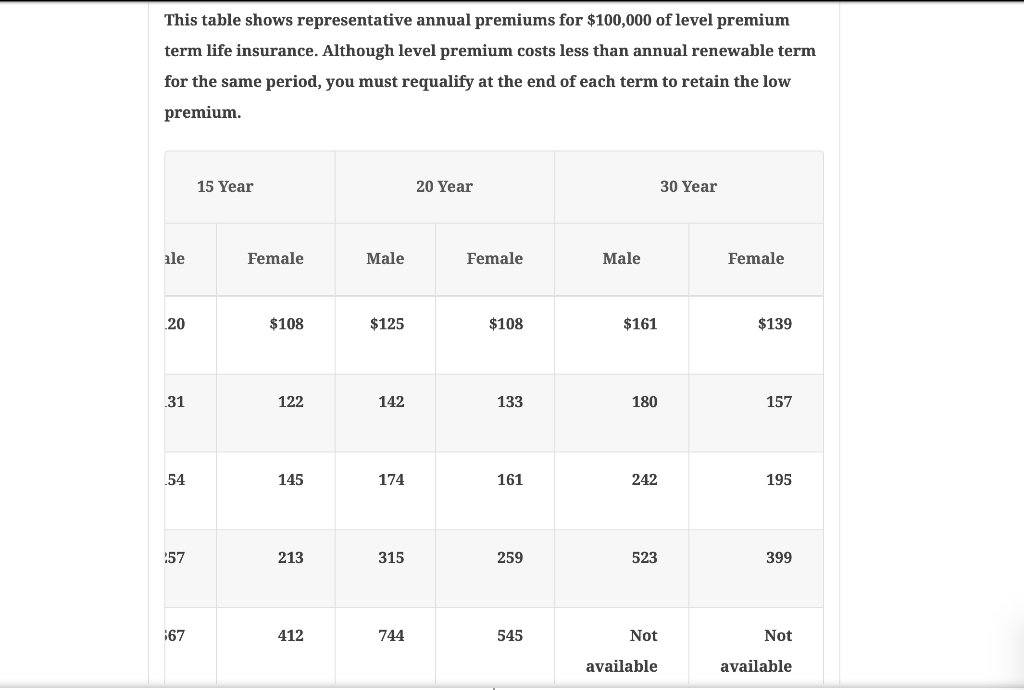

Below is Exhibit 8.3

Martha and Louis Mitchell are a dual-career couple who just had their first child. Louis age 30 , already has a group life insurance policy, but Martha's employer does not offer a life insurance benefit. A financial planner is recommending that the 27-year-old Martha buy a $250,000 whole life policy with an annual premium of $1,670 (the policy has an assumed rate of earnings of 5 percent a year). Help Martha evaluate this advice and decide on an appropriate course of action. 1. Do some research on what the average group life insurance policy provides. 2. Then Using the table is Exhibit 8.3, see what the premiums would be for a term policy 3. Discuss what you would advise the Mitchell's. This table shows representative annual premiums for $100,000 of level premium term life insurance. Although level premium costs less than annual renewable term for the same period, you must requalify at the end of each term to retain the low premium. This table shows representative annual premiums for $100,000 of level premium term life insurance. Although level premium costs less than annual renewable term for the same period, you must requalify at the end of each term to retain the low premium. Martha and Louis Mitchell are a dual-career couple who just had their first child. Louis age 30 , already has a group life insurance policy, but Martha's employer does not offer a life insurance benefit. A financial planner is recommending that the 27-year-old Martha buy a $250,000 whole life policy with an annual premium of $1,670 (the policy has an assumed rate of earnings of 5 percent a year). Help Martha evaluate this advice and decide on an appropriate course of action. 1. Do some research on what the average group life insurance policy provides. 2. Then Using the table is Exhibit 8.3, see what the premiums would be for a term policy 3. Discuss what you would advise the Mitchell's. This table shows representative annual premiums for $100,000 of level premium term life insurance. Although level premium costs less than annual renewable term for the same period, you must requalify at the end of each term to retain the low premium. This table shows representative annual premiums for $100,000 of level premium term life insurance. Although level premium costs less than annual renewable term for the same period, you must requalify at the end of each term to retain the low premium