Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below is how to do a similar problem, i just cant get this one correct so please help Over the past six months, Six Flags

Below is how to do a similar problem, i just cant get this one correct so please help

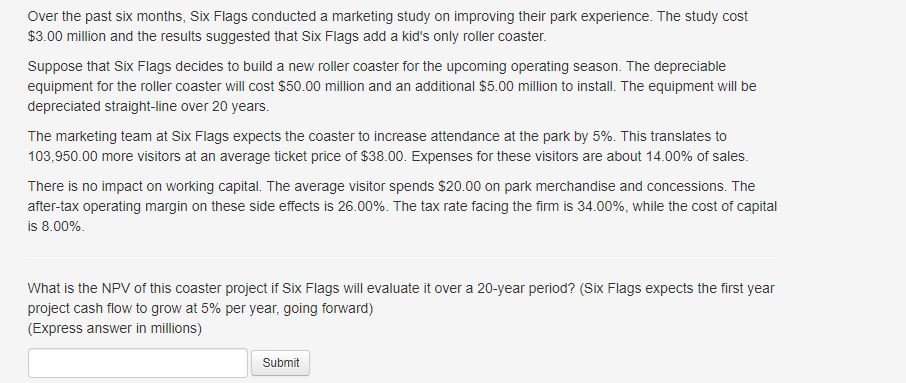

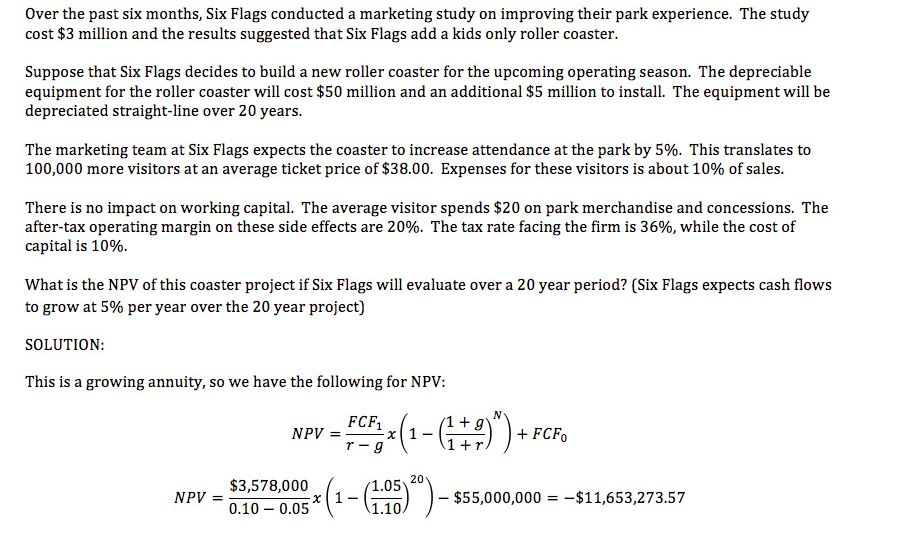

Over the past six months, Six Flags conducted a marketing study on improving their park experience. The study cost $3.00 million and the results suggested that Six Flags add a kid's only roller coaster. Suppose that Six Flags decides to build a new roller coaster for the upcoming operating season. The depreciable equipment for the roller coaster will cost $50.00 million and an additional $5.00 million to install. The equipment will be depreciated straight-line over 20 years. The marketing team at Six Flags expects the coaster to increase attendance at the park by 5%. This translates to 103,950.00 more visitors at an average ticket price of $38.00. Expenses for these visitors are about 14.00% of sales. There is no impact on working capital. The average visitor spends $20.00 on park merchandise and concessions. The after-tax operating margin on these side effects is 26.00%. The tax rate facing the firm is 34.00%, while the cost of capital is 8.00%. What is the NPV of this coaster project if Six Flags will evaluate it over a 20-year period? (Six Flags expects the first year project cash flow to grow at 5% per year, going forward) (Express answer in millions) Submit Over the past six months, Six Flags conducted a marketing study on improving their park experience. The study cost $3 million and the results suggested that Six Flags add a kids only roller coaster. Suppose that Six Flags decides to build a new roller coaster for the upcoming operating season. The depreciable equipment for the roller coaster will cost $50 million and an additional $5 million to install. The equipment will be depreciated straight-line over 20 years. The marketing team at Six Flags expects the coaster to increase attendance at the park by 5%. This translates to 100,000 more visitors at an average ticket price of $38.00. Expenses for these visitors is about 10% of sales. There is no impact on working capital. The average visitor spends $20 on park merchandise and concessions. The after-tax operating margin on these side effects are 20%. The tax rate facing the firm is 36%, while the cost of capital is 10%. What is the NPV of this coaster project if Six Flags will evaluate over a 20 year period? (Six Flags expects cash flows to grow at 5% per year over the 20 year project) SOLUTION: This is a growing annuity, so we have the following for NPV: NPV = F**(1-6+9)") + FCF. $3,578,000 NPV = 0.10 - 0.05 - $55,000,000 = -$11,653,273.57 Over the past six months, Six Flags conducted a marketing study on improving their park experience. The study cost $3.00 million and the results suggested that Six Flags add a kid's only roller coaster. Suppose that Six Flags decides to build a new roller coaster for the upcoming operating season. The depreciable equipment for the roller coaster will cost $50.00 million and an additional $5.00 million to install. The equipment will be depreciated straight-line over 20 years. The marketing team at Six Flags expects the coaster to increase attendance at the park by 5%. This translates to 103,950.00 more visitors at an average ticket price of $38.00. Expenses for these visitors are about 14.00% of sales. There is no impact on working capital. The average visitor spends $20.00 on park merchandise and concessions. The after-tax operating margin on these side effects is 26.00%. The tax rate facing the firm is 34.00%, while the cost of capital is 8.00%. What is the NPV of this coaster project if Six Flags will evaluate it over a 20-year period? (Six Flags expects the first year project cash flow to grow at 5% per year, going forward) (Express answer in millions) Submit Over the past six months, Six Flags conducted a marketing study on improving their park experience. The study cost $3 million and the results suggested that Six Flags add a kids only roller coaster. Suppose that Six Flags decides to build a new roller coaster for the upcoming operating season. The depreciable equipment for the roller coaster will cost $50 million and an additional $5 million to install. The equipment will be depreciated straight-line over 20 years. The marketing team at Six Flags expects the coaster to increase attendance at the park by 5%. This translates to 100,000 more visitors at an average ticket price of $38.00. Expenses for these visitors is about 10% of sales. There is no impact on working capital. The average visitor spends $20 on park merchandise and concessions. The after-tax operating margin on these side effects are 20%. The tax rate facing the firm is 36%, while the cost of capital is 10%. What is the NPV of this coaster project if Six Flags will evaluate over a 20 year period? (Six Flags expects cash flows to grow at 5% per year over the 20 year project) SOLUTION: This is a growing annuity, so we have the following for NPV: NPV = F**(1-6+9)") + FCF. $3,578,000 NPV = 0.10 - 0.05 - $55,000,000 = -$11,653,273.57

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started