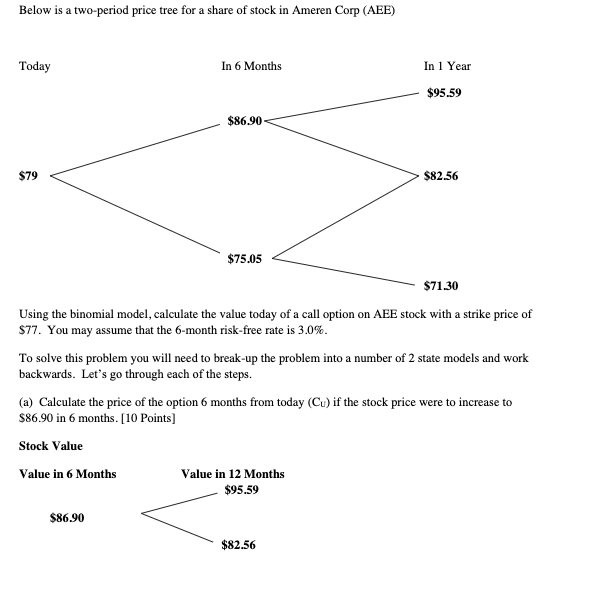

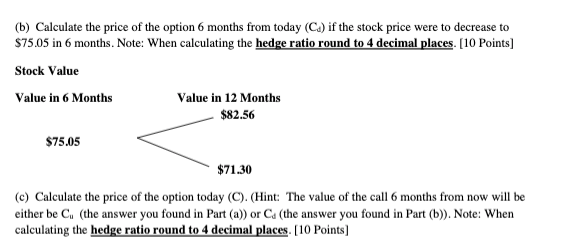

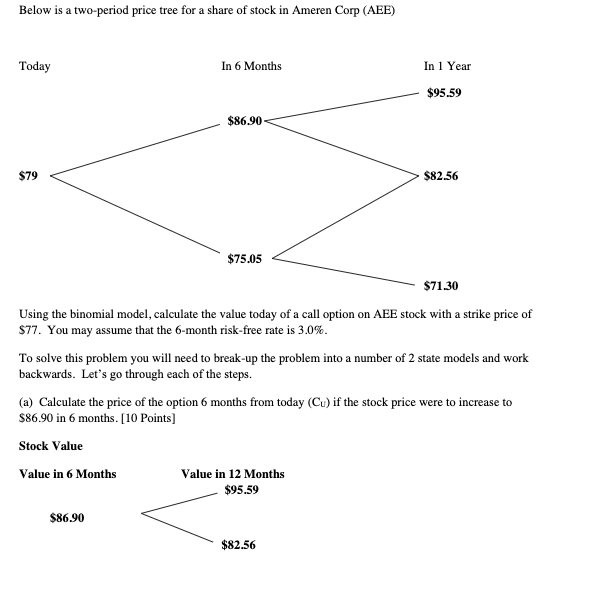

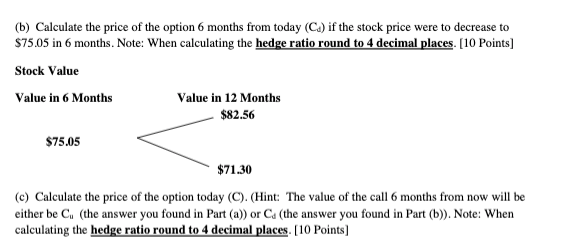

Below is a two-period price tree for a share of stock in Ameren Corp (AEE) Today In 6 Months In 1 Year $95.59 $86.90 $79 $82.56 $75.05 $71.30 Using the binomial model, calculate the value today of a call option on AEE stock with a strike price of $77. You may assume that the 6-month risk-free rate is 3.0%. To solve this problem you will need to break-up the problem into a number of 2 state models and work backwards. Let's go through each of the steps. (a) Calculate the price of the option 6 months from today (Cu) if the stock price were to increase to $86.90 in 6 months. [10 Points] Stock Value Value in 6 Months Value in 12 Months $95.59 $86.90 $82.56 (b) Calculate the price of the option 6 months from today (Cs) if the stock price were to decrease to $75.05 in 6 months. Note: When calculating the hedge ratio round to 4 decimal places. [10 Points) Stock Value Value in 6 Months Value in 12 Months $82.56 $75.05 $71.30 (c) Calculate the price of the option today (C). (Hint: The value of the call 6 months from now will be either be C, (the answer you found in Part (a)) or C (the answer you found in Part (b)). Note: When calculating the hedge ratio round to 4 decimal places. [10 Points) Below is a two-period price tree for a share of stock in Ameren Corp (AEE) Today In 6 Months In 1 Year $95.59 $86.90 $79 $82.56 $75.05 $71.30 Using the binomial model, calculate the value today of a call option on AEE stock with a strike price of $77. You may assume that the 6-month risk-free rate is 3.0%. To solve this problem you will need to break-up the problem into a number of 2 state models and work backwards. Let's go through each of the steps. (a) Calculate the price of the option 6 months from today (Cu) if the stock price were to increase to $86.90 in 6 months. [10 Points] Stock Value Value in 6 Months Value in 12 Months $95.59 $86.90 $82.56 (b) Calculate the price of the option 6 months from today (Cs) if the stock price were to decrease to $75.05 in 6 months. Note: When calculating the hedge ratio round to 4 decimal places. [10 Points) Stock Value Value in 6 Months Value in 12 Months $82.56 $75.05 $71.30 (c) Calculate the price of the option today (C). (Hint: The value of the call 6 months from now will be either be C, (the answer you found in Part (a)) or C (the answer you found in Part (b)). Note: When calculating the hedge ratio round to 4 decimal places. [10 Points)