Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company X is looking to acquire a new equipment for a project that will last for eight years. The after-tax required rate of return

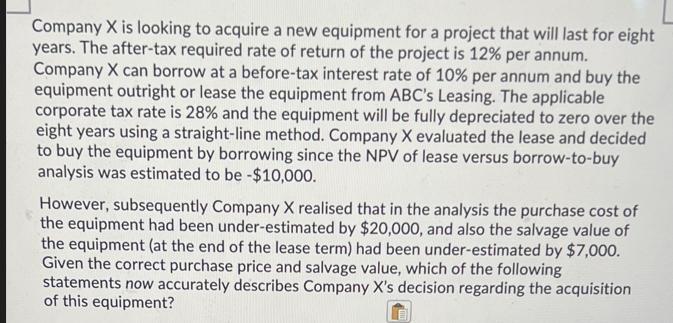

Company X is looking to acquire a new equipment for a project that will last for eight years. The after-tax required rate of return of the project is 12% per annum. Company X can borrow at a before-tax interest rate of 10% per annum and buy the equipment outright or lease the equipment from ABC's Leasing. The applicable corporate tax rate is 28% and the equipment will be fully depreciated to zero over the eight years using a straight-line method. Company X evaluated the lease and decided to buy the equipment by borrowing since the NPV of lease versus borrow-to-buy analysis was estimated to be -$10,000. However, subsequently Company X realised that in the analysis the purchase cost of the equipment had been under-estimated by $20,000, and also the salvage value of the equipment (at the end of the lease term) had been under-estimated by $7,000. Given the correct purchase price and salvage value, which of the following statements now accurately describes Company X's decision regarding the acquisition of this equipment?

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Based on the revised information Company X should now lease the equipment from A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started