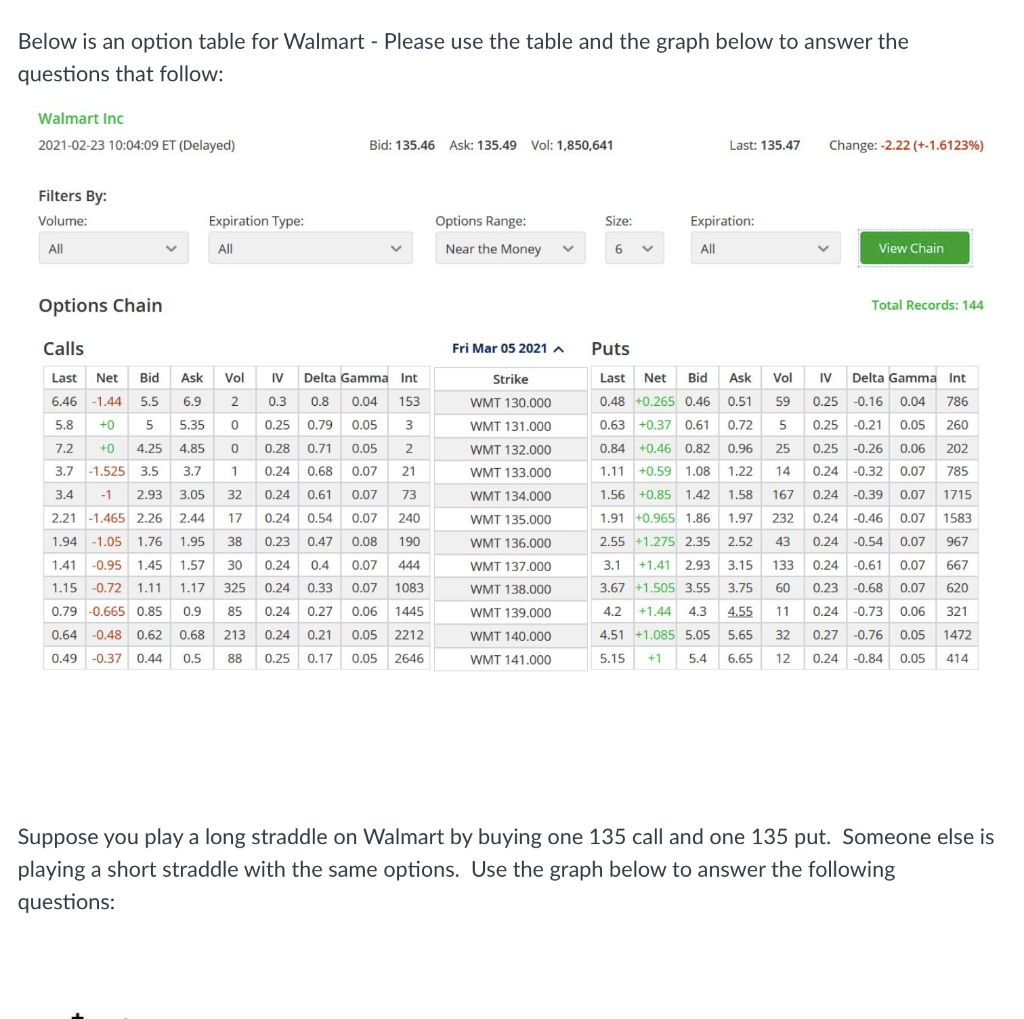

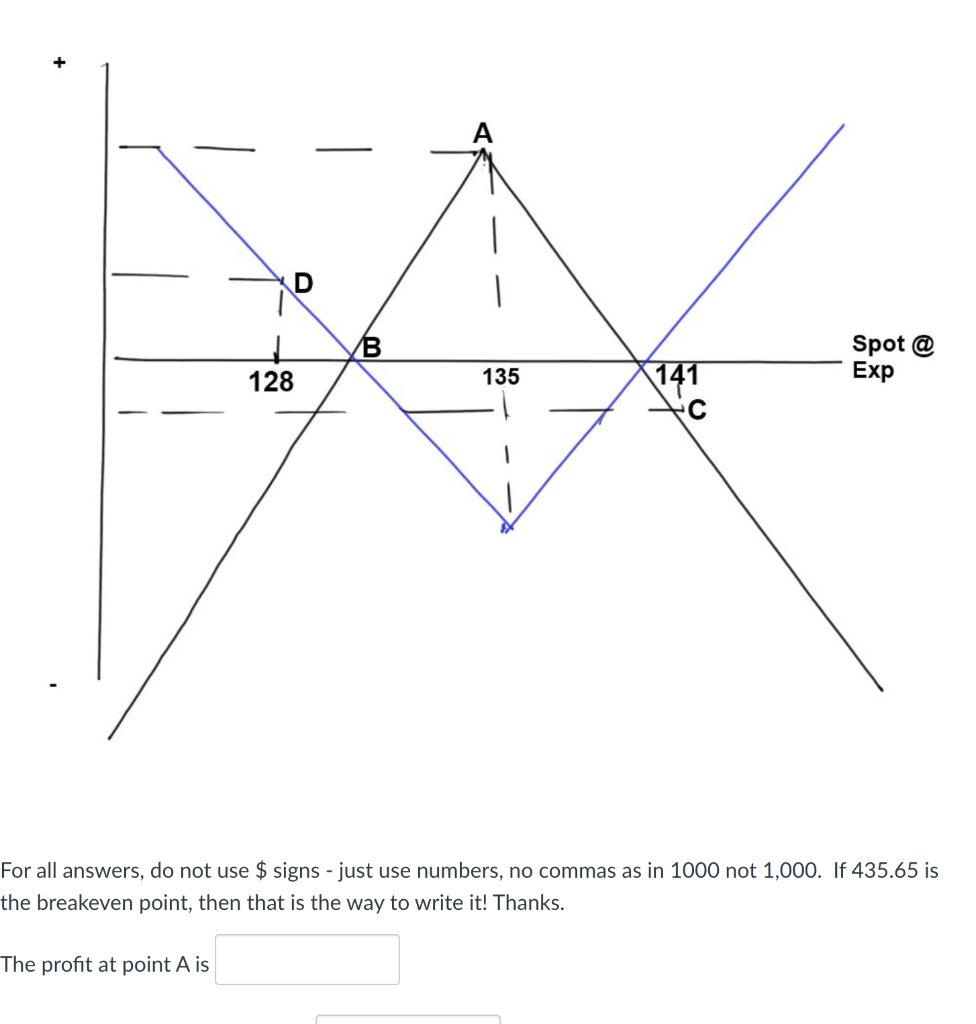

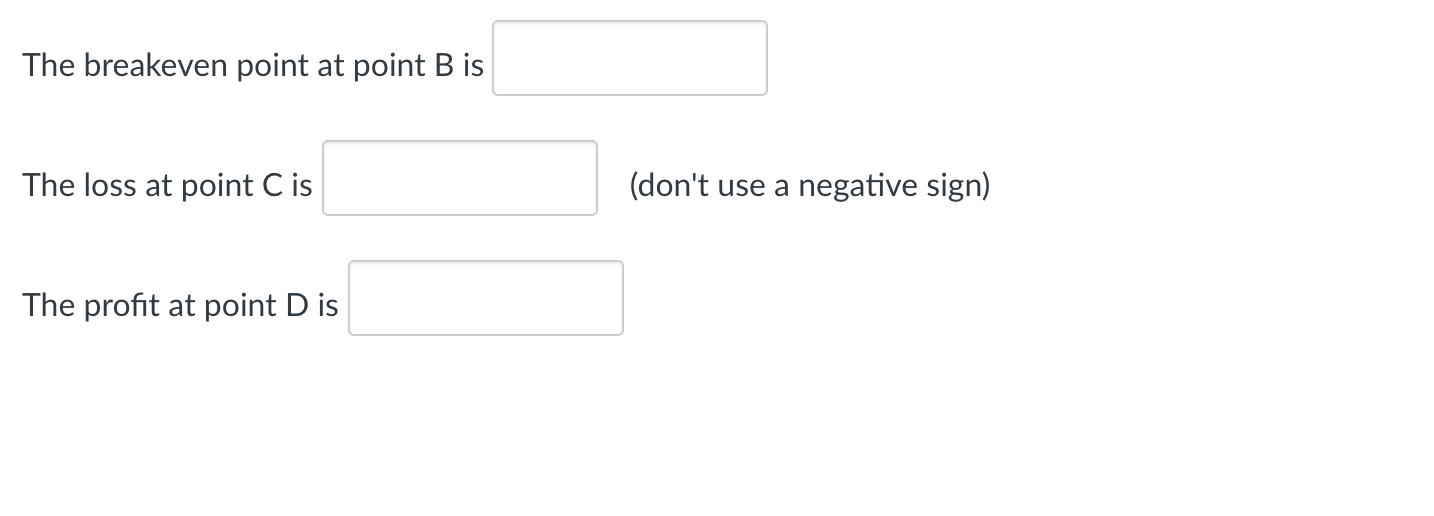

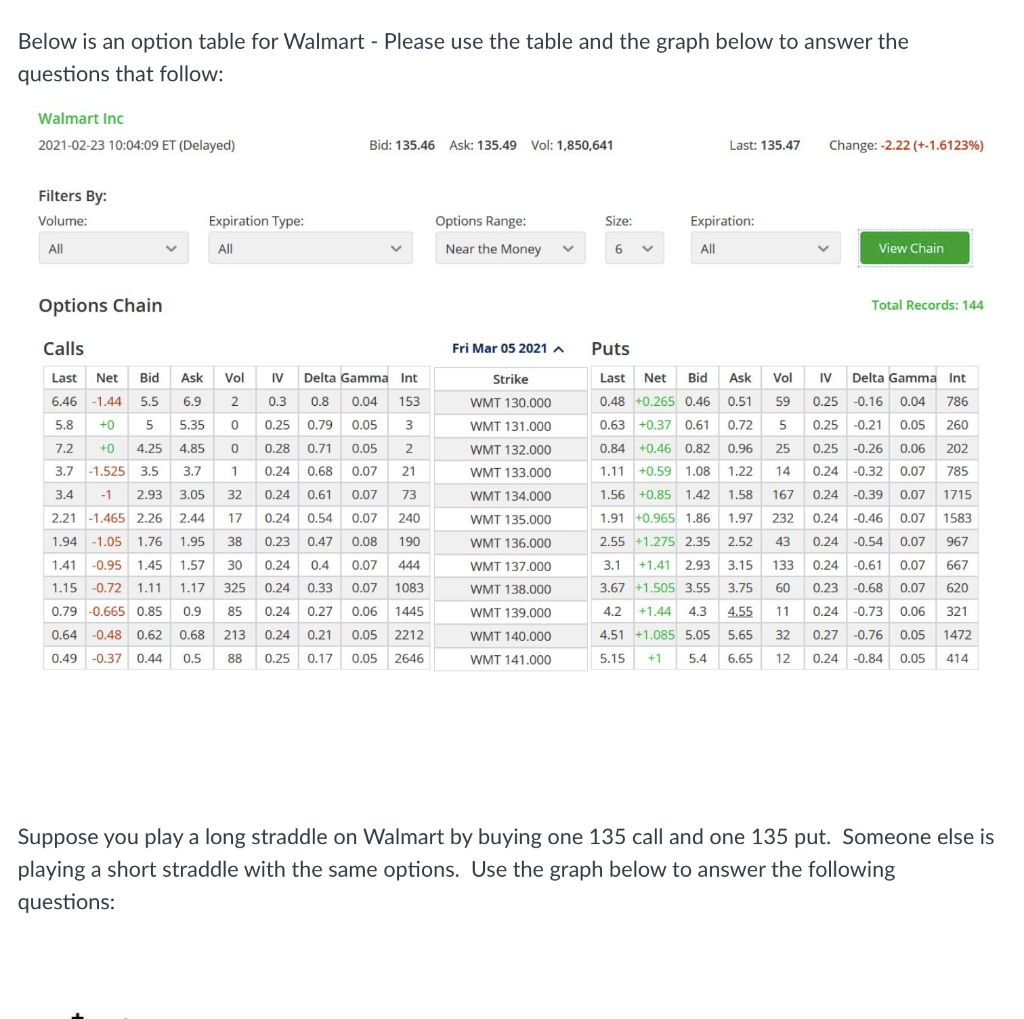

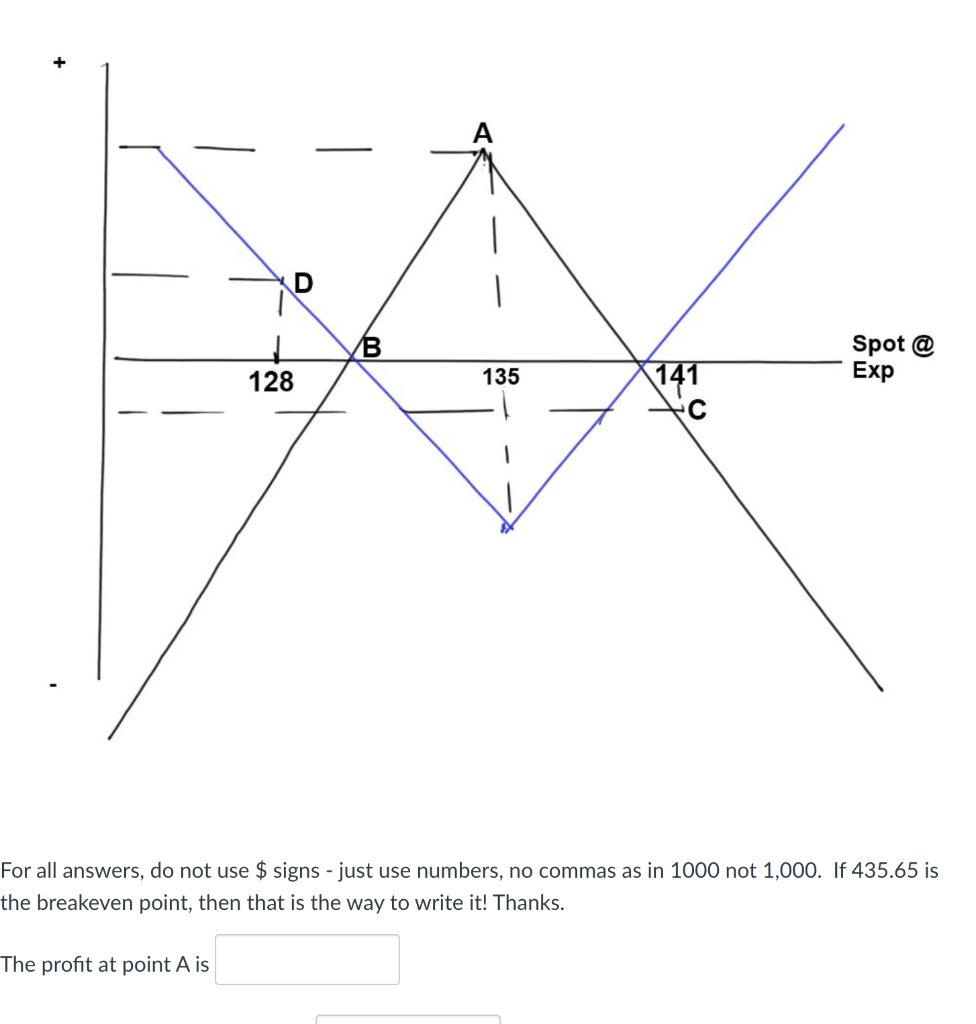

Below is an option table for Walmart - Please use the table and the graph below to answer the questions that follow: Walmart Inc 2021-02-23 10:04:09 ET (Delayed) Bid: 135.46 Ask: 135.49 Vol: 1,850,641 Last: 135.47 Change: -2.22 (+-1.6123%) Filters By: Volume: Expiration Type: Size: Expiration: Options Range: Near the Money All V All All View Chain Options Chain Total Records: 144 Calls Fri Mar 05 2021 A Puts Strike WMT 130.000 WMT 131.000 WMT 132.000 WMT 133.000 WMT 134.000 Last Net Bid Ask Vol IV Delta Gamma Int 6.46 -1.44 5.5 6.9 2 0.3 0.8 0.04 153 5.8 +0 5 5.35 0 0.25 0.79 0.05 3 7.2 +0 4.25 4.85 0 0.28 0.71 0.05 2 2. 