 3. Segregation of duties between accounts payable and custody of signed checks 4. Verification of classification of disbursement 5. Bank reconciliation prepared at least monthly by an employee independent of recording cash disbursements or having custody of assets 6. Supporting documentation examined before checks signed by authorized person 7. Approval of payment made on supporting documentation when checks are signed Part II: Substantive Tests 1. Check accounts on invoices to chart of accounts 2. Examine documents underlying payments 3. Reconcile cash payments per bank with cash payments per book 4. Prepare or test bank reconciliation 5. Recalculate invoices paid 6. Examine paid checks for appropriate endorsements Below is a list of audit procedures that are routinely performed. Some of the procedures are controls, while others are substantive tests. To the left of the procedure, please write out the assertion that is linked to the procedure (Existence, Completeness, Rights, Presentation, Valuation). Part I: Controls 1. Calculations and amounts are verified 2. Checks are prenumbered and accounted for 3. Segregation of duties between accounts payable and custody of signed checks 4. Verification of classification of disbursement 5. Bank reconciliation prepared at least monthly by an employee independent of recording cash disbursements or having custody of assets 6. Supporting documentation examined before checks signed by authorized person 7. Approval of payment made on supporting documentation when checks are signed Part II: Substantive Tests 1. Check accounts on invoices to chart of accounts 2. Examine documents underlying payments 3. Reconcile cash payments per bank with cash payments per book 4. Prepare or test bank reconciliation 5. Recalculate invoices paid 6. Examine paid checks for appropriate endorsements