Answered step by step

Verified Expert Solution

Question

1 Approved Answer

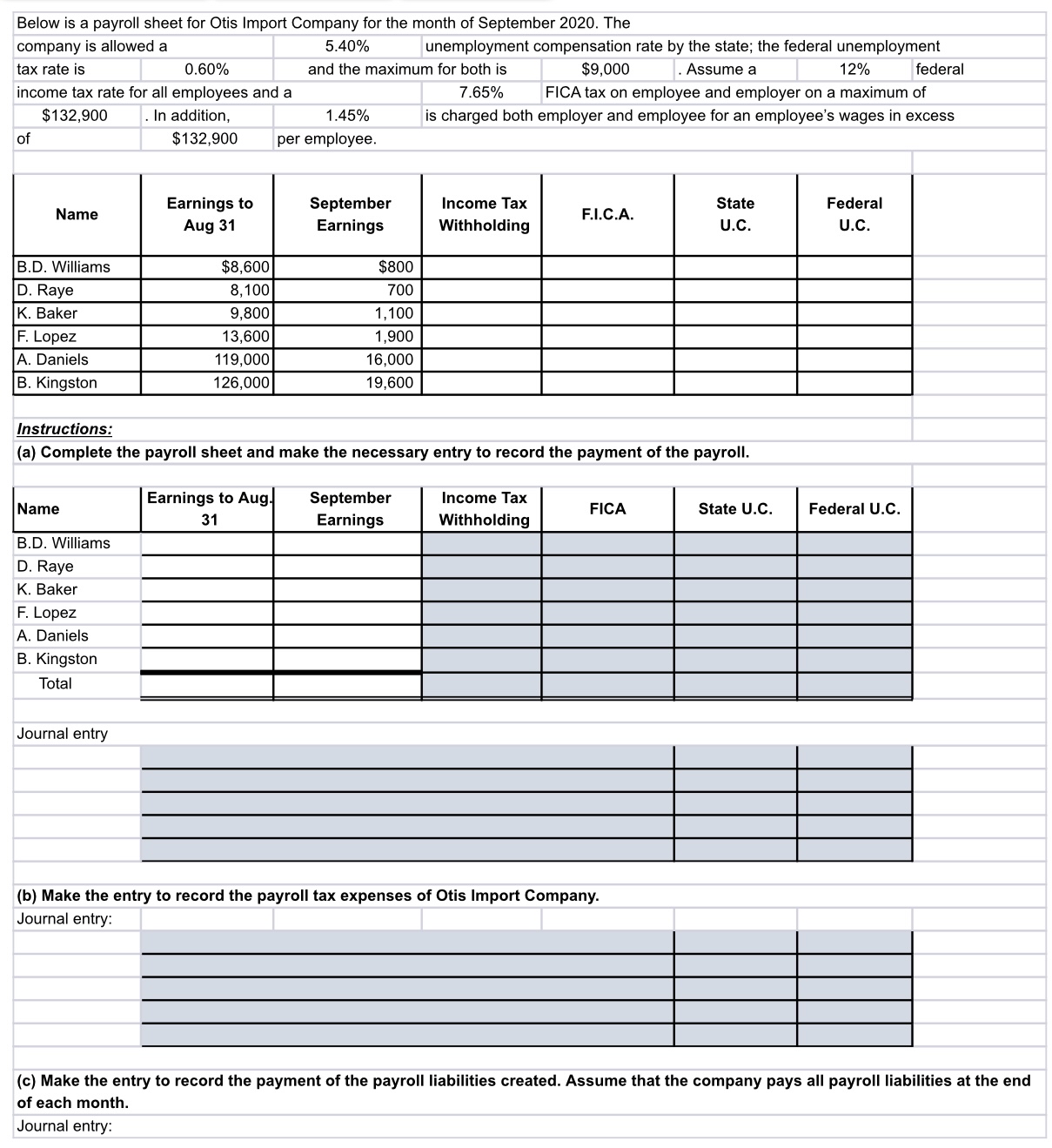

Below is a payroll sheet for Otis Import Company for the month of September 2 0 2 0 . The table [ [ company

Below is a payroll sheet for Otis Import Company for the month of September The

tablecompany is allowed aunemployment compensation rate by the state; the federal unemploymenttax rate isand the maximum for both is$ Assume afederalincome tax rate for all employees and a

tableFICA tax on employee and employer on a maximum ofemployer and employee for an employee's wages in excess$In addition,,is charged both employer and employee for an employee's wages in excessof$per employee.NametableEarnings toAug tableSeptemberEarningstableIncome TaxWithholdingFI.CAtableStateUCtableFederalUCBD Williams,$$D Raye,K Baker,F Lopez,A Daniels,B Kingston,

Instructions:

a Complete the payroll sheet and make the necessary entry to record the payment of the payroll.

tableNametableEarnings to Aug.tableSeptemberEarningstableIncome TaxWithholdingFICA,State UCFederal UCBD WilliamsD RayeK BakerF LopezA DanielsB KingstonTotal

Journal entry

table

b Make the entry to record the payroll tax expenses of Otis Import Company.

c Make the entry to record the payment of the payroll liabilities created. Assume that the company pays all payroll liabilities at the end of each month.

Journal entry:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started