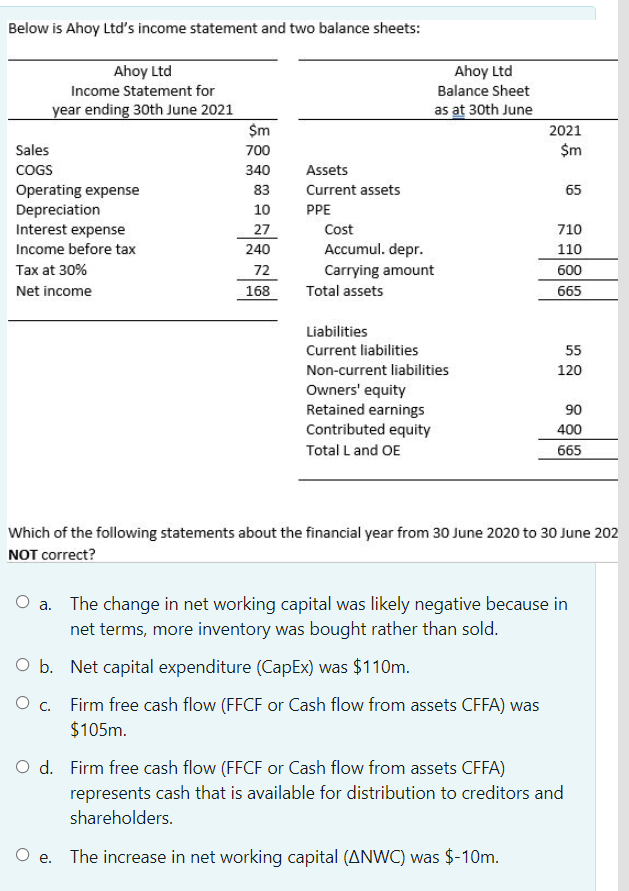

Below is Ahoy Ltd's income statement and two balance sheets: Ahoy Ltd Income Statement for year ending 30th June 2021 Ahoy Ltd Balance Sheet as at 30th June 2021 $m $m 700 340 83 10 27 240 Sales COGS Operating expense Depreciation Interest expense Income before tax Tax at 30% Net income 65 Assets Current assets PPE Cost Accumul. depr. Carrying amount Total assets 72 710 110 600 665 168 55 120 Liabilities Current liabilities Non-current liabilities Owners' equity Retained earnings Contributed equity Total Land OE 90 400 665 Which of the following statements about the financial year from 30 June 2020 to 30 June 202 NOT correct? O a. The change in net working capital was likely negative because in net terms, more inventory was bought rather than sold. O b. Net capital expenditure (CapEx) was $110m. O c. Firm free cash flow (FFCF or Cash flow from assets CFFA) was $105m. O d. Firm free cash flow (FFCF or Cash flow from assets CFFA) represents cash that is available for distribution to creditors and shareholders. Oe. The increase in net working capital (ANWC) was $-10m. Below is Ahoy Ltd's income statement and two balance sheets: Ahoy Ltd Income Statement for year ending 30th June 2021 Ahoy Ltd Balance Sheet as at 30th June 2021 $m $m 700 340 83 10 27 240 Sales COGS Operating expense Depreciation Interest expense Income before tax Tax at 30% Net income 65 Assets Current assets PPE Cost Accumul. depr. Carrying amount Total assets 72 710 110 600 665 168 55 120 Liabilities Current liabilities Non-current liabilities Owners' equity Retained earnings Contributed equity Total Land OE 90 400 665 Which of the following statements about the financial year from 30 June 2020 to 30 June 202 NOT correct? O a. The change in net working capital was likely negative because in net terms, more inventory was bought rather than sold. O b. Net capital expenditure (CapEx) was $110m. O c. Firm free cash flow (FFCF or Cash flow from assets CFFA) was $105m. O d. Firm free cash flow (FFCF or Cash flow from assets CFFA) represents cash that is available for distribution to creditors and shareholders. Oe. The increase in net working capital (ANWC) was $-10m