3.7 -1.525 3.5 3.7 1 0.24 0.68 0.07 21 3.4 -1 2.93 3.05 32 0.24 0.61 0.07 73 2.21 -1.465 2.26 2.44 17 0.24 0.54 0.07 240 1.94 -1.05 1.76 1.95 38 0.23 0.47 0.08 190 1.41 -0.95 1.45 1.57 30 0.24 0.4 0.07 444 1.15 -0.72 1.11 1.17 325 0.24 0.33 0.07 1083 0.79 -0.665 0.85 0.9 85 0.24 0.27 0.06 1445 0.64 -0.48 0.62 0.68 213 0.24 0.21 0.05 2212 0.49 -0.37 0.44 0.5 88 0.25 0.17 0.05 2646 WMT 135.000 WMT 136.000 WMT 137.000 WMT 138.000 WMT 139.000 WMT 140.000 WMT 141.000 Last Net Bid Ask Vol 0.48 +0.265 0.46 0.51 59 0.63 +0.37 0.61 0.72 5 0.84 +0.46 0.82 0.96 25 1.11 +0.59 1.08 1.22 14 1.56 +0.85 1.42 1.58 167 1.91 +0.965 1.86 1.97 232 2.55 +1.275 2.35 2.52 43 3.1 +1.41 2.93 3.15 133 3.67 +1.505 3.55 3.75 60 4.2 +1.44 4.3 4.55 11 4.51 +1.085 5.05 5.65 32 5.15 5.4 6.65 12 I Delta Gamma Int 0.25 -0.16 0.04 786 0.25 -0.21 0.05 260 0.25 -0.26 0.06 202 0.24 -0.32 0.07 785 0.24 -0.39 0.07 1715 0.24 -0.46 0.07 1583 0.24 -0.54 0.07 967 0.24 -0.61 0.07 667 0.23 -0.68 0.07 620 0.24 -0.73 0.06 321 0.27 -0.76 0.05 1472 0.24 -0.84 0.05 414 +1 Suppose you play a long straddle on Walmart by buying one 135 call and one 135 put. Someone else is playing a short straddle with the same options. Use the graph below to answer the following questions: B Spot @ Exp 128 135 141 C For all answers, do not use $ signs - just use numbers, no commas as in 1000 not 1,000. If 435.65 is the breakeven point, then that is the way to write it! Thanks. The profit at point A is The breakeven point at point B is The loss at point C is (don't use a negative sign) The profit at point D is Below is an option table for Walmart - Please use the table and the graph below to answer the questions that follow: Walmart Inc 2021-02-23 10:04:09 ET (Delayed) Bid: 135.46 Ask: 135.49 Vol: 1,850,641 Last: 135.47 Change: -2.22 (+-1.6123%) Filters By: Volume: Expiration Type: Size: Expiration: Options Range: Near the Money All V All All View Chain Options Chain Total Records: 144 Calls Fri Mar 05 2021 A Puts Strike WMT 130.000 WMT 131.000 WMT 132.000 WMT 133.000 WMT 134.000 Last Net Bid Ask Vol IV Delta Gamma Int 6.46 -1.44 5.5 6.9 2 0.3 0.8 0.04 153 5.8 +0 5 5.35 0 0.25 0.79 0.05 3 7.2 +0 4.25 4.85 0 0.28 0.71 0.05 2 2. 3.7 -1.525 3.5 3.7 1 0.24 0.68 0.07 21 3.4 -1 2.93 3.05 32 0.24 0.61 0.07 73 2.21 -1.465 2.26 2.44 17 0.24 0.54 0.07 240 1.94 -1.05 1.76 1.95 38 0.23 0.47 0.08 190 1.41 -0.95 1.45 1.57 30 0.24 0.4 0.07 444 1.15 -0.72 1.11 1.17 325 0.24 0.33 0.07 1083 0.79 -0.665 0.85 0.9 85 0.24 0.27 0.06 1445 0.64 -0.48 0.62 0.68 213 0.24 0.21 0.05 2212 0.49 -0.37 0.44 0.5 88 0.25 0.17 0.05 2646 WMT 135.000 WMT 136.000 WMT 137.000 WMT 138.000 WMT 139.000 WMT 140.000 WMT 141.000 Last Net Bid Ask Vol 0.48 +0.265 0.46 0.51 59 0.63 +0.37 0.61 0.72 5 0.84 +0.46 0.82 0.96 25 1.11 +0.59 1.08 1.22 14 1.56 +0.85 1.42 1.58 167 1.91 +0.965 1.86 1.97 232 2.55 +1.275 2.35 2.52 43 3.1 +1.41 2.93 3.15 133 3.67 +1.505 3.55 3.75 60 4.2 +1.44 4.3 4.55 11 4.51 +1.085 5.05 5.65 32 5.15 5.4 6.65 12 I Delta Gamma Int 0.25 -0.16 0.04 786 0.25 -0.21 0.05 260 0.25 -0.26 0.06 202 0.24 -0.32 0.07 785 0.24 -0.39 0.07 1715 0.24 -0.46 0.07 1583 0.24 -0.54 0.07 967 0.24 -0.61 0.07 667 0.23 -0.68 0.07 620 0.24 -0.73 0.06 321 0.27 -0.76 0.05 1472 0.24 -0.84 0.05 414 +1 Suppose you play a long straddle on Walmart by buying one 135 call and one 135 put. Someone else is playing a short straddle with the same options. Use the graph below to answer the following questions: B Spot @ Exp 128 135 141 C For all answers, do not use $ signs - just use numbers, no commas as in 1000 not 1,000. If 435.65 is the breakeven point, then that is the way to write it! Thanks. The profit at point A is The breakeven point at point B is The loss at point C is (don't use a negative sign) The profit at point D is