Question

Below is a table of probabilities and expected returns for 2 securities under 3 possible scenarios: Possible outcomes Probability Rate of Return Company G

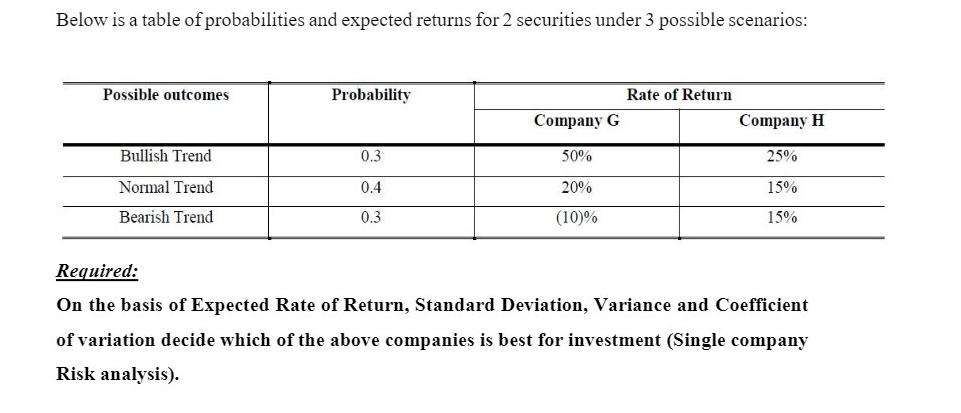

Below is a table of probabilities and expected returns for 2 securities under 3 possible scenarios: Possible outcomes Probability Rate of Return Company G Company H Bullish Trend 0.3 50% 25% Normal Trend 0.4 Bearish Trend 0.3 20% (10)% 15% 15% Required: On the basis of Expected Rate of Return, Standard Deviation, Variance and Coefficient of variation decide which of the above companies is best for investment (Single company Risk analysis).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Finance Theory and Policy

Authors: Paul R. Krugman, Maurice Obstfeld, Marc J. Melitz

10th edition

978-0133425895, 133425894, 978-0133423631, 133423638, 978-0133423648

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App