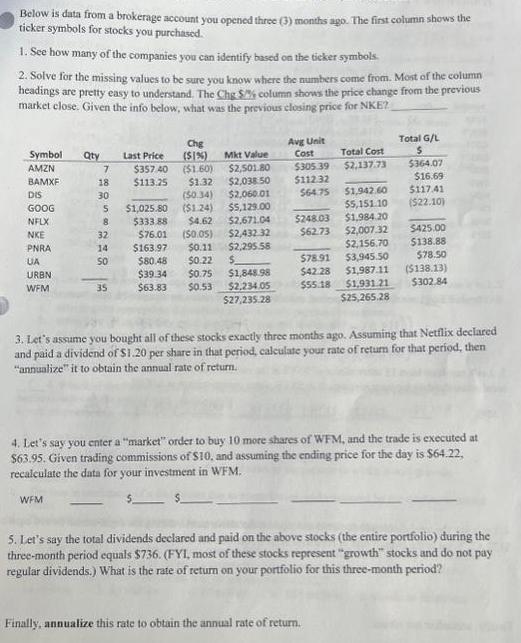

Question: Below is data from a brokerage account you opened three (3) months ago. The first column shows the ticker symbols for stocks you purchased.

Below is data from a brokerage account you opened three (3) months ago. The first column shows the ticker symbols for stocks you purchased. 1. See how many of the companies you can identify based on the ticker symbols. 2. Solve for the missing values to be sure you know where the numbers come from. Most of the column headings are pretty easy to understand. The Chg $% column shows the price change from the previous market close. Given the info below, what was the previous closing price for NKE? Symbol AMZN BAMXF DIS GOOG NFLX NKE PNRA UA URBN WFM Qty 7 18 30 5 8 32 14 50 35 Chg ($1%) $357.40 ($1.60) $113.25 $1.32 Last Price (50.34) $1,025.80 ($1.24) 5333.88 $4.62 $76.01 (50.05) $0.11 $163.97 $80.48 $0.22 $39.34 $63.83 Total G/L $ $364.07 $16.69 $117.41 55,151.10 ($22.10) Avg Unit Cost Total Cost $64.75 $1,942.60 M $62.73 $2,007.32 $2,156.70 $78.91 $3,945.50 $42.28 $1,987.11 $55.18 $1,931.21 $25,265.28 Mkt Value $2,501.80 $305.39 $2,137.73 $2,038.50 $112.32 $2,060.01 $5,129.00 $2,671.04 5248.03 $1,984.20 $2,432.32 $2,295.58 $ $0.75 $1,848.98 $0.53 $2,234.05 $27,235.28 $425.00 $138.88 $78.50 ($138.13) $302.84 3. Let's assume you bought all of these stocks exactly three months ago. Assuming that Netflix declared and paid a dividend of $1.20 per share in that period, calculate your rate of return for that period, then "annualize" it to obtain the annual rate of return. 4. Let's say you enter a "market" order to buy 10 more shares of WFM, and the trade is executed at $63.95. Given trading commissions of $10, and assuming the ending price for the day is $64.22, recalculate the data for your investment in WFM. WFM Finally, annualize this rate to obtain the annual rate of return. 5. Let's say the total dividends declared and paid on the above stocks (the entire portfolio) during the three-month period equals $736. (FYI, most of these stocks represent "growth" stocks and do not pay regular dividends.) What is the rate of return on your portfolio for this three-month period?

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Symbol identification AMZN Amazoncom Inc BAMXF Bayerische Motoren Werke AG BMW DIS The Walt Disney Company GOOG Alphabet Inc Google NFLX Netflix Inc N... View full answer

Get step-by-step solutions from verified subject matter experts