Answered step by step

Verified Expert Solution

Question

1 Approved Answer

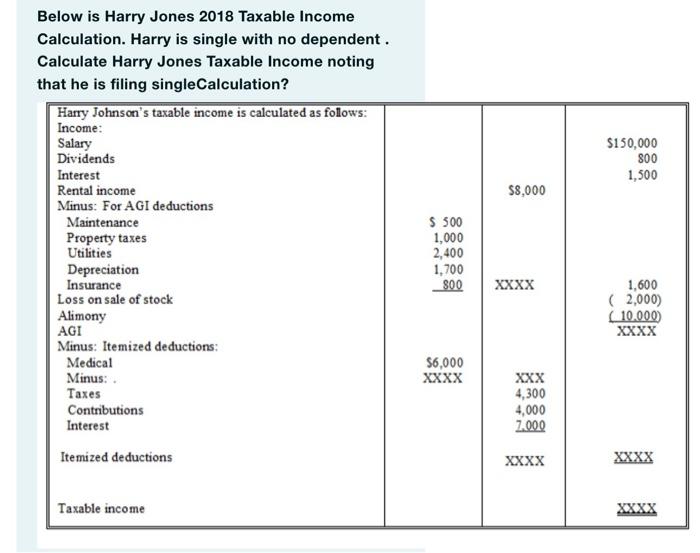

Below is Harry Jones 2018 Taxable Income Calculation. Harry is single with no dependent. Calculate Harry Jones Taxable Income noting that he is filing singleCalculation?

Below is Harry Jones 2018 Taxable Income Calculation. Harry is single with no dependent. Calculate Harry Jones Taxable Income noting that he is filing singleCalculation? Harry Johnson's taxable income is calculated as follows: Income: Salary Dividends Interest Rental income Minus: For AGI deductions Maintenance Property taxes Utilities Depreciation Insurance Loss on sale of stock Alimony AGI Minus: Itemized deductions: Medical Minus: . Taxes Contributions Interest Itemized deductions Taxable income $ 500 1,000 2,400 1,700 800 $6,000 XXXX $8,000 XXXX XXX 4,300 4,000 7.000 XXXX $150,000 800 1,500 1,600 ( 2,000) (10.000) XXXX XXXX XXXX

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started